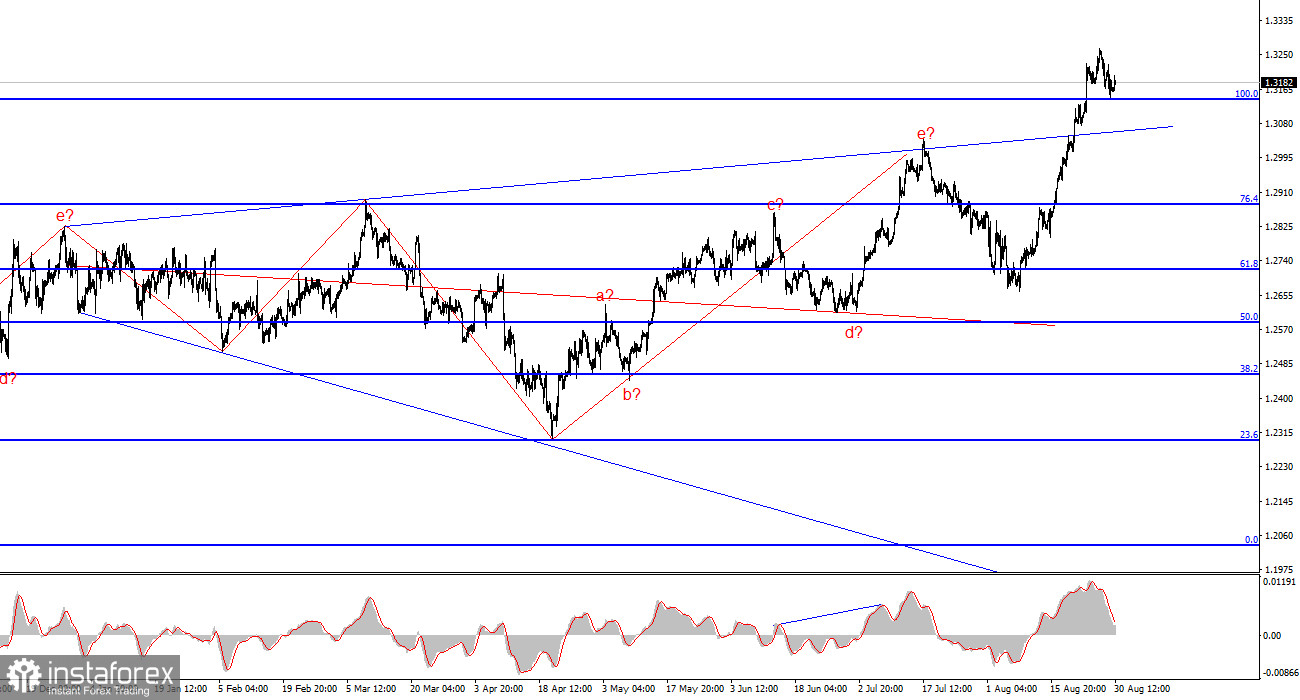

The wave pattern for the GBP/USD pair remains quite complex and ambiguous. For some time, the wave structure looked quite convincing and suggested the formation of a downward set of waves with targets below the 23rd level. However, in practice, demand for the U.S. dollar increased too much for this scenario to materialize, and it continues to grow.

