Analysis of Trades and Tips for Trading the Euro

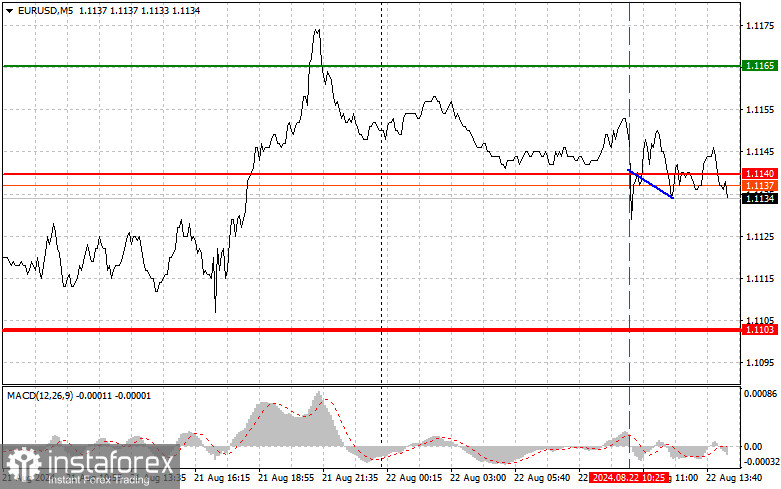

The test of the 1.1140 price level coincided with the moment when the MACD indicator had just started moving down from the zero mark, validating the ideal entry point to sell the euro. However, despite rather weak statistics on activity in the Eurozone, the pair did not experience a significant decline. The data released from Eurozone countries, particularly in the manufacturing sector, were highly disappointing in August. However, this was offset by good performance in the services sector, which once again saved the economy from sliding into a recession. The second half of the day might see dollar buyers taking the initiative, but for this to happen, the data needs to surpass economists' forecasts. Expected figures include the Manufacturing PMI, Services PMI, and Composite PMI for the U.S. for August, as well as the weekly Initial Jobless Claims and Existing Home Sales data. Only very strong data can strengthen the dollar against the euro. As for the intraday strategy, I plan to act based on the implementation of Scenarios 1 and 2.

Buy Signal

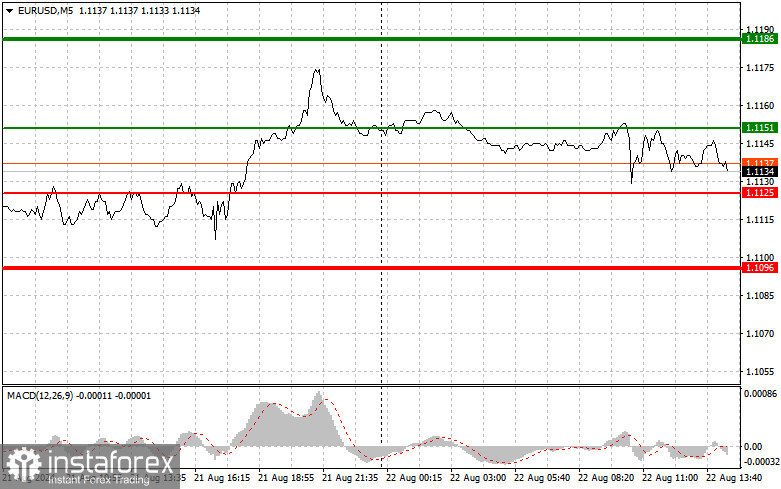

Scenario 1: Today, I plan to buy the euro if the price reaches around 1.1151 (green line on the chart) with a target of 1.1186. At 1.1186, I will exit the market and also sell the euro, targeting a 30-35 point movement from the entry point. A strong upward movement in the euro today is likely following weak U.S. data, continuing the upward correction. It is important to ensure that the MACD indicator is above the zero mark and just starting its upward movement before buying.

Scenario 2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1125 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. The expected rise would target the resistance levels at 1.1151 and 1.1186.

Sell Signal

Scenario 1: I will sell the euro after the price reaches 1.1125 (red line on the chart). The target will be the 1.1096 level, where I plan to exit the market and immediately buy the euro (targeting a 20-25 point movement from the level). Pressure on the pair will return if the attempt to rise above the daily high fails. It is important to ensure that the MACD indicator is below the zero mark and just starting its downward movement before selling.

Scenario 2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1151 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. The expected decline would target the levels at 1.1125 and 1.1096.

Explanation of the chart elements:

- Thin green line: Entry price at which you can buy the trading instrument.

- Thick green line: Expected price where you can set Take Profit or manually lock in profits, as further growth beyond this level is unlikely.

- Thin red line: Entry price at which you can sell the trading instrument.

- Thick red line: Expected price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely.

- MACD Indicator: It is important to consider overbought and oversold zones when entering the market.

Important: Beginner traders in the forex market need to make trading decisions very cautiously. Before the release of important fundamental reports, it's best to stay out of the market to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you're not practicing money management and trading large volumes.

And remember, for successful trading, it is crucial to have a clear trading plan. Spontaneous trading decisions based on the current market situation are initially a losing strategy for intraday traders.