Analysis of Trades and Trading Tips for the European Currency

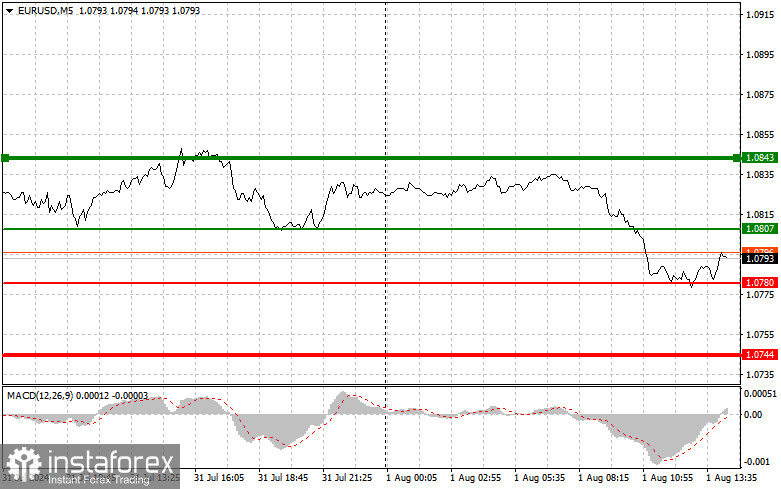

The test of the 1.0823 price level occurred when the MACD indicator began moving down from the zero mark, confirming the correct entry point for selling the euro in continuation of the downward trend. As a result, the pair fell by more than 30 points. Pressure on the euro increased immediately after weak data on manufacturing activity in Eurozone countries, especially Germany. Similar statistics will be released for the U.S. in the second half of the day, which could further influence the pair's movement. In addition to the ISM manufacturing index, weekly data on initial jobless claims and changes in U.S. construction spending are expected. Strong reports mean a strong dollar, which would trigger a new sell-off of EUR/USD. As for the intraday strategy, I plan to act based on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the euro upon reaching the price area of 1.0807 (the green line on the chart) with a target of rising to 1.0843. At 1.0843, I will exit the market and then sell the euro, expecting a movement of 30-35 points from the entry point. A strong upward movement of the euro today can be expected only after weak U.S. data, which cannot be ruled out. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the price at 1.0780 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal upwards. Growth can be expected to the opposite levels of 1.0807 and 1.0843.

Sell Signal

Scenario #1: I will sell the euro after reaching the level of 1.0780 (the red line on the chart). The target will be 1.0744, where I plan to exit the market and then immediately buy the euro, expecting a movement of 20-25 points in the opposite direction from the level. Pressure on the pair will return in case of strong statistics, continuing the downward trend. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the price at 1.0807 when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. A decline can be expected to the opposite levels of 1.0780 and 1.0744.

Chart Explanation:

- Thin green line: Entry price where the trading instrument can be bought.

- Thick green line: Expected price where Take Profit can be set, or profits can be manually fixed, as further growth above this level is unlikely.

- Thin red line: Entry price where the trading instrument can be sold.

- Thick red line: Expected price where Take Profit can be set, or profits can be manually fixed, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginner traders in the forex market must make market entry decisions cautiously. It is best to stay out of the market before significant fundamental reports are released to avoid sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

Remember, successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is an initially losing strategy for an intraday trader.