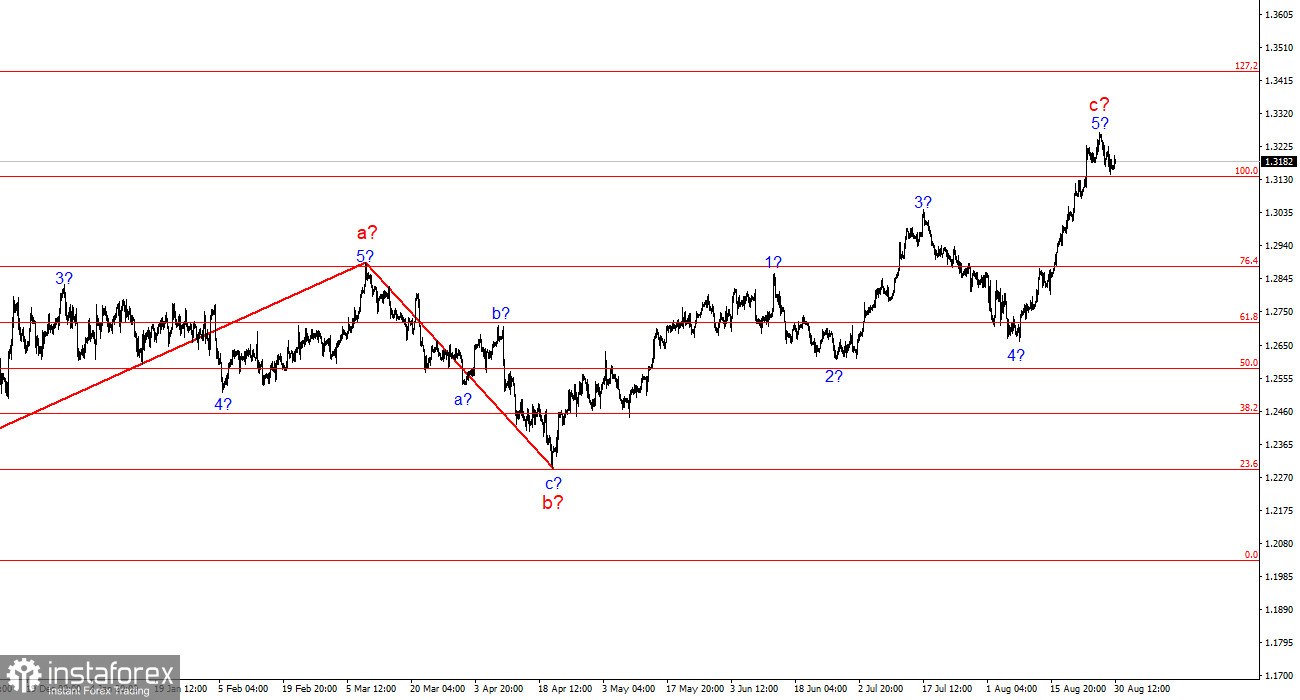

Currently, the wave structure is entirely unreadable. As a reminder, in my analysis, I try to use simple structures, as complex ones involve too many nuances and ambiguities. Currently, we observe an upward wave overlapping a downward wave, which itself overlapped a prior upward wave, all within a triangle formation. The most likely scenario is an expanding triangle with a peak around the 30th level and a balancing line around the 26th level. However, the next upward wave, which doesn't fit any wave structure, has driven the quotes above the triangle. An alternative wave structure is shown in the lower chart.

The market has found a new incentive for buying the pound. The GBP/USD pair saw only a slight decline on Friday, although it could decline further by the end of the day. Recently, we've observed the formation of an upward trend segment, which in all cases has taken on a five-wave structure and extended as much as possible. Consequently, we should now expect at least a corrective wave. Yesterday, the U.S. GDP report exceeded market expectations, but demand for the U.S. dollar did not increase significantly. Today, the PCE index was slightly below expectations but did not rise compared to the previous month. And it didn't fall either. Therefore, if U.S. inflation is slowing, it is doing so very slowly, casting significant doubt on the possibility of three rounds of easing by the Federal Reserve before the end of the year.

However, the market still seems fully convinced of three rate cuts by the end of the year. In the context of the Bank of England's policy easing, its expectations are much more moderate. There is no information on how the BoE might act before the end of the year. It seems that analysts and economists are not interested in this question at all. As a result, the market is based solely on expectations regarding the Fed's rate decisions. It still believes that the U.S. regulator will cut the rate at every meeting. I would like to remind you that there are both "doves" and "hawks" within the FOMC. Therefore, I personally doubt there will be three rounds of easing. Nevertheless, the market is playing out this scenario, and demand for the dollar is barely increasing.

Overall Conclusions

The wave pattern for GBP/USD still suggests a decline. If the upward trend segment started on April 22, it has already taken on a five-wave structure. Therefore, we should, in any case, now expect at least a three-wave correction. In my view, in the near future, it is advisable to consider selling the pair with targets around the 1.2627 level. However, there are no signals yet that the last upward wave has ended, but it is still possible to expect a corrective wave.

On a higher time frame, the wave structure has evolved. We can now assume the formation of a complex and extended upward corrective structure. At the moment, this is a three-wave structure, but it could evolve into a five-wave structure, which could take several more months or even longer to complete.

Basic Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are difficult to trade and often undergo changes.

- If you are unsure about what is happening in the market, it's better not to enter it.

- There is never 100% certainty in the direction of movement. Don't forget to use Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.