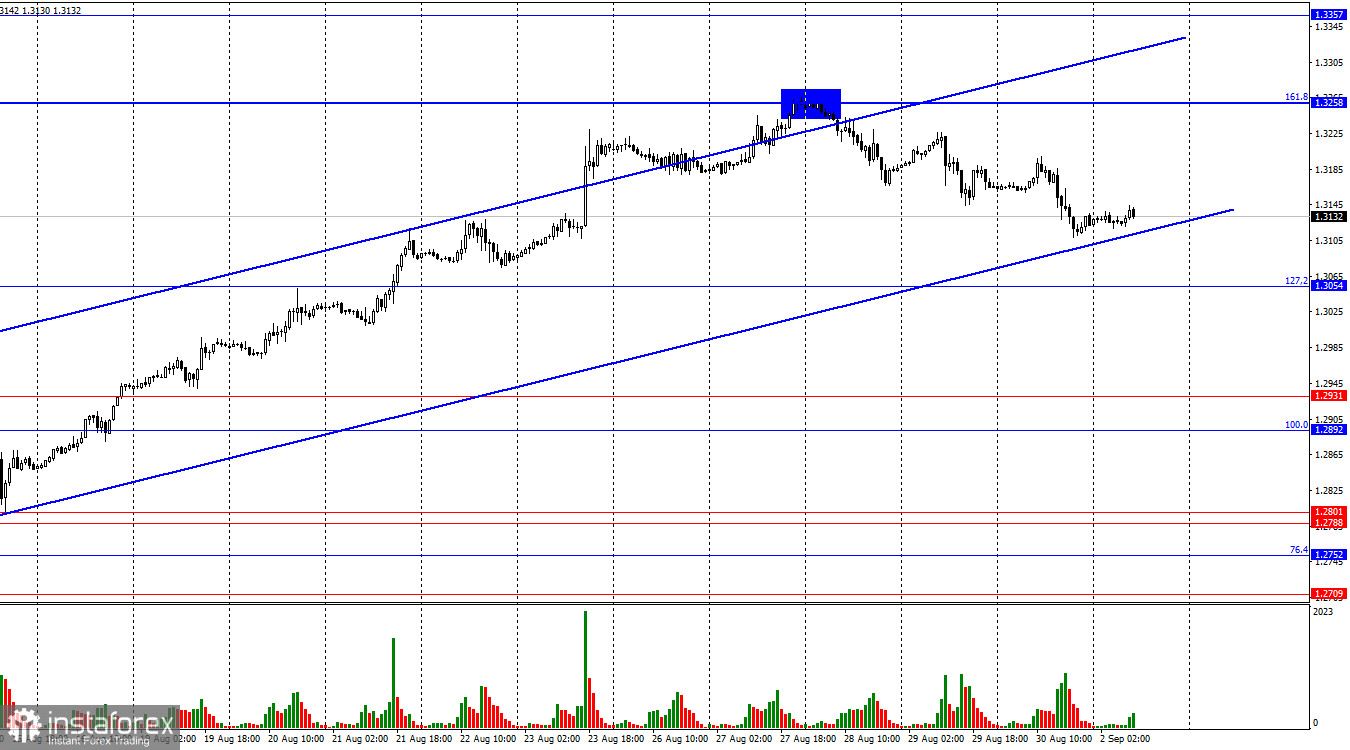

On the hourly chart, the GBP/USD pair moved slightly down on Friday, but it didn't even reach the lower line of the upward trend channel. The decline has lasted for three full days, but it is too weak to indicate that bears have taken control. A sustained move below the channel could signal a continuation of the pound's decline towards the nearest levels. However, this week traders are anticipating important U.S. statistics, and it is already evident that no one is rushing to buy the dollar ahead of this data.

The wave situation is clear. The last completed downward wave did not break the low of the previous wave, while the latest upward wave managed to surpass the peak of the previous wave. Thus, we are currently dealing with a "bullish" trend, but the waves are so large that detecting a trend change may be significantly delayed. I just don't see internal waves that could be used to identify a trend reversal. However, there is an upward trend channel.

The information background on Friday was relatively weak, but the dollar did strengthen slightly. The U.S. Personal Consumption Expenditures (PCE) index remained unchanged in July. The University of Michigan Consumer Sentiment Index came in at 67.9 points, compared to the expected 68.0 points. Thus, traders had no reasons to buy or sell the dollar. This week, there may be even fewer buyers, while the number of sellers could significantly increase. As I mentioned, labor market and unemployment statistics remain a starting point for traders. If Friday's data proves weaker than expected, even if there is a close below the trend channel, the pair might resume its upward movement and "bullish" trend. Therefore, in my opinion, caution is warranted with these reports.

