No matter how good the news from politicians may be, the laws of supply and demand remain in force. Both Republicans and Democrats are keen to win the support of crypto enthusiasts. Kamala Harris' team plans to pass bipartisan legislation regulating the digital assets industry by the end of 2024. Meanwhile, Donald Trump has even promised to create a strategic reserve of bitcoins. However, the U.S. government's transfer of 10,000 tokens to Coinbase wallets could disrupt his plans. At the same time, this move is preventing BTC/USD from fully recovering after the recent market crash referred to as Black Monday.

For many years, Bitcoin was considered a risky asset and mirrored the movements of U.S. tech stock indices. However, a significant divergence between them emerged in July and August. Investors feared that a large-scale sale of tokens by the U.S. government, aimed at returning them to scam victims, would increase supply and put pressure on BTC/USD prices.

BTCUSD and Nasdaq-100 Dynamics

Currently, the U.S. holds 203,000 bitcoins worth around $12 billion, seized from fraudsters and other criminals. Donald Trump has promised to make these the foundation of a strategic reserve, but the Department of Justice has transferred about 10,000 tokens to Coinbase, according to Arkham Intelligence. This could be for storage purposes, but if such a large amount of cryptocurrency floods the market as part of its conversion to fiat money, BTC/USD could be in trouble.

Rumors of an imminent surge in supply, especially in the traditionally low-liquidity August market due to vacations, are keeping Bitcoin bulls in check. The price of the leading cryptocurrency has been stuck in a narrow trading range, unlike the Nasdaq-100, which has been rising for seven consecutive trading days. In such conditions, one might start to doubt whether the digital asset is truly risky. Or could it be considered a safe haven? However, the success of gold suggests there may be internal issues within the crypto system affecting BTC/USD.

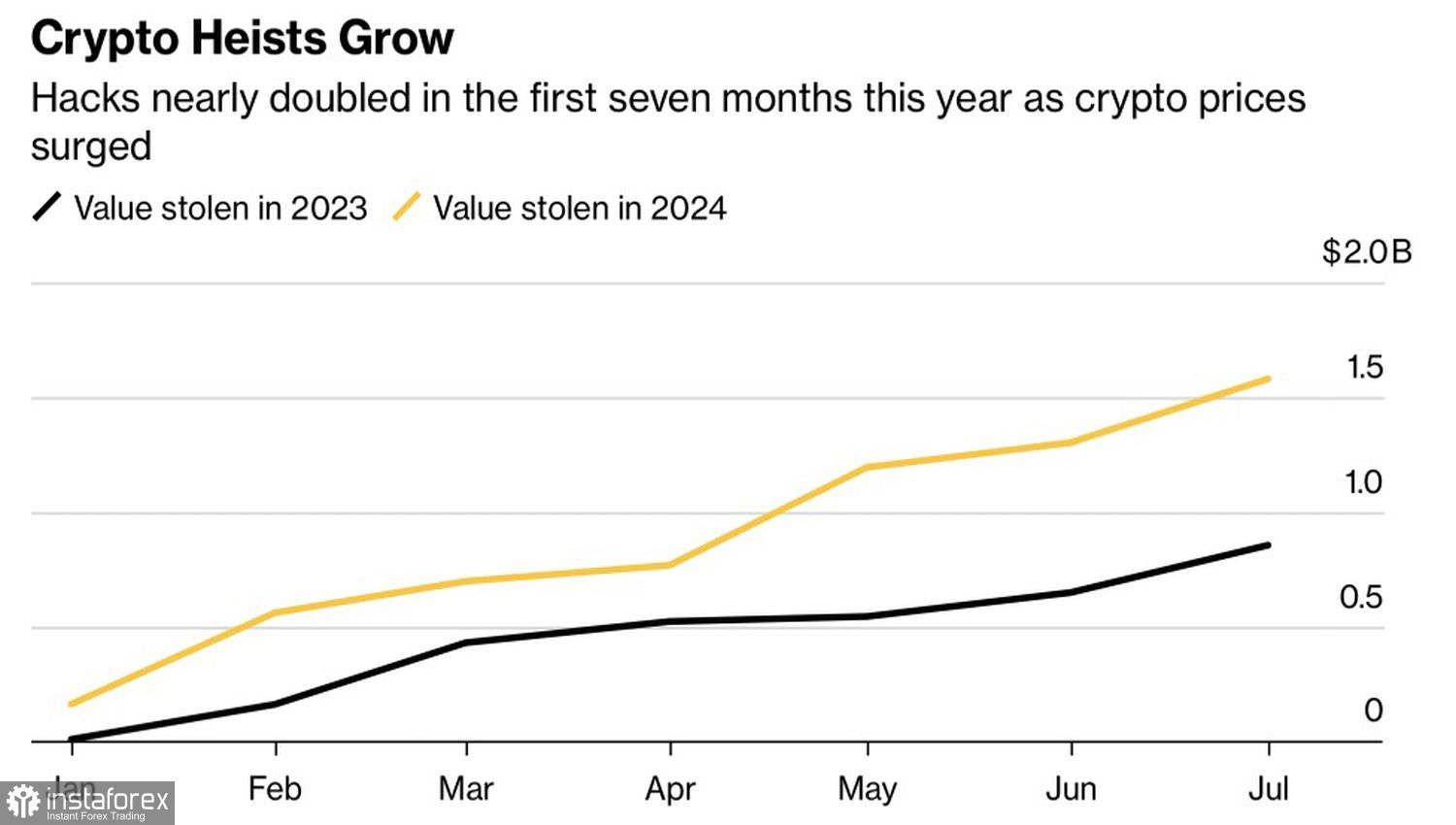

One of these issues is the rising scale of thefts. In the first seven months of the year, thefts nearly doubled compared to the same period in 2023, reaching $1.6 billion. The number of incidents remained relatively stable, with 149 this year compared to 145 last year. The increase in the amount stolen is due to rising prices, with 40% of all thefts involving Bitcoin.

