Are fears exaggerated, or is there no smoke without fire? After the US nonfarm payrolls for July, panic hit the financial markets. Investors are selling everything they can, first and foremost, the US dollar. The Federal Reserve is being pressured to aggressively ease monetary policy. The last time this happened, in March 2020, EUR/USD surged from 1.063 to 1.234, or 16%, over nine months. Is history repeating itself?

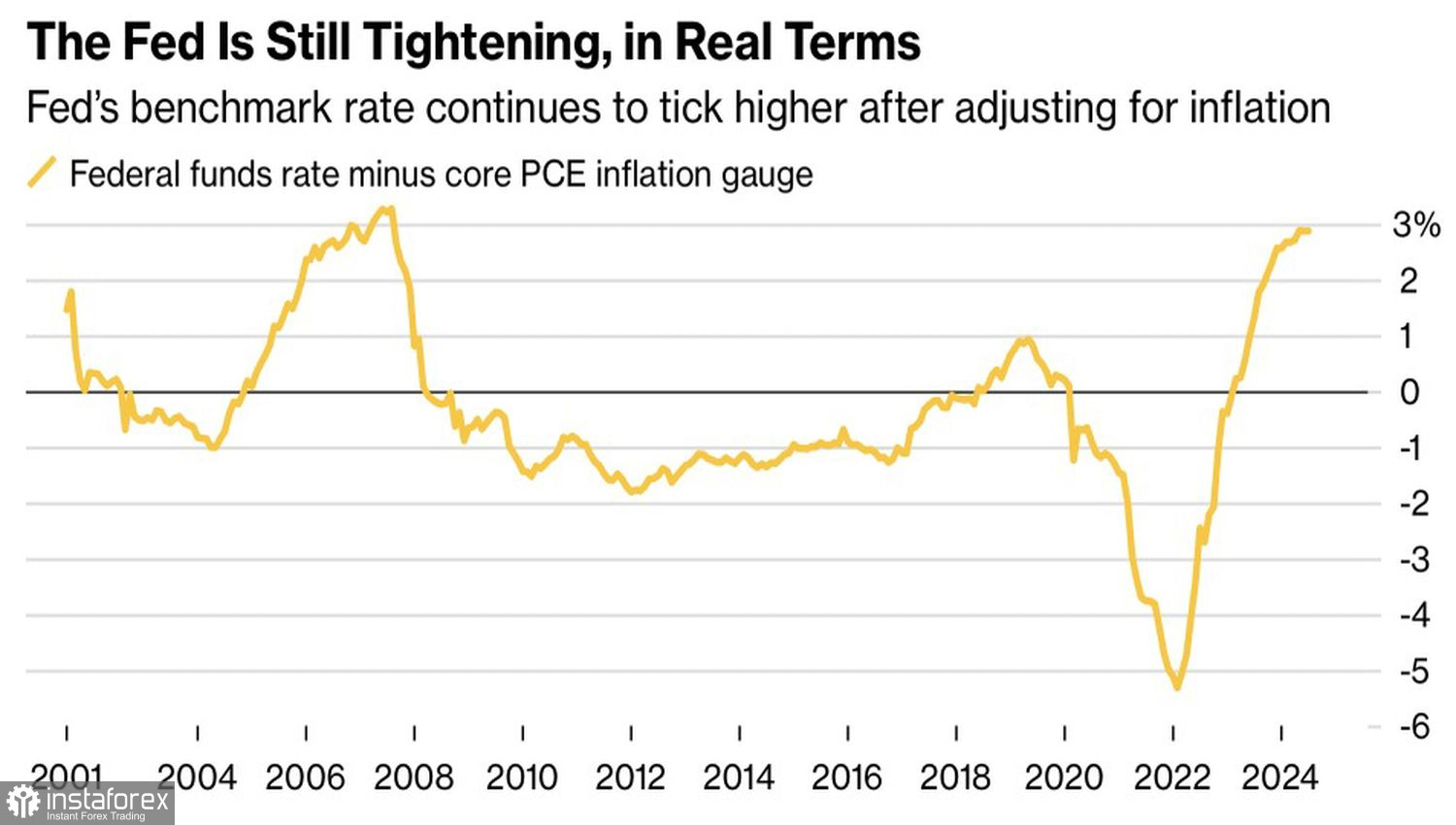

Forex traders agree that the Federal Reserve has missed its chance. The regulator should have started the monetary policy easing cycle no later than July. Last December, Jerome Powell noted that it's not necessary to wait for inflation to return to 2%. The central bank wanted to lower rates long before that to avoid overcooling the economy. So why didn't they do it? The real cost of borrowing is currently at its highest since the 2008 global financial crisis.

