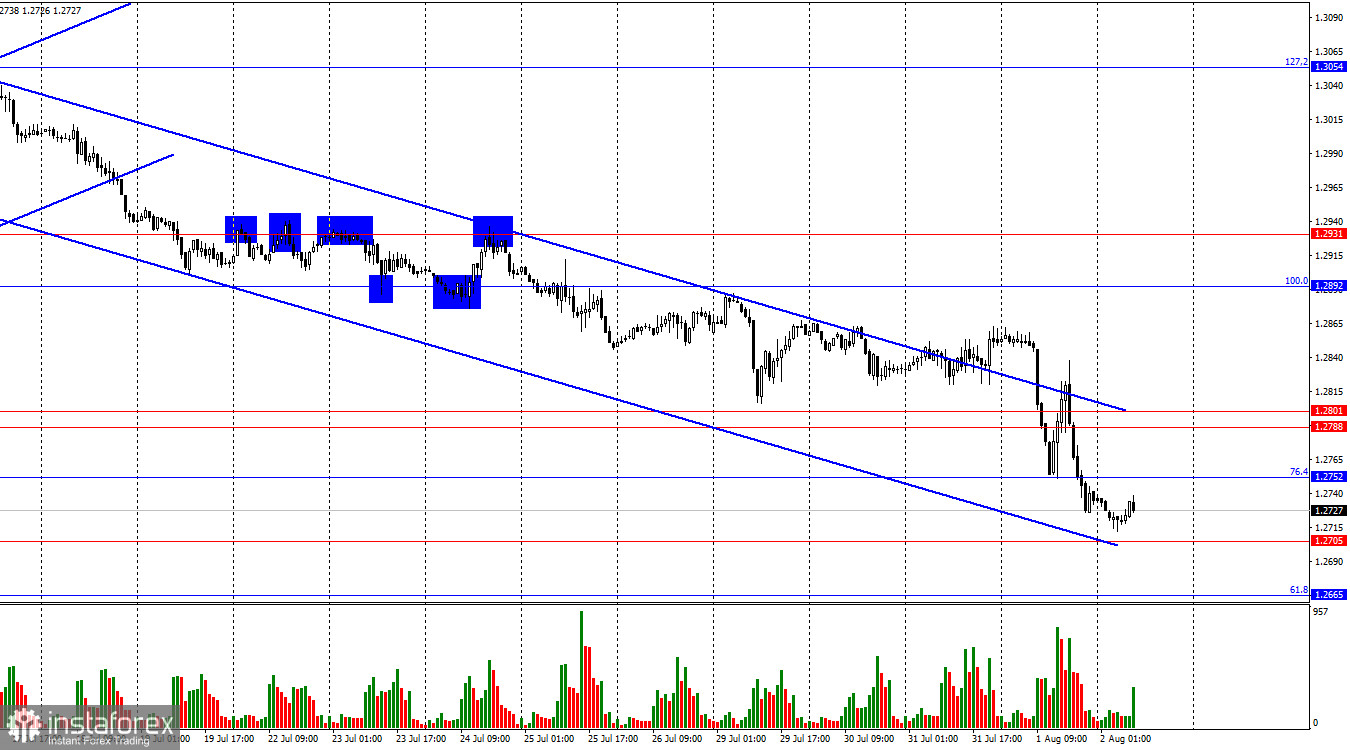

On the hourly chart, the GBP/USD pair consolidated below the support zone of 1.2788–1.2801 on Thursday and then below the 76.4% corrective level of 1.2752. Thus, the pair's decline may continue toward the next levels of 1.2705 and 1.2665. The downward trend channel was briefly breached but remains active, influenced by the Bank of England's first interest rate cut in a long time. I am not considering purchases and rises of the pound in the coming days.

