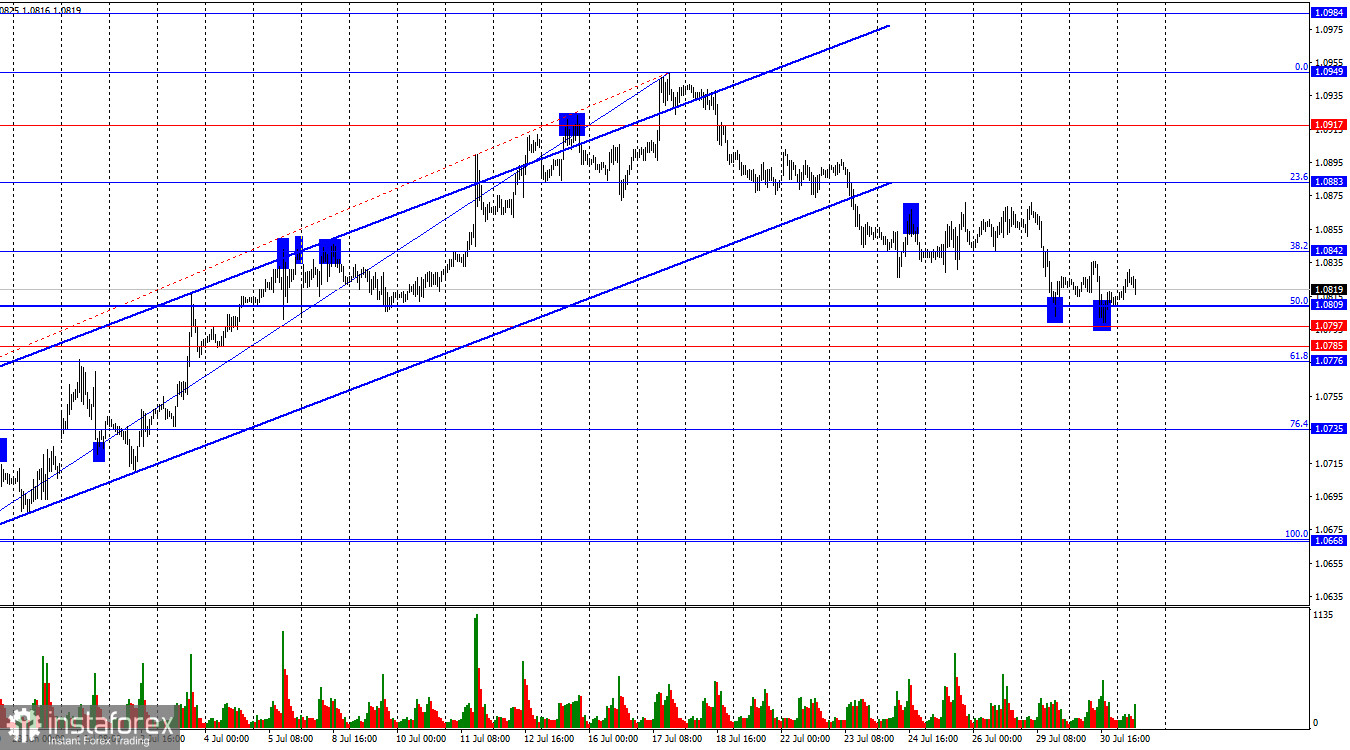

On Tuesday, the EUR/USD pair made a second rebound from the support zone of 1.0776–1.0809. The zone is quite wide but includes four levels at once. The second rebound did not lead to a bull counterattack, nor was there a rise to the 38.2% corrective level at 1.0842. Therefore, I expect the bears to enter the zone of 1.0776–1.0809 on the third or fourth attempt. It may take a few days to exit the zone and show the direction in which the trend will develop further.

The wave situation has become more complex but still raises no questions overall. The last upward wave can be considered complete as it broke the peak of the previous wave. Therefore, the bears have begun forming a corrective wave. For the "bullish" trend to be canceled, the bears need to break the low of the previous downward wave around the 1.0668 level. They need to move down another 170-180 points to achieve this. With the current trader activity, this could take 2-3 weeks. A quick drop is not expected.

Tuesday's information background could have pleased the euro bulls. The European economy grew slightly more than expected, while inflation in the Eurozone slightly accelerated in July. However, the GDP report from Germany unexpectedly showed a contraction of 0.1%. This news offers no positivity for the European currency. The European economy remains stagnant, and we see only very weak growth, close to 0% each quarter. The ECB has already started easing monetary policy, which should accelerate GDP. But at the same time, inflation should continue to decrease. Otherwise, the ECB will have to take a rather long pause to give inflation time to slow down. The European currency did not receive real support yesterday, so I expect a further decline.

