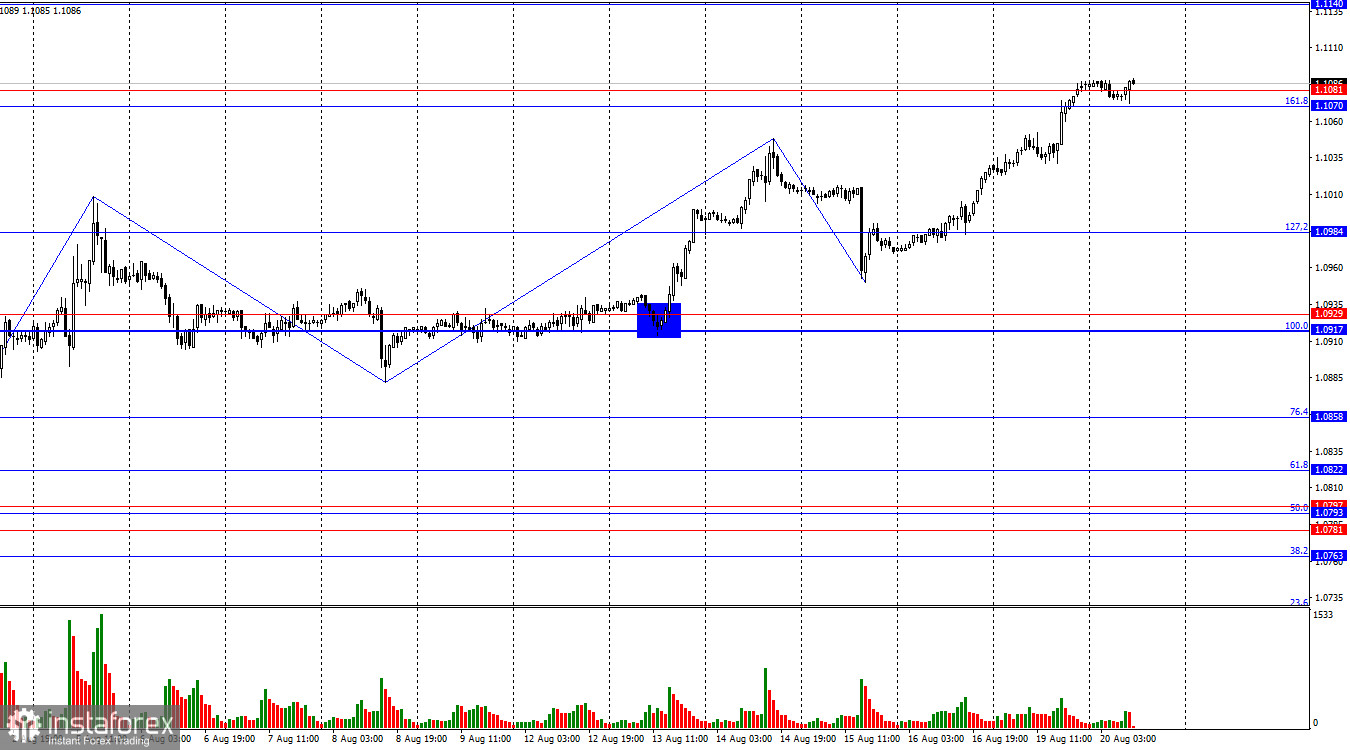

The wave situation has become slightly more complex, but overall, it remains clear. The last completed downward wave did not break below the previous wave's low, while the new upward wave surpassed the peak from August 14. Therefore, the bullish trend is still intact. For this trend to be reversed, the bears now need to break the low of the last downward wave, which is around the 1.0950 level.

There was no significant news on Monday, but this did not deter bullish traders. We observed steady buying of the euro throughout the day. While there are numerous potential reasons for this, there is no clear evidence that these factors are the exact causes of the dollar's decline. It is important to note that the market is always influenced by a multitude of informational factors that can be attributed to any movement. For example, later this week, Federal Reserve Chairman Jerome Powell is scheduled to speak, and the market is undoubtedly expecting dovish rhetoric. Additionally, the Federal Reserve is likely to hold a significant meeting in a month, where for the first time in many years, monetary policy might be eased instead of tightened. Bullish traders may be driving their continuous attacks based on these factors. At the same time, it's worth noting that the market rarely moves without being fueled by new data. Last week, the news wasn't disastrous for the dollar, and there was no news at all on Monday, yet the dollar couldn't manage even a slight recovery. Technical analysis currently seems to have greater priority.