Real federal funds rate dynamics

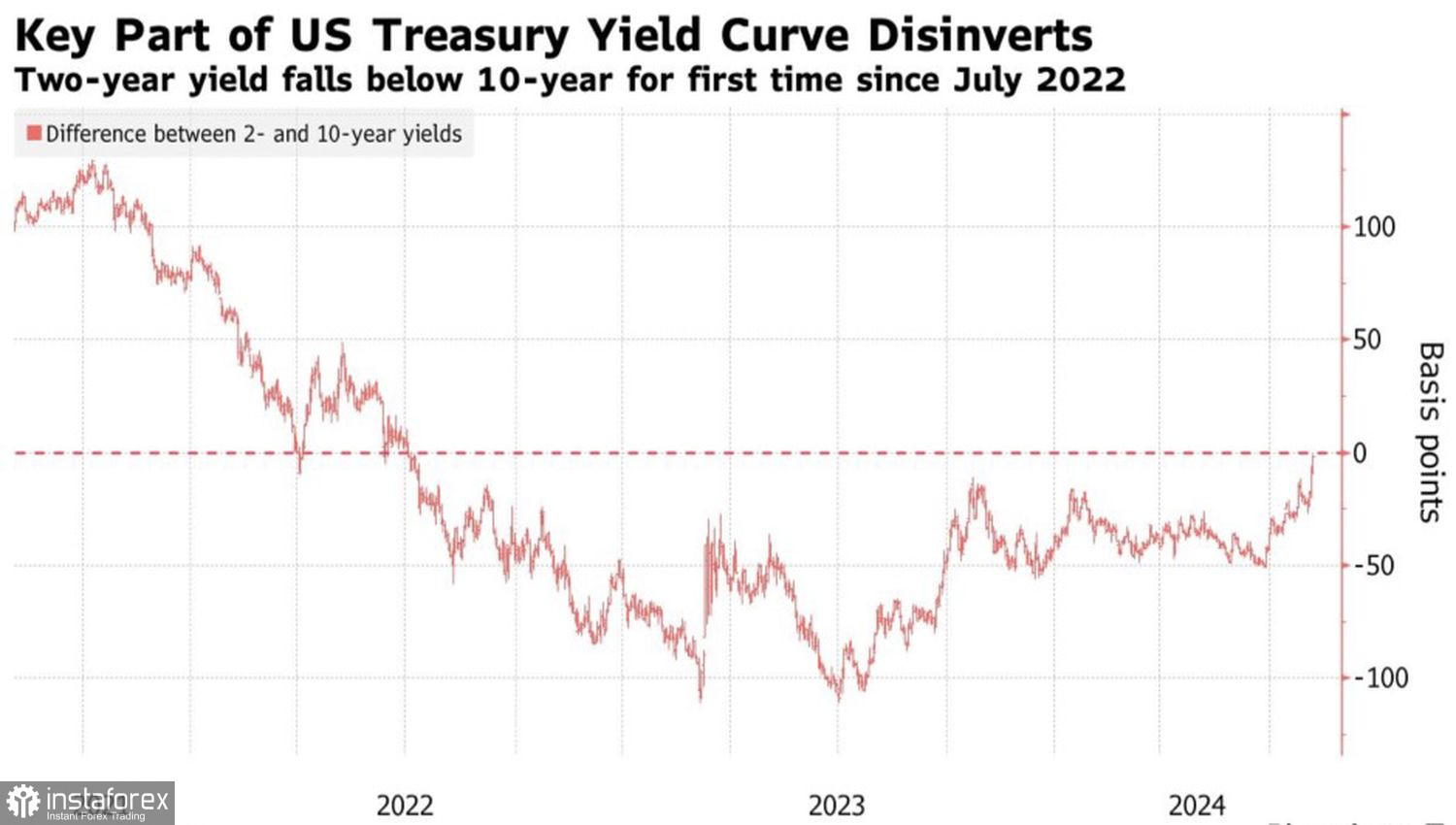

Such high borrowing costs inevitably hurt the economy. The first exit from yield curve inversion since July 2022 and the implementation of the Sahm Rule, indicating a 0.5% rise in unemployment from its 12-month low, signal that the US economy is already in recession. If that's the case, the Fed needs not just to cut interest rates but to do so hyper-aggressively.

The futures market shows almost a 90% probability of a 50-basis-point rate cut in September. Citigroup and JP Morgan estimate the scope of monetary expansion in 2024 at 125 basis points, while analysts at the Wharton School suggest a 75-basis-point rate cut in September, followed by another 75 basis points in November.

Yield curve dynamics

Is there much ado about nothing? Yes, the US labor market report for October was disappointing, but does that mean a recession is imminent? Markets are demanding the central bank make the emergency decision when it throws a life jacket in critical situations. But does the US economy really need artificial respiration?