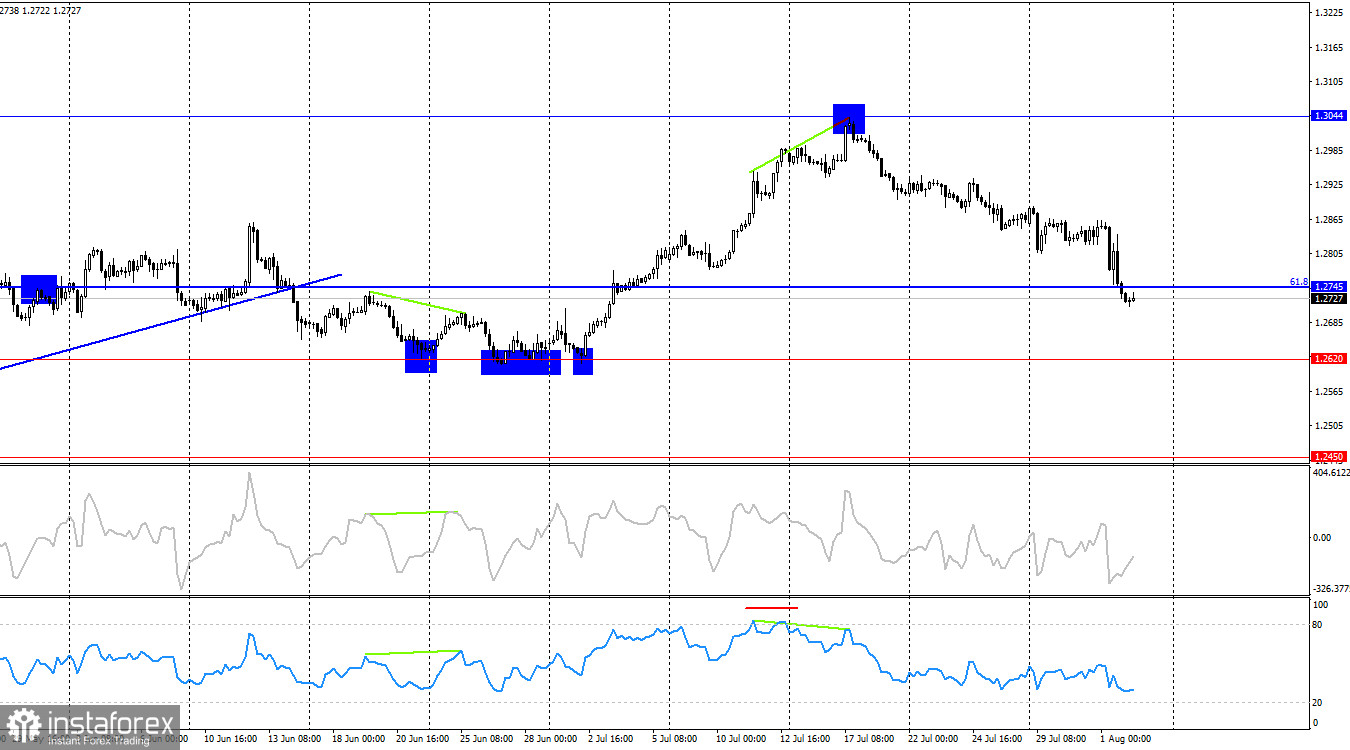

The wave pattern has slightly changed. The last completed downward wave (which began forming on June 12) managed to break the low of the previous downward wave, and the last upward wave broke the peak of the previous upward wave. Therefore, we are currently dealing with a "bullish" trend. The rise of the pound may continue, but traders are now forming a corrective wave downwards. There is no talk of a trend change to "bearish" from a wave perspective yet. It remains to be seen if the bears have enough strength to reach the previous low recorded on July 2, but for now, they are confidently moving towards their goal.

For the pound, Thursday's news was limited to one event. The Bank of England predictably cut the rate by 25 points, which triggered bearish activity. However, do not expect that the Bank of England will lower the rate quickly. According to the Bank of England's forecasts, inflation in the UK may accelerate to 2.7% in the second half of the year. If the regulator itself expects inflation to rise, it is unlikely to lower the rate quickly. Yesterday's monetary policy easing signaled the regulator's intentions and was a response to the consumer price index being at the target level for two months. The regulator had no choice but to cut the rate, as its executives have repeatedly stated that easing would begin once confidence in achieving the inflation target was confirmed. The target was met.

On the 4-hour chart, the pair rebounded from the 1.3044 level, forming a "bearish" divergence on the RSI indicator. Just before that, the same indicator entered the overbought zone. Thus, several signals for selling on the senior chart were received. After consolidating below the 61.8% corrective level at 1.2745, the falling process can be continued toward the level of 1.2620.

