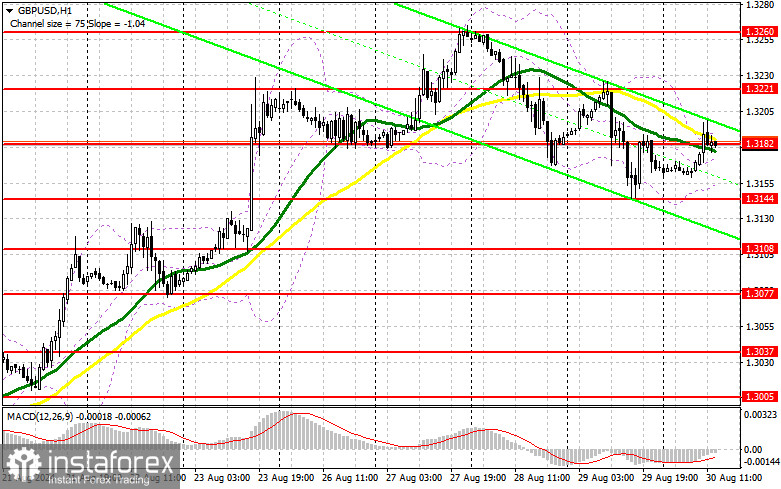

In my morning forecast, I focused on the 1.3182 level for making market entry decisions. Let's examine the 5-minute chart to see what happened. The breakout and retest of this range took place, but the pound failed to achieve significant growth, indicating a cautious stance by buyers ahead of important U.S. statistics. The technical picture has not been revised for the second half of the day.

For Opening Long Positions on GBP/USD:

The data on UK lending positively impacted the pound, but its effect was limited. Now, everything depends on U.S. statistics. Key indicators will be the changes in personal spending and income levels, as well as the U.S. Core Personal Consumption Expenditures (PCE) Index. Secondary statistics will include reports on the University of Michigan's Consumer Sentiment Index and inflation expectations. If the pound declines following the data, only a false breakout around 1.3144 will provide an opportunity to open long positions, anticipating a return to the middle of the 1.3182 channel, where trading is currently taking place. A breakout and retest from above this range, as discussed earlier, will strengthen the chances of an uptrend, lead to the removal of sellers' stop orders, and provide a good entry point for long positions, with the potential to reach 1.3221. The furthest target will be the 1.3260 level, where I plan to take profits. In the scenario of a GBP/USD decline and a lack of bullish activity around 1.3144 in the second half of the day, pressure on the pair will increase toward the end of the week. This could also lead to a decline and retesting the next support at 1.3108. Only a false breakout formation will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3077 low, targeting an intraday correction of 30-35 points.

For Opening Short Positions on GBP/USD:

Sellers remain active, but not as aggressively as before. The main task will be to break the significant support at 1.3144, which will likely be achieved on the back of strong U.S. statistics and news of rising inflation. If the data disappoints, defending the 1.3221 level will become a priority, as the 1.3182 level should not be heavily relied upon at this point. Only a false breakout there will be a suitable condition for opening short positions against the trend, aiming for a correction and retesting the 1.3182 support, which has attracted traders today. A breakout and retest from below this range will undermine buyers' positions, leading to the removal of stop orders and opening the way to 1.3144, where I expect more active actions from major players. The furthest target will be the 1.3108 level, where I will take profits. Testing this level will lead to a decent downward correction in the pair, jeopardizing the continuation of the bullish market for the pound. If GBP/USD rises and there is no bearish activity at 1.3221 in the second half of the day, there will be no choice but to retreat to the 1.3260 resistance area, coinciding with the monthly high. In this case, I will postpone selling until a false breakout at the 1.3300 level. If there is no downward movement there either, I will sell GBP/USD immediately on a rebound from 1.3340, targeting a downward correction of 30-35 points.

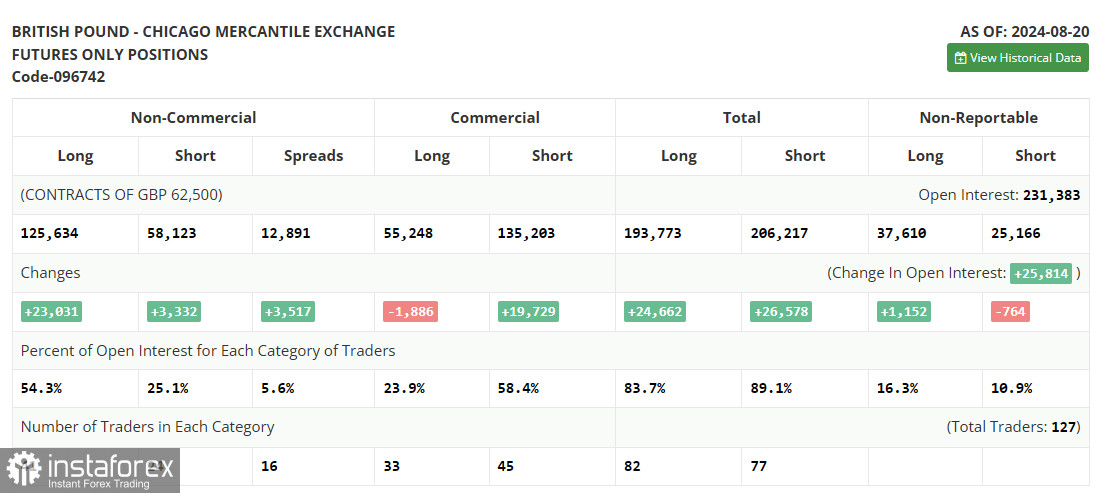

In the COT report (Commitment of Traders) for August 20, the report showed a sharp increase in long positions and a slight decrease in short positions. More and more people are betting on the pound's rise, which demonstrated one of the strongest streaks of strengthening last week. The market is not deterred by the fact that the Bank of England continues to cut interest rates, as everyone is confident in the more aggressive easing policy of the U.S. Federal Reserve. So it's not really about the strength of the pound but rather about the weakness of the U.S. dollar, which will likely continue to face challenges in the near future, especially with statistics indicating further declines in U.S. inflation expected this week. The latest COT report shows that long non-commercial positions jumped by 23,031 to 125,634, while short non-commercial positions increased by 3,332 to 58,123. As a result, the difference between long and short positions widened by 3,517.

Indicator Signals:

Moving Averages:

Trading is occurring around the 30 and 50-day moving averages, indicating indecision in the market.

Note: The period and prices of the moving averages are calculated based on the hourly H1 chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3145 will act as support.

Indicator Descriptions:

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions: The total long open position of non-commercial traders.

- Short non-commercial positions: The total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.