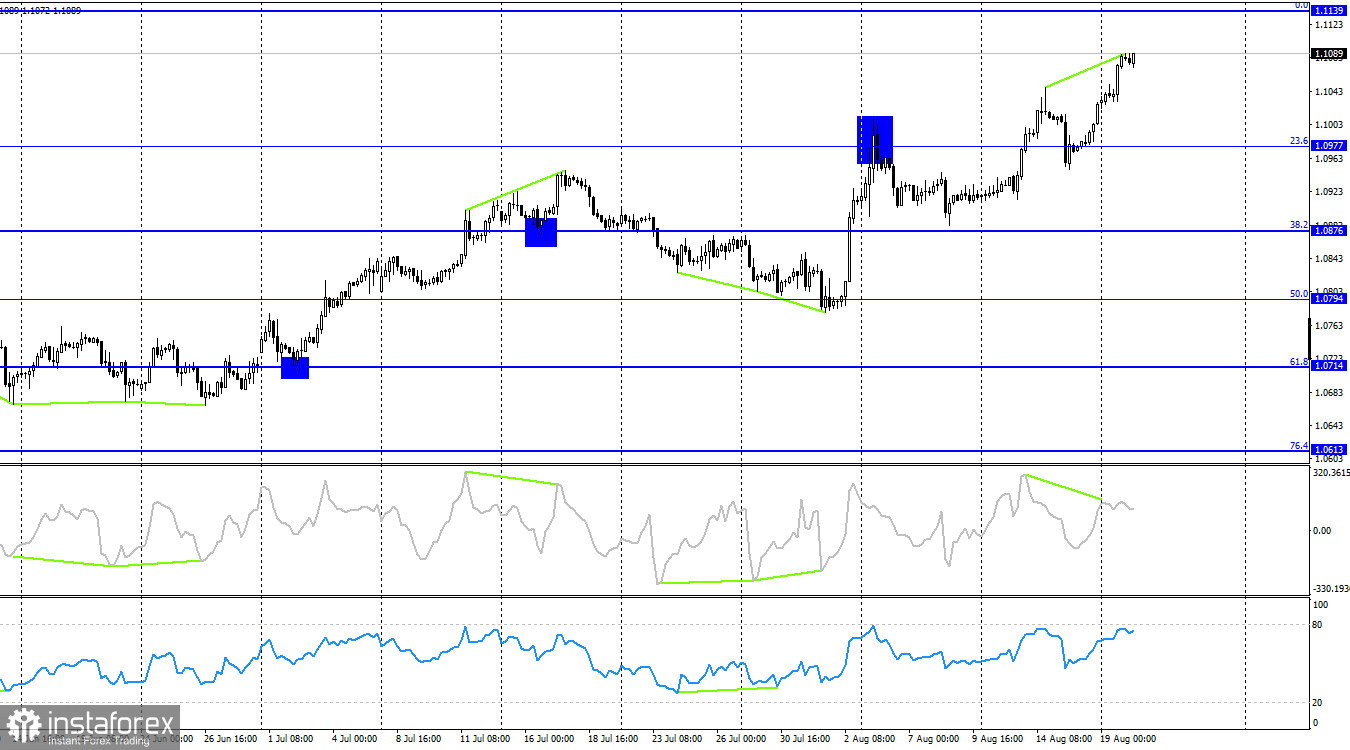

On the 4-hour chart, the pair reversed in favor of the euro around the 38.2% Fibonacci corrective level at 1.0876 and began a new upward movement. The consolidation above the 23.6% Fibonacci level at 1.0977 suggests that the pair may continue to rise towards the next corrective level at 0.0% – 1.1139. Today, a bearish divergence formed on the CCI indicator, but within a bullish trend, this may only signal a potential correction. In my view, the current growth does not align with the fundamental background, but the technical picture clearly indicates a bullish trend without signs of completion.

