The wave analysis for GBP/USD remains quite complex and ambiguous. For a while, the wave pattern appeared convincing and suggested the development of a downward wave sequence with targets below the 1.23 level. However, in practice, demand for the U.S. dollar increased too much to allow this scenario to unfold, and this demand continues to grow.

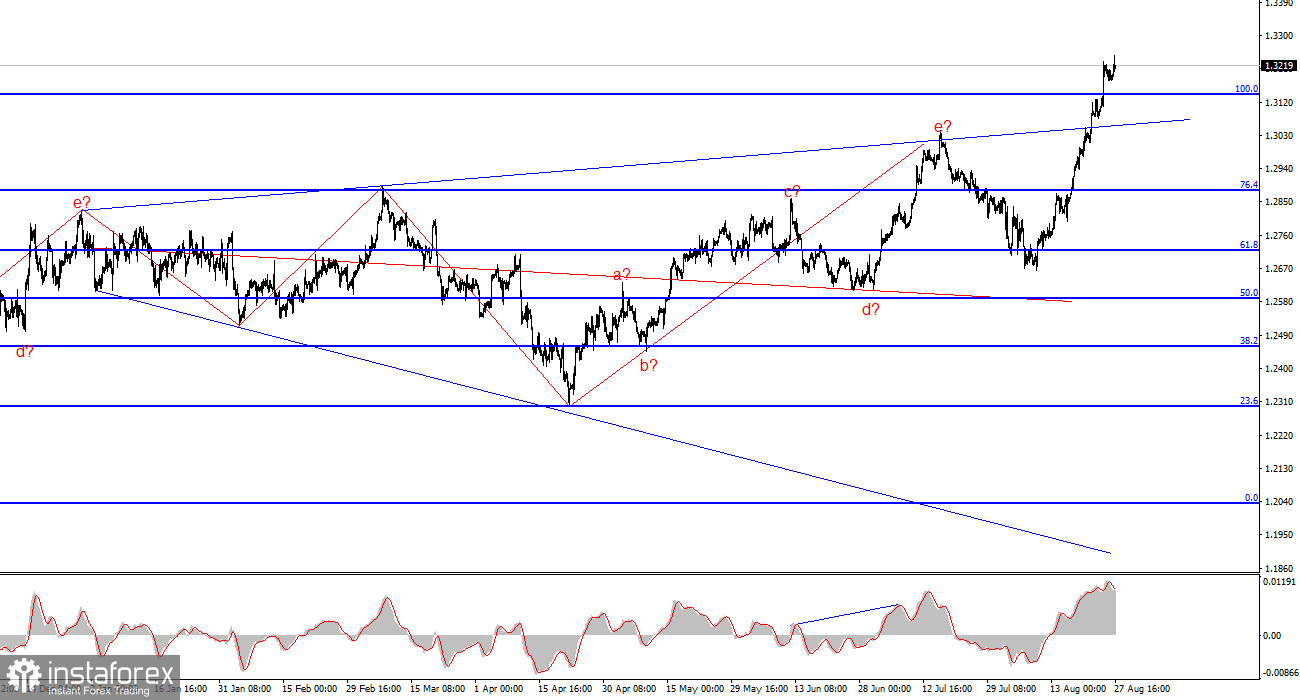

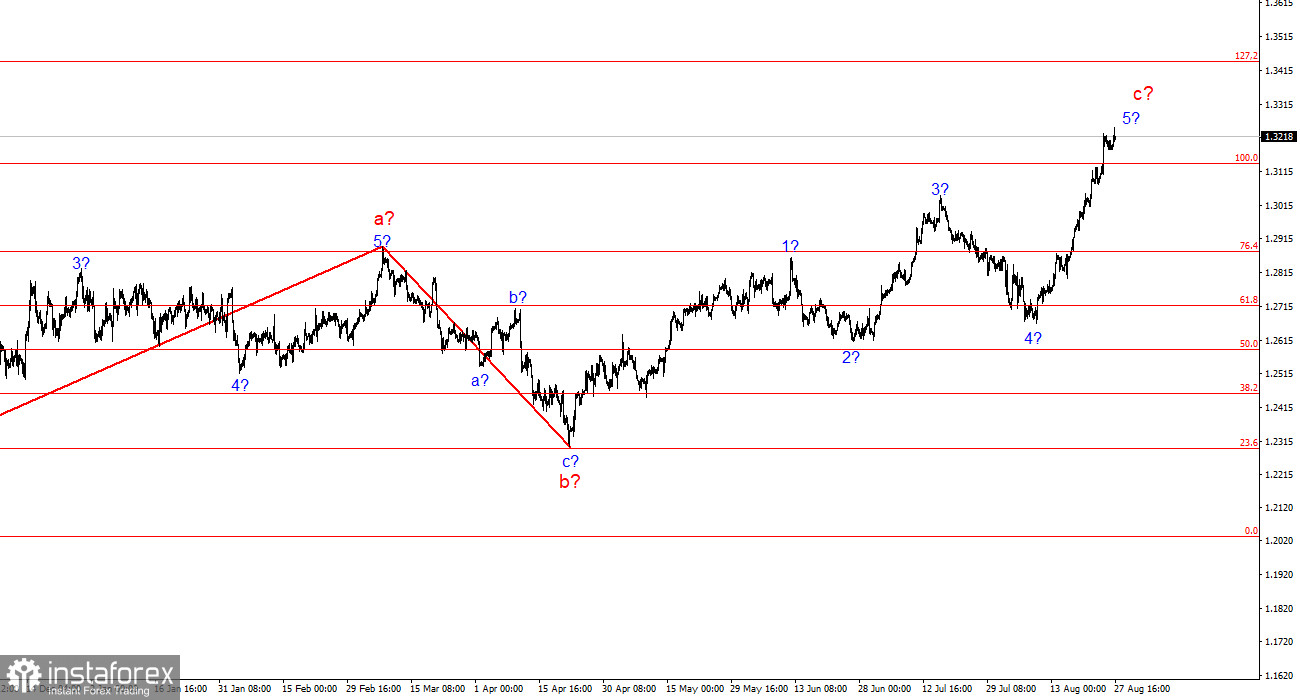

Currently, the wave pattern has become unreadable. As a reminder, I prefer using simple structures in my analysis because complex ones have too many nuances and ambiguous points. At present, we see an upward wave that has covered a downward wave, which in turn covered a previous upward wave, which covered a prior downward wave (all within a triangle). The only assumption we can make is an expanding triangle with an upper point around the 1.30 level and a balancing line around the 1.26 level. However, a new upward wave, which does not fit into any wave pattern, has pushed quotes above the triangle. The lower chart shows an alternative wave pattern.

The Market Found a New Reason for Buying

The GBP/USD exchange rate fell by 60 basis points on Wednesday, but in light of its recent upward wave, this movement is insignificant and guarantees absolutely nothing. The pound, along with the euro, is overbought, as increasingly noted by analysts from major banks and companies. However, overbought conditions alone do not indicate that the movement is ending. We see that in August, demand for the U.S. dollar has been declining, although not every day brings negative economic data from the U.S. Accordingly, the market is trading based on the global factor of Federal Reserve rates, rather than the Bank of England. Therefore, why should it stop selling the U.S. dollar today?

