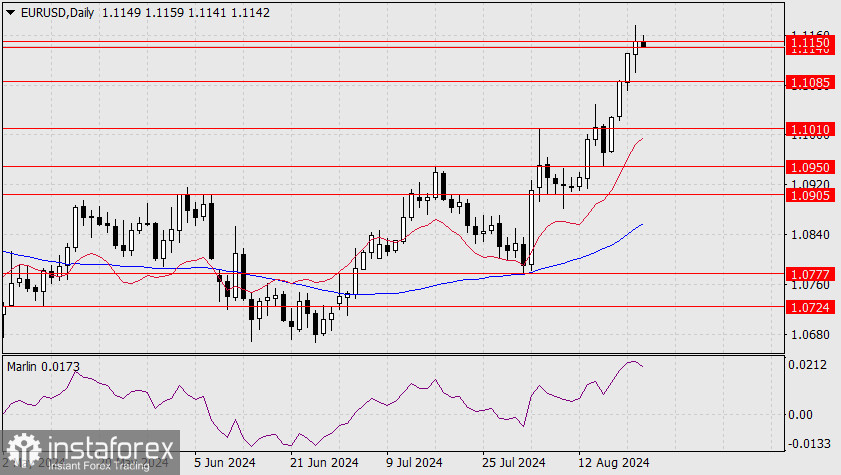

Yesterday, the euro displayed a range of 70 pips, with the central part falling within the target range of 1.1140/50. Today, during the Pacific session, the price holds within this range. A reversal of the Marlin oscillator from the overbought zone could indicate the market cooling off before Federal Reserve Chair Jerome Powell's speech at tomorrow's Jackson Hole symposium.

Following this speech, our main scenario assumes a price decline in the medium term. The first sign of such a decline would be the price consolidation below the 1.1085 level. If we are wrong about the Fed's strategy, the euro could experience a solid rise to the target range of 1.1280-1.1310.

In the 4-hour chart, the Marlin oscillator's signal line attempts a downward breakout from its range. This is the first and weak sign of a reversal. We await confirmation through Marlin moving into negative territory and the price surpassing the MACD line around the target support of 1.1085.