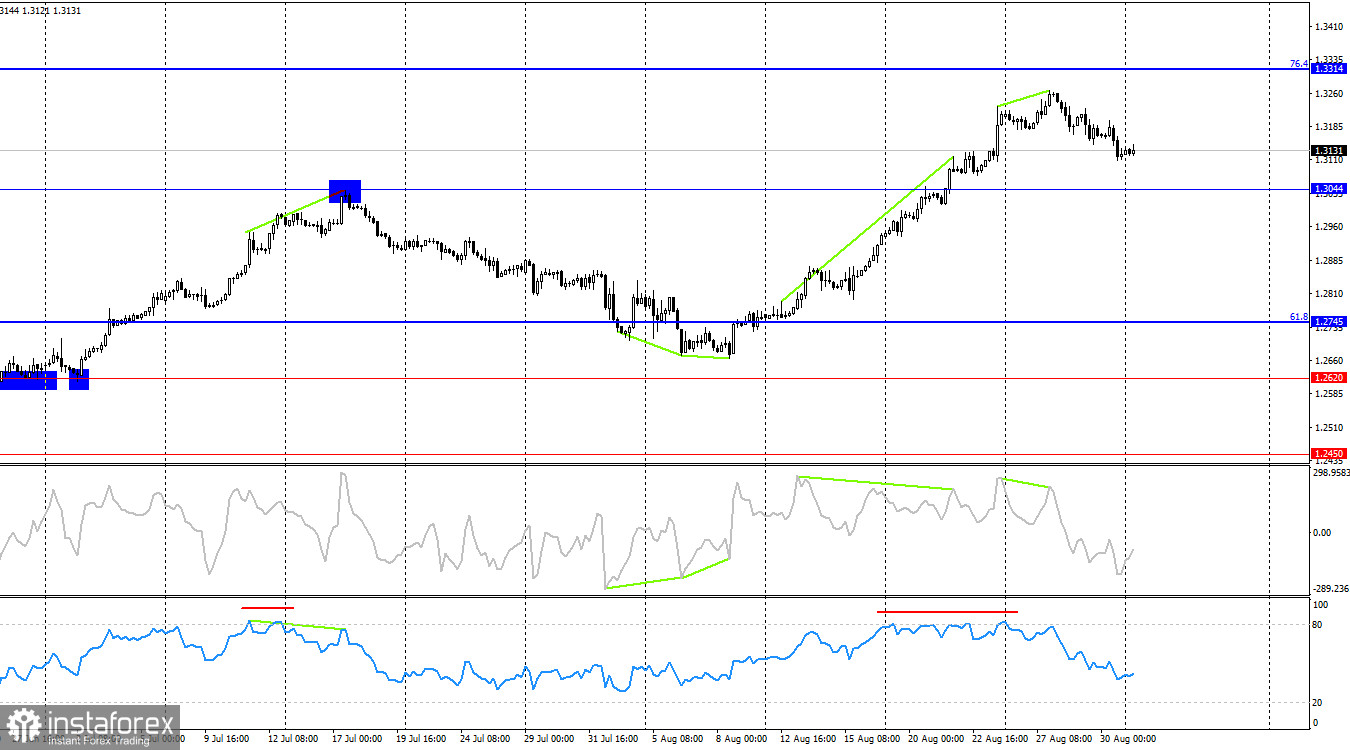

On the 4-hour chart, the pair has consolidated above the 1.3044 level. However, the CCI indicator has been warning of a "bearish" divergence for over a week, and the RSI indicator was in overbought territory for a week, which is unusual. Thus, a reversal in favor of the U.S. dollar seems to have occurred, and a decline towards the 1.3044 level has started. A rebound from this level would suggest a resumption of growth towards the 76.4% corrective level at 1.3314.

