Analysis of macroeconomic reports:

Once again, there are very few macroeconomic events scheduled for Tuesday. The only notable one is the ISM Manufacturing Activity Index in the United States, which will be released in the second half of the day. This report is considered important, and it has been below the "waterline" of 50.0 for quite some time. Any increase above expectations could strengthen the U.S. dollar.

Analysis of fundamental events:

Among Tuesday's fundamental events, the speeches by European Central Bank Monetary Committee members Buch and Jochnick stand out. However, their more prominent colleagues have already expressed support for a rate cut in September. We believe the ECB will ease monetary policy for the second time at the next meeting. If Buch and Jochnick confirm these expectations, the euro may decline further. In addition, Bundesbank President Joachim Nagel is set to speak, and he could also confirm readiness for a second key rate cut.

General conclusions:

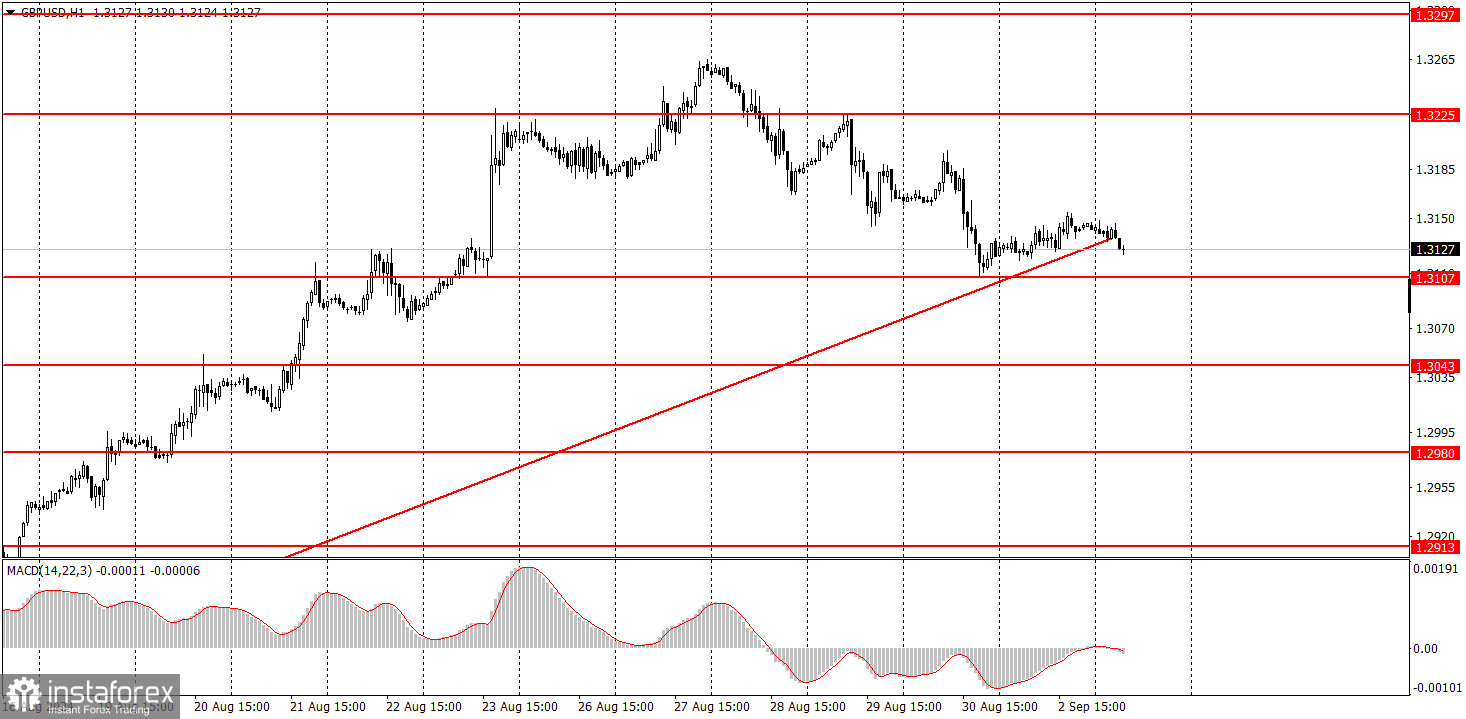

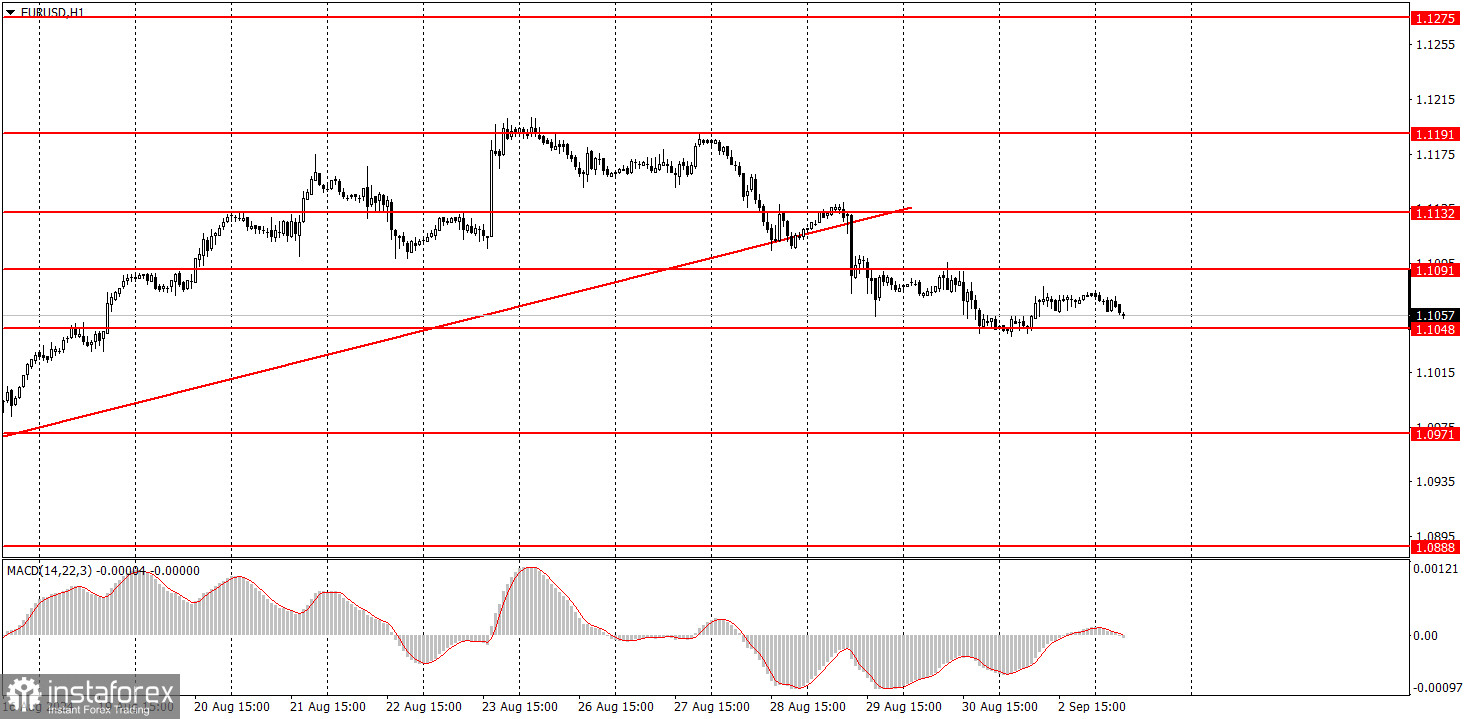

On Tuesday, both currency pairs may continue to pull back, but only within the framework of a correction against the upward trend. The euro has broken through the upward trendline, so it is more likely to continue moving south than the pound, which is still above its trendline. The British pound is still declining much more reluctantly than the euro. Both currency pairs may show relatively low volatility on Tuesday, as there will be few fundamental and macroeconomic events, but the important ISM index will be released in the second half of the day.

Basic rules of the trading system:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst substantial volatility and an established trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered support or resistance.

7) After moving 15-20 pips in the intended direction, the Stop Loss should be set to break even.

What's on the charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels near them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD (14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over a long period.