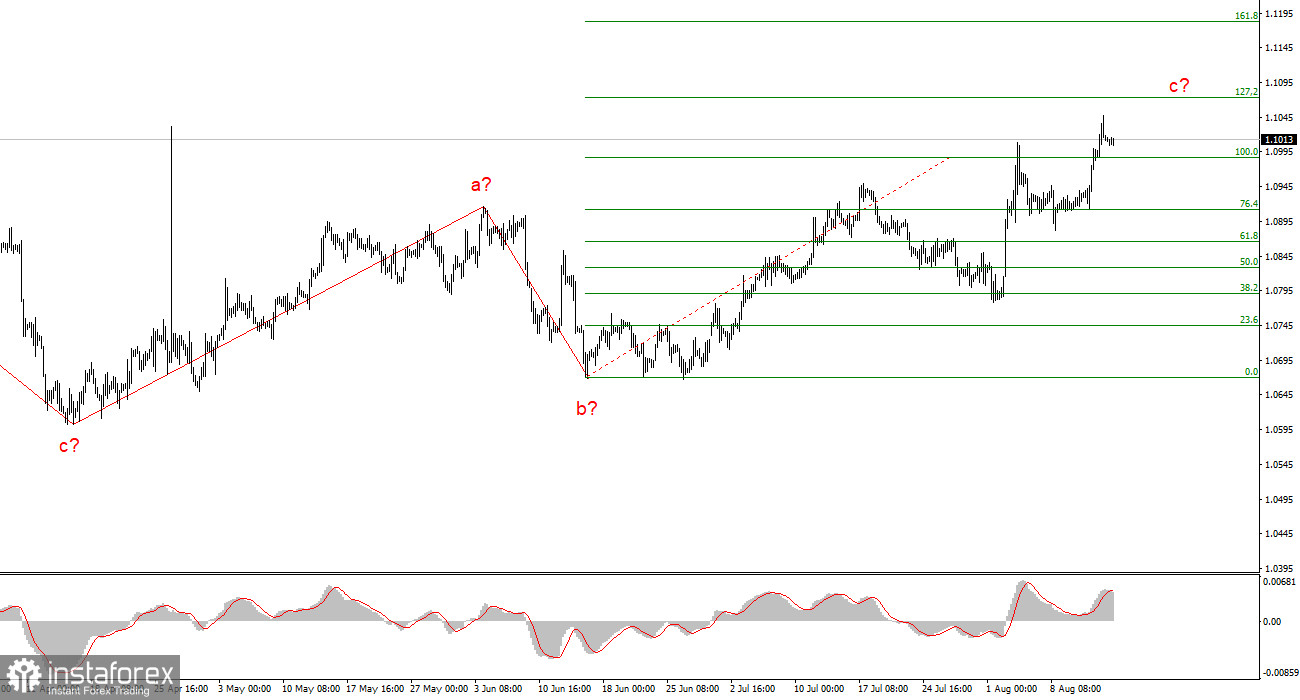

The wave pattern of EUR/USD on the 4-hour chart is starting to take on a more complex shape. If we analyze the entire trend segment that began in September 2022, when the euro dropped to 0.9530, it appears that we are inside an upward set of waves. However, even within this segment, it's challenging to distinguish larger-scale waves. In other words, there is no clear impulsive trend. We are observing a constant alternation of three- and five-wave corrective structures. The market has not yet formed a clear downward three-wave pattern from the peak reached in July last year. First, there was a downward wave that broke through the lows of previous waves, followed by a deep upward wave, and now, for the seventh month in a row, something unclear is being formed.

Since January 2024, I can only identify two a-b-c three-wave patterns, with a turning point on April 16. Therefore, the first thing to understand is that there is currently no trend. Once the current wave completes, a new three-wave downward pattern may begin to form. The trend segment from April 16 may take the shape of a five-wave structure, but it is likely to remain corrective. In such circumstances, I cannot trust in a prolonged rise of the euro, but it could very well continue for several more months.

The EUR/USD exchange rate did not change on Thursday, but the U.S. session is just beginning, so it can be assumed that the main movements are still ahead. The last two days have been challenging for the U.S. dollar, although if you look only at the U.S. data without considering the market movements, things don't look that bad for the dollar. The Producer Price Index (PPI) fell to 2.2% against market expectations of 2.3%, and inflation dropped to 2.9%, which is still quite high and far from the target level. Nevertheless, all types of inflation decreased, which is a reason to demand, with even greater intensity, that the Federal Reserve lowers rates on September 18.

"Demand" is the key word, not "wait," "allow," or "assume." The market has been demanding, not waiting, for some time. From January to June, it was waiting for rate cuts; since July, it has been demanding them. Currently, the probability of a 50-basis-point rate cut in September has decreased to 41.5%, and the probability of the rate remaining at its current level is zero. Over the past few days, the market has constantly changed its expectations regarding the magnitude of the rate cut. The probability of a 50-point round of easing has fluctuated up and down. This means that the market itself doesn't fully understand what to expect from the FOMC but continues to demand monetary policy easing. The structure within the assumed wave c is unclear, further complicating the situation.

General Conclusions

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to form a series of corrective structures. From the current positions, the increase may continue within the framework of a five-wave corrective structure, and the scenario with the formation of a downward wave d has been temporarily canceled. However, this does not mean that this wave cannot start forming today. Wave c is becoming more extended, although recent news casts doubt on the euro's ability to rise above the 10th figure. However, the market continues to sell the dollar under any circumstances, reacting to expectations of Federal Reserve rate cuts in September, November, December, and into 2025.

On a larger scale, it is also evident that the wave structure is becoming more complex. It is likely that we are in for an upward series of waves, but its length and structure are difficult to imagine at this point.

Key Principles of My Analysis:

- Wave structures should be simple and easy to interpret. Complex structures are challenging to trade and often undergo changes.

- If you are uncertain about what is happening in the market, it's better not to enter it.

- There is never 100% certainty in the direction of movement. Always remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.