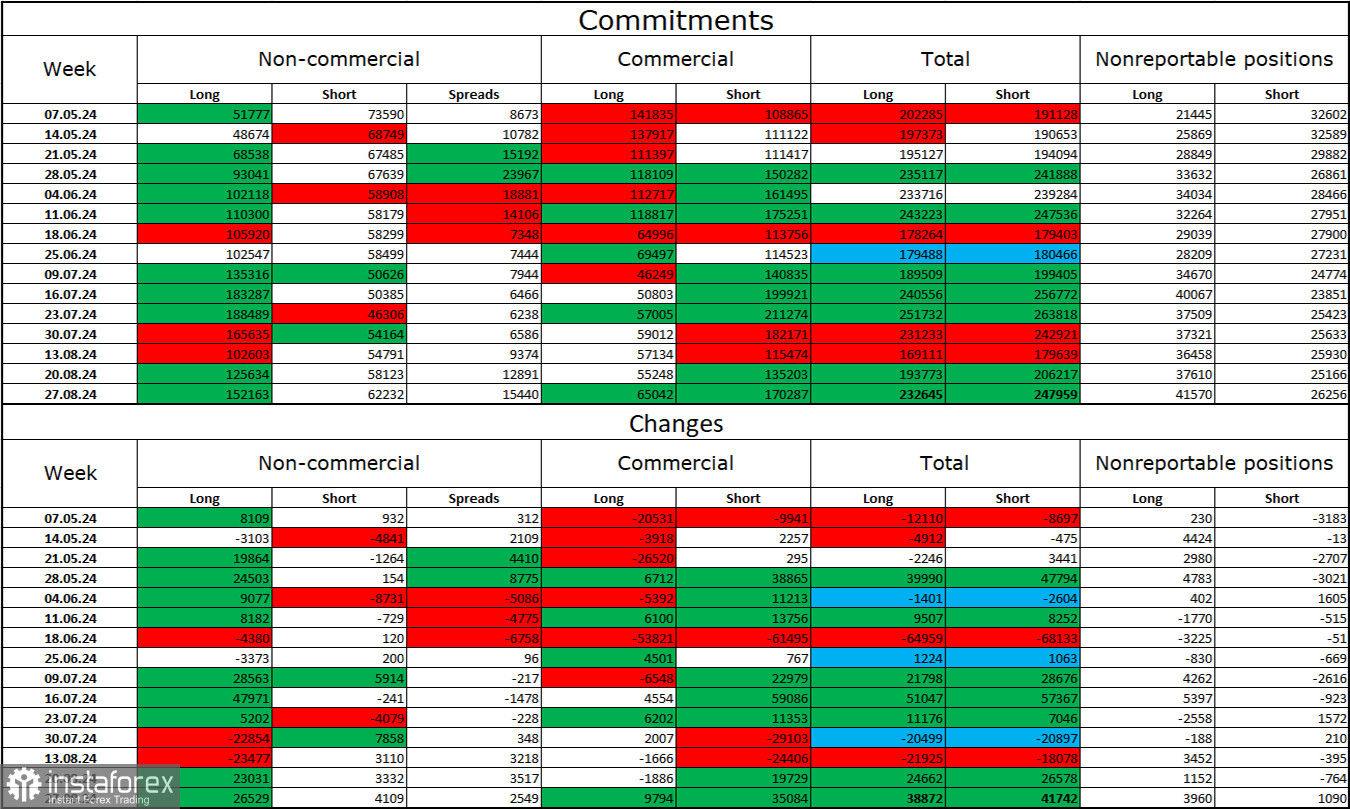

Commitments of Traders (COT) Report:

The sentiment of "non-commercial" traders has become significantly more "bullish" over the last reporting week. The number of long positions held by speculators increased by 26,529, while the number of short positions rose by 4,109 units. Bulls still hold a solid advantage. The gap between long and short positions is nearly 90,000: 152,000 versus 62,000.

In my view, the pound still has potential for a decline, but COT reports suggest otherwise for now. Over the past 3 months, the number of long positions has grown from 51,000 to 152,000, while the number of short positions has decreased from 74,000 to 62,000. I believe that over time, professional traders will start to reduce their long positions or increase their short positions, as all possible buying factors for the British pound have been exhausted. However, this is merely a hypothesis. Technical analysis indicates a likely decline in the near future, but the current trend remains decidedly "bullish."

News Calendar for the U.S. and the U.K.:

U.K. – Manufacturing PMI (08:30 UTC).

On Monday, the economic events calendar contains only one entry. The impact of the information background on market sentiment today will be very weak or non-existent.

GBP/USD Forecast and Trading Tips:

Sales of the pair were possible from a rebound at the 1.3258 level on the hourly chart, targeting 1.3054. These trades can now be kept open. I would not rush into new purchases even if there is a rebound from the lower line of the upward trend channel.

Fibonacci levels are plotted from 1.2892 to 1.2298 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.