Analysis of trades and tips on EUR/USD

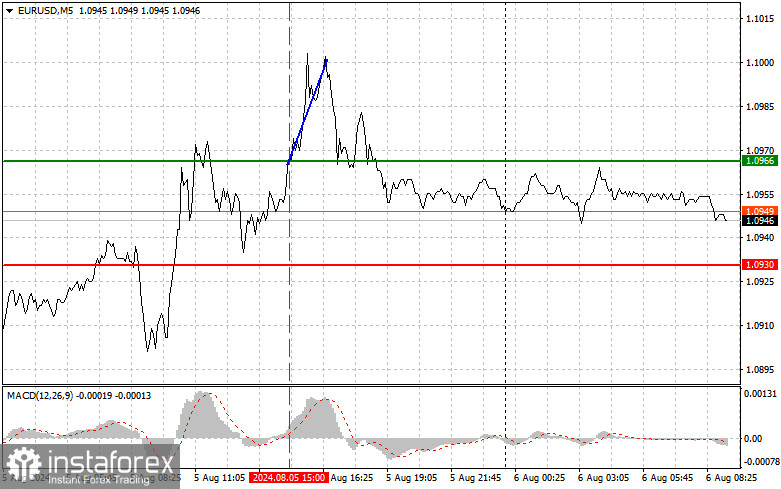

The price test of 1.0966 occurred when the MACD indicator started its upward movement from the zero mark, confirming the correct entry point for buying the euro. As a result, EUR/USD rose by more than 35 pips. Yesterday, the Eurozone Producer Price Index and the Services PMI data provided some support for the euro, but it all ended with the US releasing good data. As a result, the pair went through a bearish correction in the U.S. session. Today, the pair has every chance to get stuck in a horizontal channel, leading to a decrease in market volatility. The absence of important data will play a vital role in this. Traders should pay attention to the Eurozone retail sales report, although the data is for June, so this information is unlikely useful. Reports on factory orders in Germany and private non-farm payrolls in France are even less informative for traders. As for the intraday strategy, I will rely more on implementing scenarios No. 1 and 2.

Buy signals

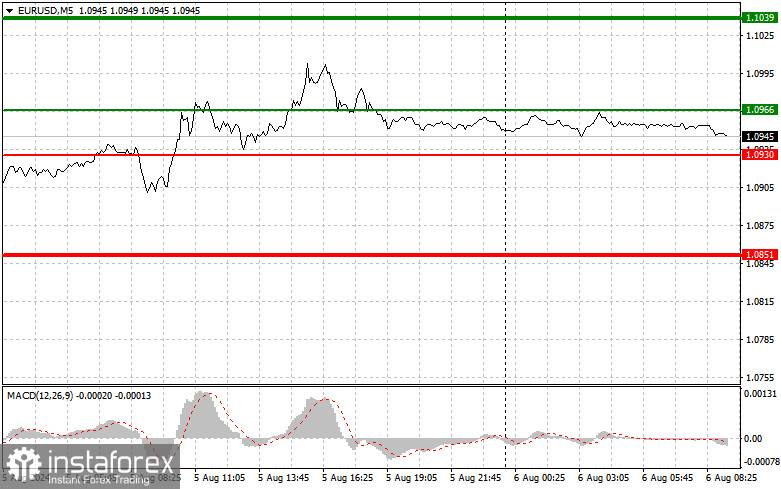

Scenario No 1. Today, you can buy the euro when the price reaches 1.0966, plotted by the green line on the chart, with the goal of rising to 1.1039. At 1.1039, I plan to exit the market and sell the euro in the opposite direction, counting on a movement of 30-35 pips from the entry point. We can count on the euro to rise today within the framework of the uptrend, as it is not worth relying on the data. Important: Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario No 2. I will also buy the euro today if the price at 1.0930 is tested twice consecutively when the MACD indicator is in the oversold area. This will limit the instrument's downward potential and lead to a reverse market upturn. One can expect growth to the opposite levels of 1.0966 and 1.1039.

Sell signals

Scenario No 1. I plan to sell the euro after it reaches 1.0930, plotted by the red line on the chart. The target will be 1.0851, where I will exit the market and buy immediately in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Pressure on EUR/USD will return today if the pair fails to consolidate near the intraday high and weak Eurozone data. Important: Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No 2. I will also sell the euro today in case of two consecutive price tests of 1.0966 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse market downturn. One can expect a decline to the opposite levels of 1.0930 and 1.0851.

What's on the chart:

Thin green line: the entry price at which you can buy the trading instrument.

Thick green line: the estimated price at which you can set Take Profit or manually close positions, as further growth above this level is unlikely.

Thin red line: the entry price at which you can sell the trading instrument.

Thick red line: an estimated price at which you can place Take Profit or manually close positions, as further decline below this level is unlikely.

MACD indicator: when entering the market, it is essential to be guided by overbought and oversold zones.

Important: Novice traders in the forex market must be cautious when deciding to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You must set stop orders to avoid losing your entire deposit, especially if you don't use money management and trade in large volumes.

Remember, a clear trading plan, like the one I've outlined, is essential for successful trading. Making impulsive decisions based on the current market situation is a losing strategy for novice intraday traders.