Cryptocurrency Theft Volume Dynamics

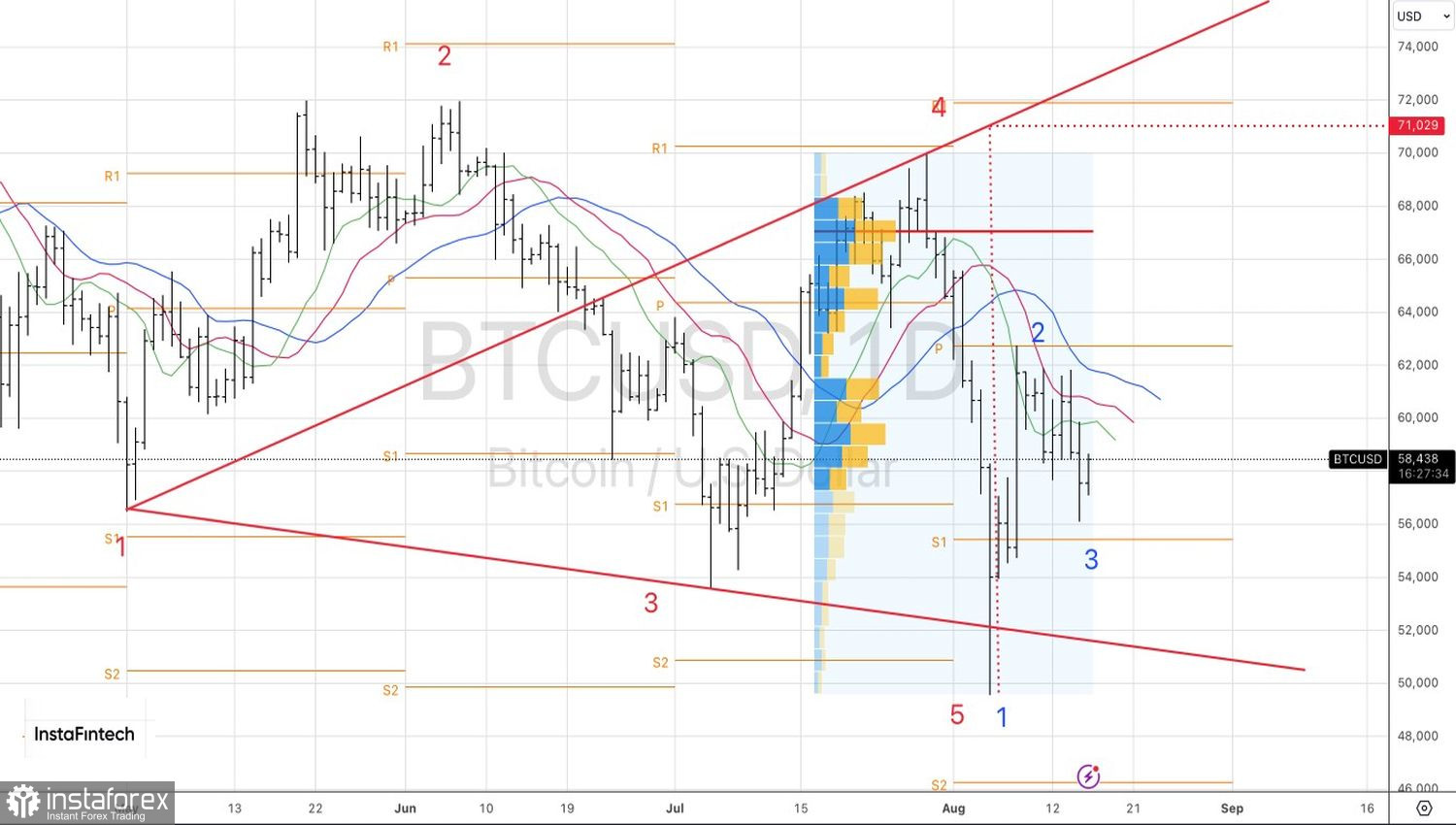

Thus, the main fears for cryptocurrency are related to the potential sale of tokens by the U.S. government, which would increase supply and could lead to a significant price crash in the low-liquidity August market. Once these fears subside, the digital asset may be ready to surge.

Technically, on the daily BTC/USD chart, there is a realization of the Wolfe Wave pattern with a target of 71,000. To enter long positions, it makes sense to wait for the activation of the 1-2-3 reversal pattern, specifically, a rise in prices above 61,700 and 62,700.