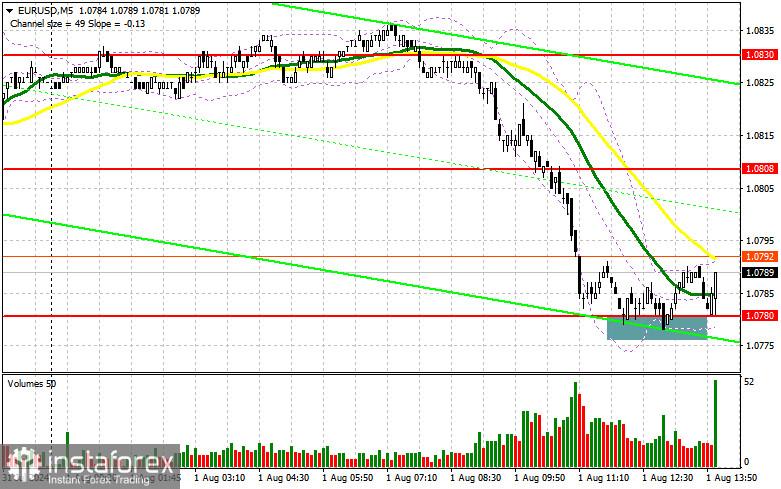

In my morning forecast, I highlighted the 1.0780 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and understand what happened there. A decline and the formation of a false breakout led to an entry point for long positions, which, by the time of writing this article, had already resulted in a rise of more than 15 points. The technical picture for the second half of the day has been minimally revised.

For opening long positions on EUR/USD:

Another round of disappointing data on manufacturing activity in Eurozone countries led to a drop in the pair. However, the outcomes of the Fed meeting yesterday left chances for an upward correction by the end of the week. Upcoming data on the number of initial jobless claims in the US and the ISM manufacturing index report in the US, where things are also not looking great, may give buyers a chance. In case of a further decline in the pair, the same 1.0780 level, which is currently being tested, can be relied upon. The repeated formation of a false breakout will provide a suitable entry point for long positions with a target of moving up to the area of 1.0805, the new intraday resistance. A breakout and an update above this range will strengthen the pair with a chance to rise towards 1.0827. The farthest target will be the maximum of 1.0850, where I will be taking profits. If EUR/USD continues to decline and there is no activity around 1.0780 in the second half of the day, this level being technically important, sellers will strengthen their initiative and begin further constructing a downward trend. In this case, I will enter only after forming a false breakout around 1.0757. I plan to open long positions immediately on a rebound from 1.0738 with a target of a 30-35 point upward correction within the day.

For opening short positions on EUR/USD:

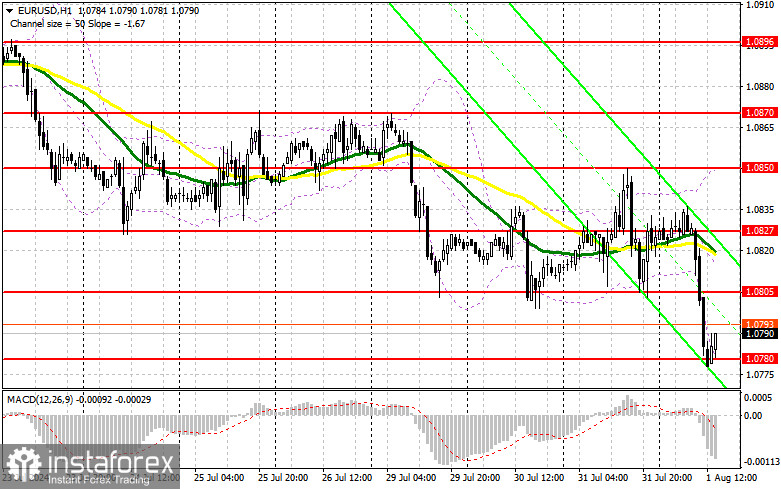

Sellers keep the market under control and are acting quite well. Only very poor fundamental statistics from the US will help correct the market situation. In case of a surge upward due to weak data, bears will need to show themselves around 1.0805. Along with a false breakout, this will ensure the presence of large players betting on the euro's fall, providing a suitable entry point for short positions with a target of reducing EUR/USD to the support of 1.0757. A breakthrough and consolidation below this range, as well as a reverse test from below to above, will give another selling point with movement towards 1.0738, where I expect more active buyer presence. The farthest target will be the area of 1.0738, where I will be taking profits. If EUR/USD moves upwards in the second half of the day and there are no bears around 1.0805, buyers will get a chance for correction and a return to the daily maximum, where the moving averages are located, playing on the sellers' side. In this case, I will postpone selling until testing the next resistance at 1.0827. I will also sell there, but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.0850 with a target of a 30-35 point downward correction.

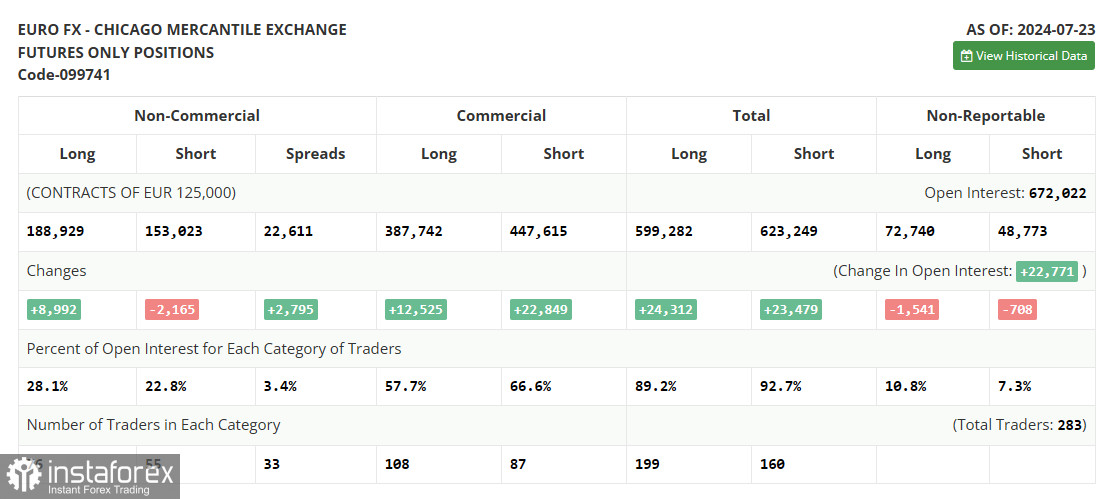

In the COT report (Commitment of Traders) for July 23, there was a reduction in short positions and an increase in long positions. However, if you look closely, nothing significant in the balance of power changed, and no new priorities were set even before the Federal Reserve meeting, despite discussions about it being high time for the US regulator to cut interest rates, which recent economic data have been suggesting. As long as the market is balanced, one can take advantage of the cheaper risky assets, including the euro, and buy them, expecting that the Fed will start cutting rates this year. The COT report indicated that long non-commercial positions increased by 8,992 to a level of 188,929, while short non-commercial positions fell by 2,165 to a level of 153,023. As a result, the spread between long and short positions increased by 2,795.

Indicator Signals:

Moving Averages: Trading is conducted below the 30 and 50-day moving averages, indicating a further decline in the pair. Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator, around 1.0780, will act as support.

Description of Indicators:

- Moving average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open positions of non-commercial traders.

- Total non-commercial net position: The difference between the short and long positions of non-commercial traders.