The Canadian dollar attempts to recover yesterday's losses.

Investors in the Canadian dollar are awaiting monthly and quarterly GDP data to be released on Friday. The GDP report is expected to show that the economy barely grew in June after a 0.2% increase in May. The Canadian economy grew at a slower year-over-year pace of 1.6%, down from 1.7% in the previous period. Signs of cooling economic prospects will heighten expectations of further interest rate cuts by the Bank of Canada.

Alongside this data, Reuters reports that General C.Q. Brown, Chairman of the Joint Chiefs of Staff, stated that concerns about an imminent larger conflict in the region have diminished. The skirmish between Israel and Hezbollah in Lebanon has not escalated further. Consequently, oil prices received support, and the Canadian dollar, which is closely linked to oil prices, also benefited.

Additionally, oil is receiving support from growing expectations of interest rate cuts in the U.S., which could stimulate fuel demand. Therefore, lower borrowing costs will increase economic activity in the U.S., the world's largest oil consumer.

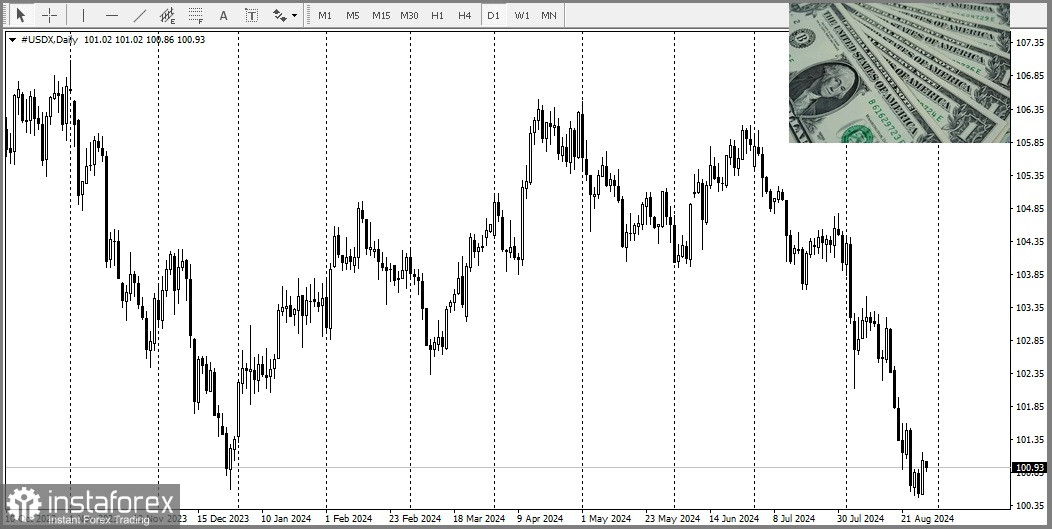

The U.S. Dollar Index, which measures the dollar against six major currencies, fell from 101.18, following a strong recovery from its new yearly low of 100.50.

The U.S. dollar is expected to remain under pressure as investors await the release of the PCE (Personal Consumption Expenditures) price index for July, which will be published on Friday. The forecast suggests that the PCE report will show that core inflation increased at a faster pace year-over-year to 2.7% from 2.6% in June, with monthly figures expected to rise by 0.2%. The inflation data is expected to significantly influence market speculation about the Federal Reserve's monetary policy decisions in September.

Currently, market participants are confident that the Fed will start cutting borrowing costs in September. However, traders remain divided on the extent of the rate cut.

According to the CME FedWatch tool, data on 30-day Fed funds futures prices show that there is a 34.5% chance of a 50 basis point rate cut in September, while the remaining participants favor a 25 basis point cut.

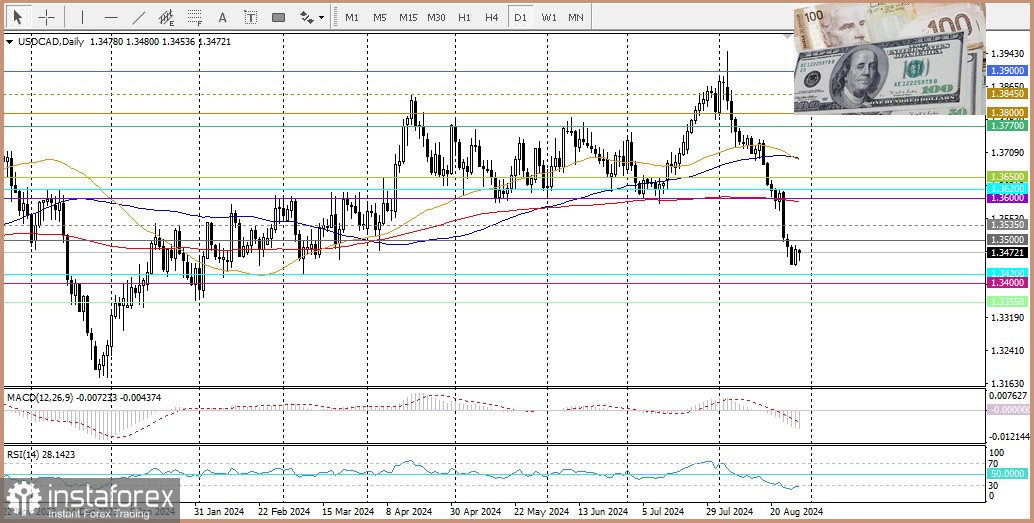

From a technical perspective, as the RSI (Relative Strength Index) has emerged from the oversold zone and is slightly above 30% but below 50%, the USD/CAD pair is more likely to move downward in the near term.