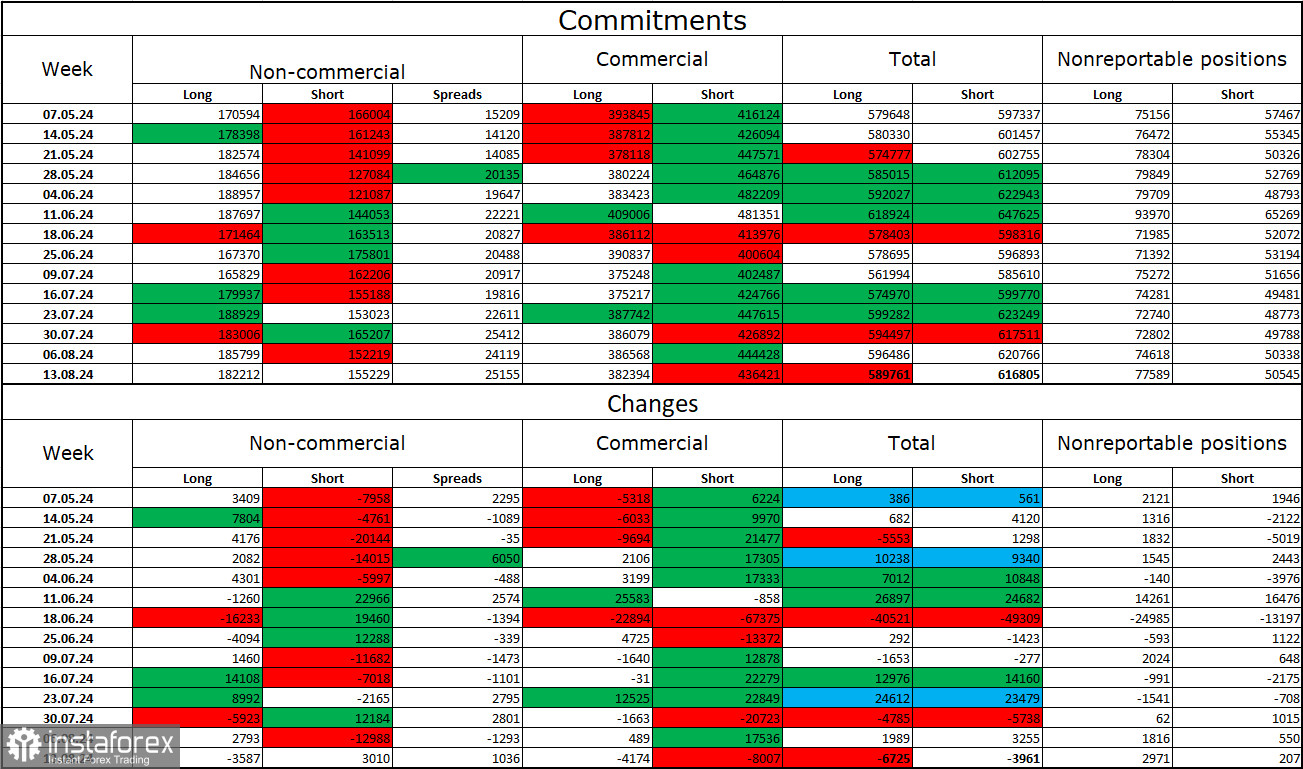

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 3,587 long positions and opened 3,010 short positions. The sentiment of the "Non-commercial" group shifted to bearish several months ago, but currently, the bulls are once again dominating. The total number of long positions held by speculators is now 182,000, while the number of short positions is 155,000.

I still believe that the situation will eventually shift in favor of the bears. I don't see any long-term reasons to buy the euro, as the ECB has begun easing monetary policy, which will reduce the yield on bank deposits and government bonds. In the U.S., bond yields are expected to remain high at least until September, making the dollar more attractive to investors. The potential for a significant decline in the euro is evident. However, one should not forget about technical analysis, which currently does not suggest a strong fall in the euro, as well as the fundamental background.

Economic Calendar for the U.S. and Eurozone:

Eurozone – Consumer Price Index (09:00 UTC).

The economic calendar for August 20th contains only one event. The impact of the information background on trader sentiment today will be very weak.

EUR/USD Forecast and Trading Tips:

Selling the pair today can be considered if it closes below the 1.1070–1.1081 zone on the hourly chart, with a target of 1.0984. I would approach buying with caution, but after a consolidation above 1.1081, new trades can be considered with a target of 1.1140.

Fibonacci levels are plotted based on 1.0917–1.0668 on the hourly chart and 1.0450–1.1139 on the 4-hour chart.