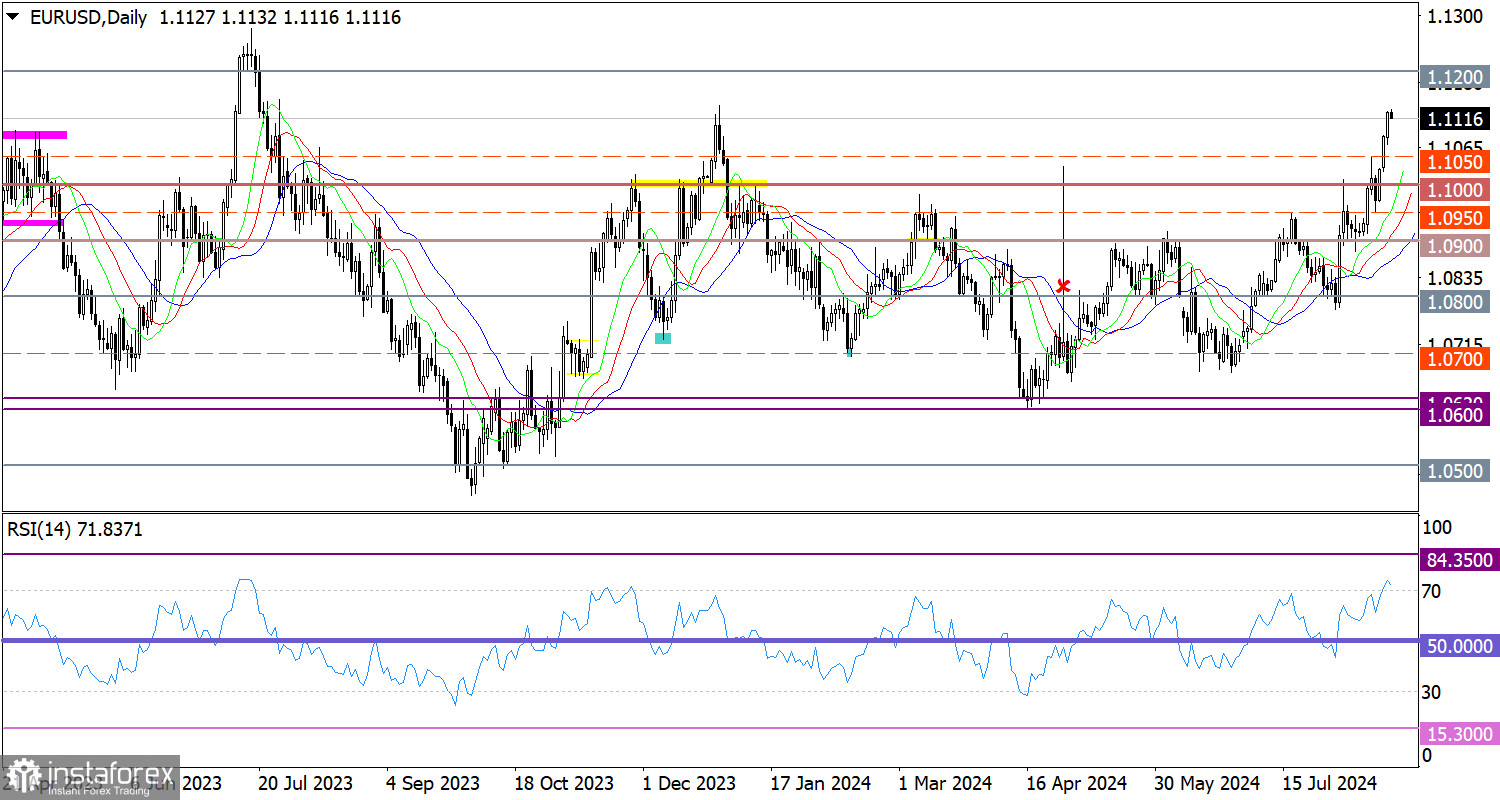

During its momentum-driven rise, the EUR/USD pair reached an eight-month high, where the volume of long positions slightly decreased.

In the 4-hour chart, the RSI technical indicator is in the overbought zone, suggesting an excessive number of long positions.

Regarding the Alligator indicator in the same time frame, the moving average lines are aligned with the direction of the trend.

Expectations and Prospects

From a technical perspective, there are signs of the euro's overbought conditions in the intraday period. However, the momentum still prevails. Therefore, if the price stabilizes above 1.1150, the pair could move towards the local high established in July 2023. As for a technical pullback, if the price does not stabilize above 1.1150, it could temporarily weaken the euro towards 1.1050, which would fit the logic of a realignment of trading forces.

The complex indicator analysis suggests an upward cycle in the short-term and intraday periods.