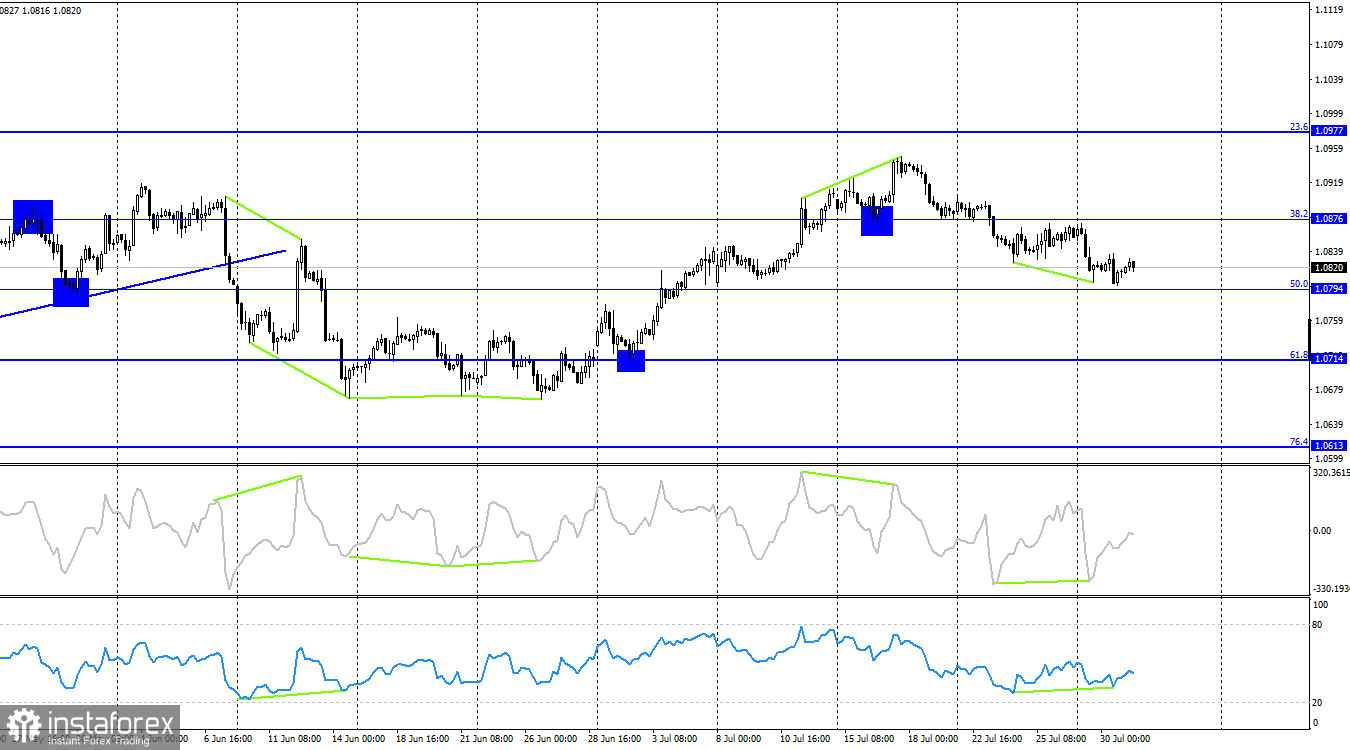

On the 4-hour chart, the pair reversed in favor of the US dollar, consolidating below the 38.2% corrective level at 1.0876. Therefore, the decline may continue towards the 50.0% Fibonacci level at 1.0794. Yesterday, a "bullish" divergence was formed on the CCI and RSI indicators, allowing for some growth towards 1.0876. Securing quotes below the 1.0794 level will suggest a further decline.

