To Open Long Positions on GBP/USD:

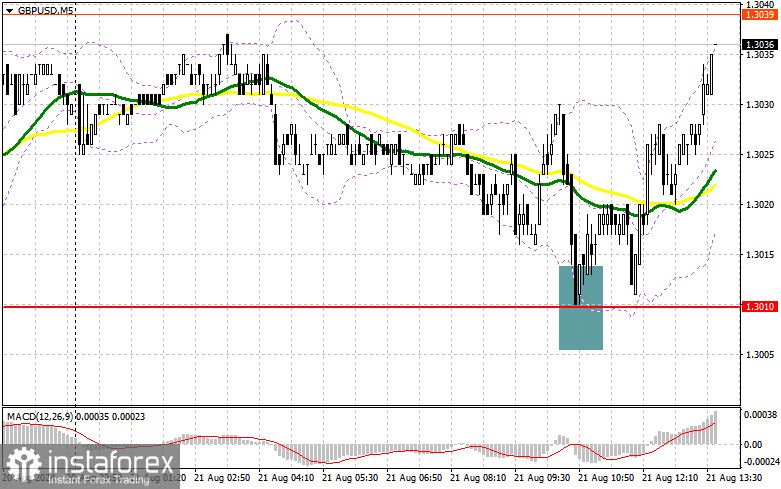

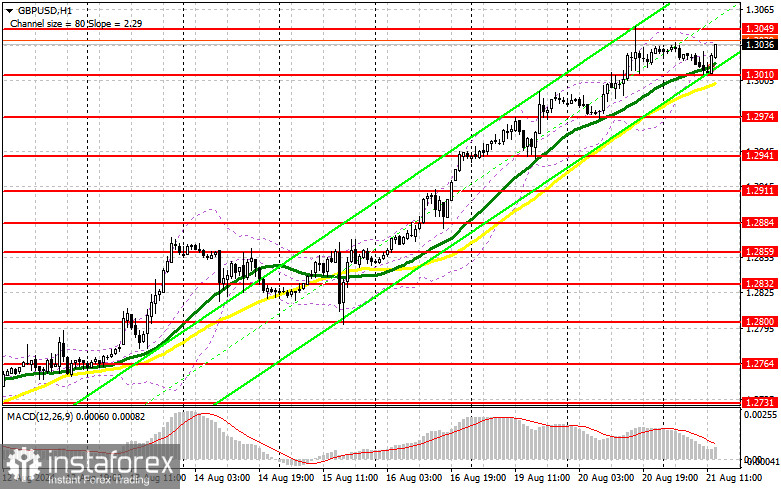

During the U.S. session, we are expecting the release of the Federal Reserve's meeting minutes, and only very hawkish statements in the minutes could potentially harm the upward potential of the GBP/USD pair. However, even if the pound declines, speculative players are likely to take advantage of it quickly, as the main focus remains on Fed Chair Jerome Powell's speech later this week. I recommend taking advantage of any decline in GBP/USD, but I will only open long positions after a false breakout forms around the 1.3010 support level, similar to the setup discussed earlier. This will provide an entry point for long positions, aiming for a retest of 1.3049, which we failed to break above yesterday. Only a breakout and a subsequent test from above will strengthen the chances of further upward trend development, leading to a stop-loss movement for sellers and providing an entry point for long positions with a potential target at 1.3085. The final target will be the 1.3138 level, where I plan to take profits. If GBP/USD declines and there is no significant bullish activity around 1.3010 in the second half of the day, where the moving averages also support the bulls, pressure on the pair will increase. This could lead to a decline and a retest of the next support at 1.2974. Only a false breakout at that level would be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2941 low, targeting a 30-35 points intraday correction.

To Open Short Positions on GBP/USD:

Sellers did their best, but they failed to gain support from major players to break through the 1.3010 level. It is clear that the pound still has upward potential, but we need to see how the pair reacts to the Fed's minutes. Only a false breakout around the 1.3049 resistance will be a valid option for me to open short positions, aiming for a retest of the 1.3010 support, which we failed to break below today. A breakout and a subsequent test from below, which would be the second test of this level, will deal a blow to buyers' positions, leading to a stop-loss movement and opening the way to 1.2974, where I expect more active participation from major players. The final target will be the 1.2941 level, where I will take profit. A test of this level will significantly harm the pound's upward potential. If GBP/USD rises and there is no bearish activity around 1.3049 in the second half of the day, buyers will maintain the initiative and have the opportunity to continue building a bullish market. In that case, I will postpone selling until a false breakout at 1.3085. If there is no downward movement, I will sell GBP/USD immediately if it rebounds from 1.3138, targeting a 30-35 points intraday correction.

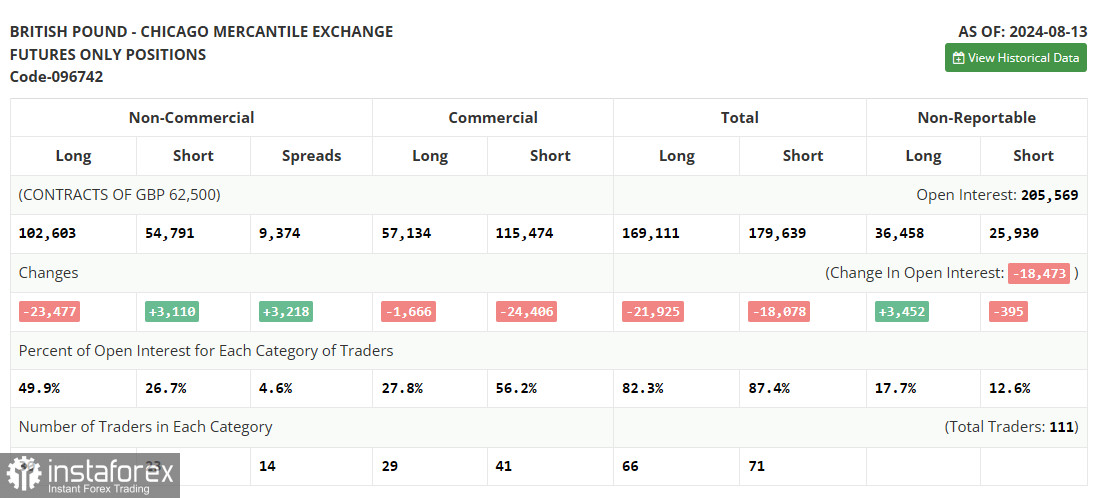

In the COT report (Commitment of Traders) for August 13, there was a sharp reduction in long positions and a slight increase in short positions. Undoubtedly, the recent statements by the Bank of England, which clearly indicated its intention to lower interest rates, as well as economic data pointing to reduced price pressures, were key factors in traders' decisions to abandon new long positions since lower rates make the pound less attractive. However, despite the central bank's dovish stance, the pound managed to resume growth due to the excessive weakness of the U.S. dollar, driven by the same factors: the Fed is expected to lower interest rates in September this year for the first time since the beginning of the coronavirus pandemic. The latest COT report indicates that long non-commercial positions fell by 23,477 to 102,603, while short non-commercial positions increased by 3,110 to 54,791. As a result, the gap between long and short positions widened by 3,218.

Indicator Signals:

Moving Averages:

Trading is above the 30 and 50-day moving averages, indicating further growth for the pound.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3010 will act as support.

Indicator Descriptions:

- Moving average (determines the current trend by smoothing volatility and noise). Period: 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period: 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages). Fast EMA period: 12. Slow EMA period: 26. SMA period: 9.

- Bollinger Bands (Bollinger Bands). Period: 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.