In the second quarter, US GDP expanded by 2.8. The Atlanta Fed's leading indicator signals a 2% expansion in July-September. Yes, the employment growth of 114,000 is modest, but it could be due to the impact of Hurricane Beryl. About 436,000 non-farm and 461,000 farm workers were reported as not working due to bad weather. This isn't just a July record; it's ten times higher than the July average since 1976.

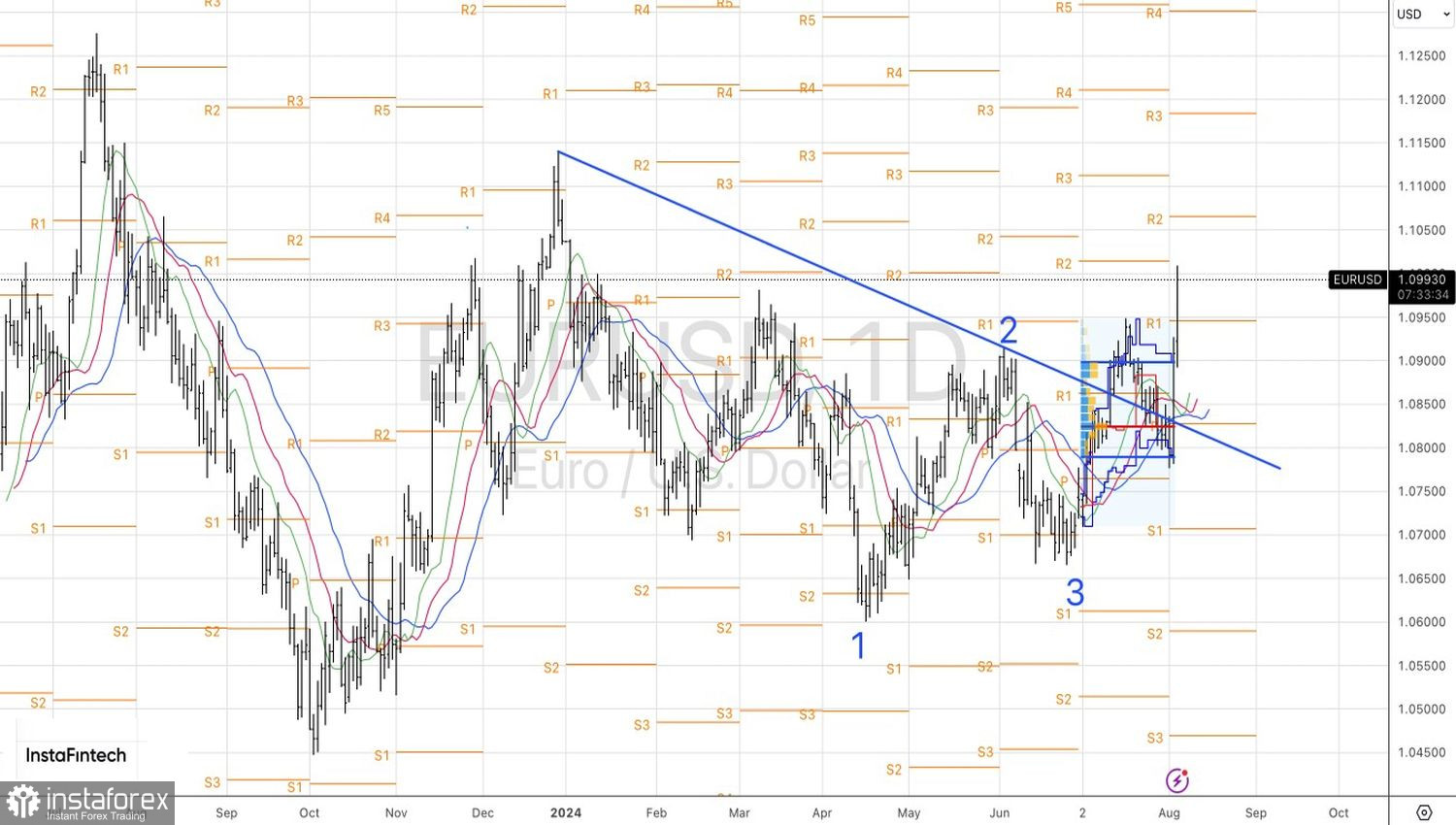

EUR/USD technical analysis

Technically, on the daily chart, EUR/USD is realizing a 1-2-3 pattern with a breakout of the trendline from below. Whether the bulls can continue the rally depends on their ability to storm the convergence zone of 1.105-1.1015. A rebound will create conditions for short-term selling. However, large buyers have been spotted near the pivot levels of 1.0965 and 1.0945.