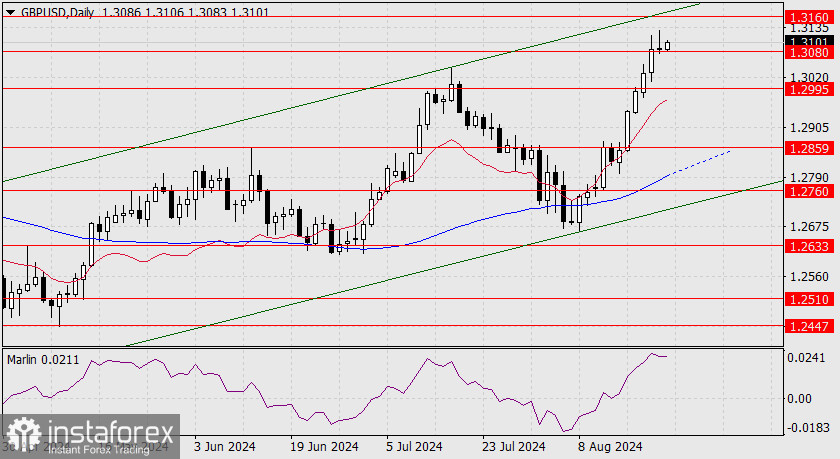

The British pound attempted to rise yesterday but failed. However, it consolidated above the 1.3080 level with a daily candle. The future direction will now depend on Federal Reserve Chair Jerome Powell's speech at the bankers' symposium in Jackson Hole.

We believe the head of the US central bank will not confirm the market's expectations of a 2.00% rate cut by the end of the year, which would strengthen the dollar and, consequently, push the pound below the 1.2995 level. Such a decline would open the way to 1.2859. The MACD line is also approaching this level.

In the 4-hour chart, the price is consolidating above the 1.3080 level. The Marlin oscillator's move towards negative territory indicates the weakness of the observed consolidation. The MACD line is approaching the 1.2995 level. Therefore, consolidating below this level would present good prospects for the bears.