Analysis of Trades and Trading Tips for the Japanese Yen

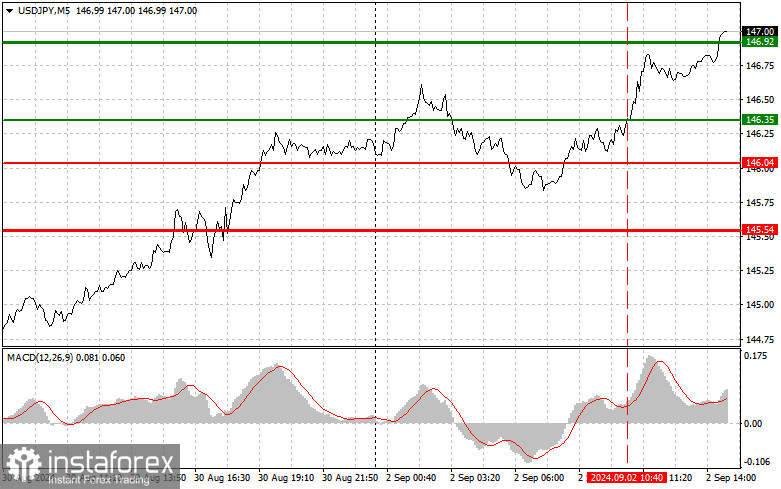

The price level of 146.35 was tested when the MACD indicator had risen significantly above the zero line, which limited further upward potential. For this reason, I did not buy the dollar, especially considering its rise during the Asian session, which made new purchases seem unlikely, in my opinion. However, as you can see on the chart, buyers easily reached the target level of 146.92. In the afternoon, volatility is expected to decrease significantly, as there is no U.S. data, which will reduce trading volume and affect the direction of the pair. On the other hand, sellers might take advantage of the situation, as they missed the market in the first half of the day, so a significant downward correction in the pair cannot be ruled out. For the intraday strategy, I will follow the scenarios outlined in #1 and #2.

Buy Signal

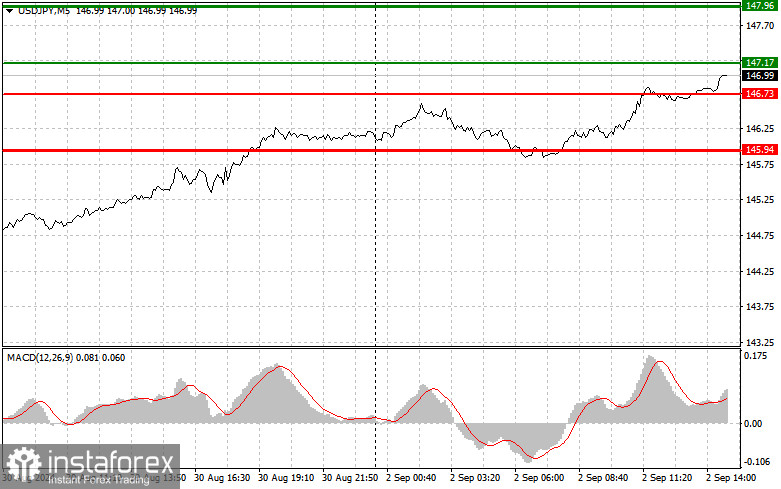

- Scenario #1: I plan to buy USD/JPY today if the price reaches around 147.17 (green line on the chart), aiming for a rise to the level of 147.96 (thicker green line on the chart). At around 147.96, I will exit my long positions and start selling (expecting a move of 30-35 points in the opposite direction from this level). Strong upward movement in the pair today is expected only within the context of the ongoing daily uptrend. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

- Scenario #2: I also plan to buy USD/JPY today if the price at 146.73 is tested twice and the MACD indicator is in the oversold region. This will limit the pair's downward potential and lead to an upward market reversal. We can expect a rise to the opposing levels of 147.17 and 147.96.

Sell Signal

- Scenario #1: I plan to sell USD/JPY today after the price updates the level of 146.73 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the level of 145.94, where I will exit my short positions and immediately buy in the opposite direction (expecting a move of 20-25 points in the opposite direction from this level). Sellers will become active if buyers fail to show strength around the daily high. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to fall from it.

- Scenario #2: I also plan to sell USD/JPY today if the price at 147.17 is tested twice and the MACD indicator is in the overbought region. This will limit the pair's upward potential and lead to a downward market reversal. We can expect a decline to the opposing levels of 146.73 and 145.94.

Chart Details:

- Thin Green Line – Entry price for buying the trading instrument.

- Thick Green Line – Estimated price for setting Take Profit or taking profit manually, as further growth above this level is unlikely.

- Thin Red Line – Entry price for selling the trading instrument.

- Thick Red Line – Estimated price for setting Take Profit or taking profit manually, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, it is important to consider overbought and oversold zones.

Important: Beginner Forex traders need to be very cautious when making market entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always use stop orders to limit potential losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.