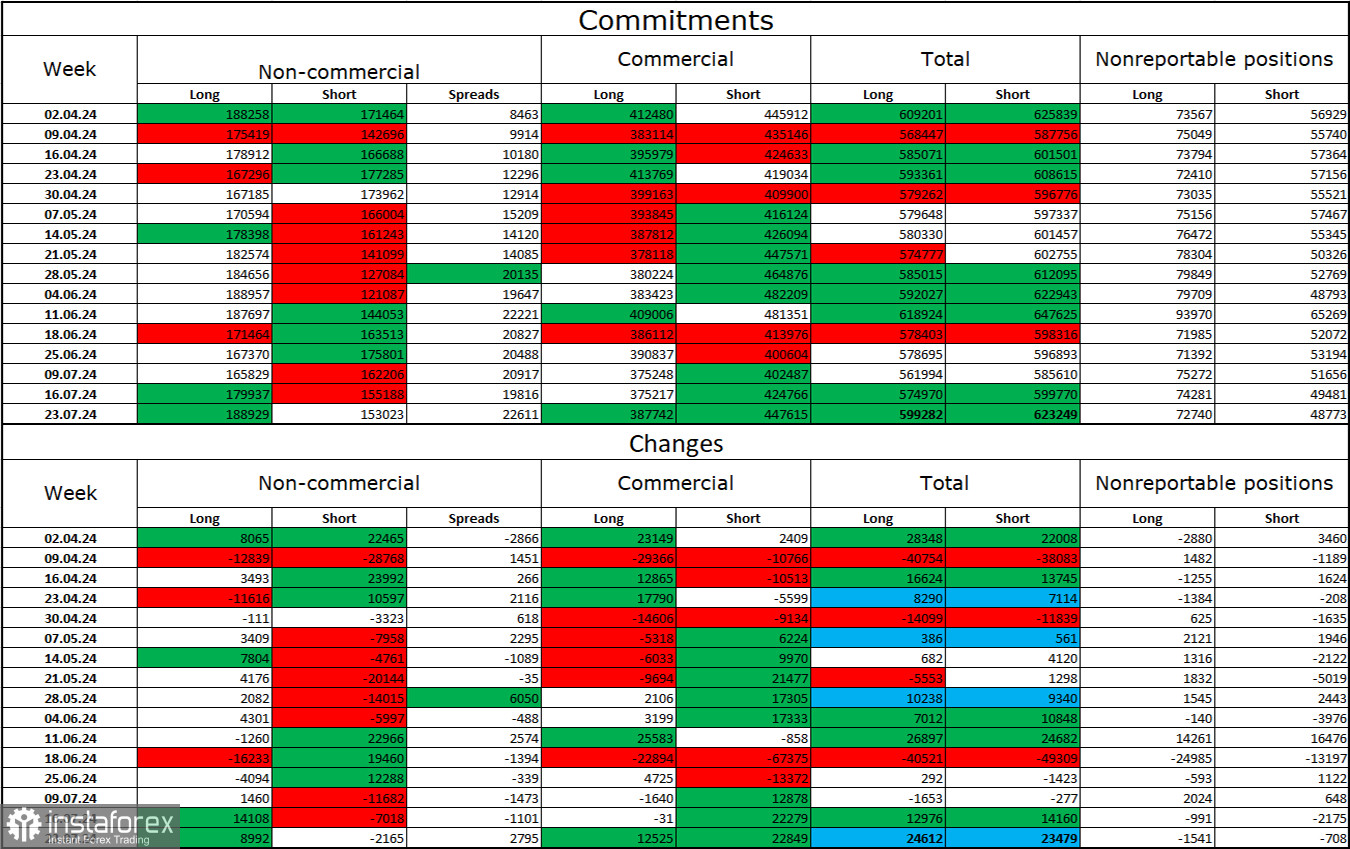

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 8,992 long positions and closed 2,165 short positions. The sentiment of the "Non-commercial" group turned "bearish" a couple of months ago, but the bulls are once again dominating. The total number of long positions speculators hold now stands at 189,000, while short positions total 153,000.

The situation will continue to change in favor of the bears. I do not see long-term reasons to buy euros, as the ECB has begun easing monetary policy, which will reduce the yields of bank deposits and government bonds. In America, they will remain high for several months, making the dollar more attractive to investors. The potential for a decline in the European currency, even according to the COT reports, looks substantial. However, one should remember graphical analysis, which currently does not allow for confidently predicting a strong fall in the euro.

News Calendar for the US and Eurozone:

- Eurozone – Germany Unemployment Rate (07:55 UTC).

- Eurozone – Consumer Price Index (09:00 UTC).

- US – ADP Employment Change (12:15 UTC).

- US – FOMC Rate Decision (18:00 UTC).

- US – FOMC Press Conference (18:30 UTC).

On July 31, the economic events calendar contains at least four important entries, among which the FOMC meeting stands out. The impact of today's information background on trader sentiment could be significant.

Forecast for EUR/USD and Trading Tips:

Sales of the pair will be possible on a rebound from the 1.0842 level on the hourly chart with a target of 1.0809. Purchases can be considered with a target of 1.0842, as there have been two rebounds from the 1.0809 level. However, significant growth can only be expected if the bulls are supported by today's information background and in the remaining days of the week.

The Fibonacci levels are constructed at 1.0668–1.0949 on the hourly chart and 1.0450–1.1139 on the 4-hour chart.