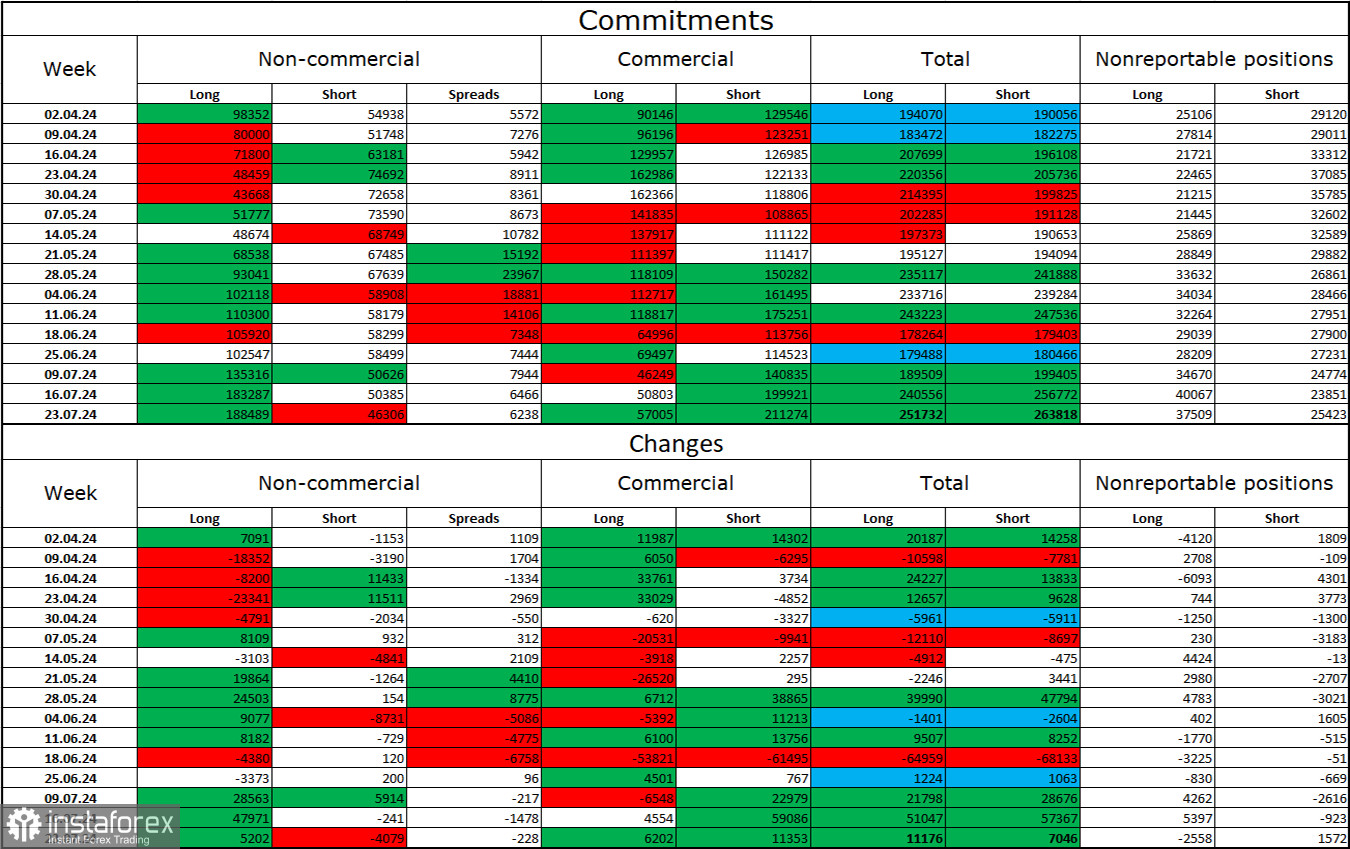

Commitments of Traders (COT) Report

The mood of the "Non-commercial" category of traders became even more "bullish" last week. The number of long positions in the hands of speculators rose by 5,202, while the number of short positions decreased by 4,079. Bulls still have a solid advantage. The gap between the number of long and short positions is already 142 thousand: 188 thousand against 46 thousand.

The prospects for the pound to fall remain, but the COT reports indicate otherwise. Over the last three months, the number of long positions has risen from 98 thousand to 188 thousand, while the number of short positions has decreased from 54 thousand to 46 thousand. Over time, professional players will again start getting rid of long positions or increase short positions, as all possible factors for buying the British pound have already been worked through. However, one should remember that this is just an assumption. Technical analysis suggests a very likely fall in the near future, but this does not mean that the fall will last several months or half a year.

News Calendar for the USA and the United Kingdom

- USA – Changes in Nonfarm Payrolls employment numbers (12-30 UTC).

- USA – Unemployment rate (12-30 UTC).

- USA – Changes in average earnings (12-30 UTC).

On Friday, the economic events calendar contains several important entries. The influence of the information background on market sentiment today may again be strong.

GBP/USD Forecast and Trader Tips

Sales of the pound were possible even with a rebound from the 1.3044 level on the 4-hour chart with a target zone of 1.2788–1.2801. Securing quotes below this zone allowed holding sales with targets of 1.2752 and 1.2705. These targets have also been met. Sales can be held today with targets of 1.2665 and 1.2620. I see no reason to consider purchases today unless American reports turn out to be significantly weaker than traders' expectations.

Fibonacci level grids are built from 1.2892–1.2298 on the hourly chart and from 1.4248–1.0404 on the 4-hour chart.