The British pound has become a victim of the situation. Nothing in the UK seemed to predict such a strengthening of the pound. In fact, the UK economy has been facing serious problems since the 2016 referendum. Recently, new Prime Minister Keir Starmer stated that Britons will need to "tighten their belts" in the coming years. In September, the budget for the next year will be presented, and it is likely that the UK population will face tax increases and cuts to various social programs. In other words, the new government needs to cut expenses and increase revenue. If the economy were performing well, would the Labor Party be implementing such measures?

The weakness of the British economy is also evident from GDP indicators. Despite growth over the past few quarters, the economy is more stagnant than growing. Therefore, we return to the primary and most important factor—the market's focus on the Federal Reserve's monetary policy easing. This factor may remain relevant for quite some time.

General Conclusions

The wave pattern for GBP/USD still suggests a decline. If the upward segment of the trend started on April 22, it has already taken on a five-wave form. Consequently, we should now expect at least a three-wave correction. In my opinion, it is prudent to consider selling the pair with targets around the 1.2627 level. However, there are no signals yet that the last upward wave has ended, and the market is not rushing to reduce demand for the British currency.

At a higher wave scale, the wave pattern has evolved. We can now assume the development of a complex and extended upward corrective structure. Currently, it is a three-wave structure, but it could evolve into a five-wave structure, which could take several more months or even longer to complete.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often involve frequent changes.

- If there is no confidence in the market situation, it is better not to enter.

- There is no such thing as 100% certainty in market direction, and there never can be. Always use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.