Analysis of Trades and Trading Advice for the Euro

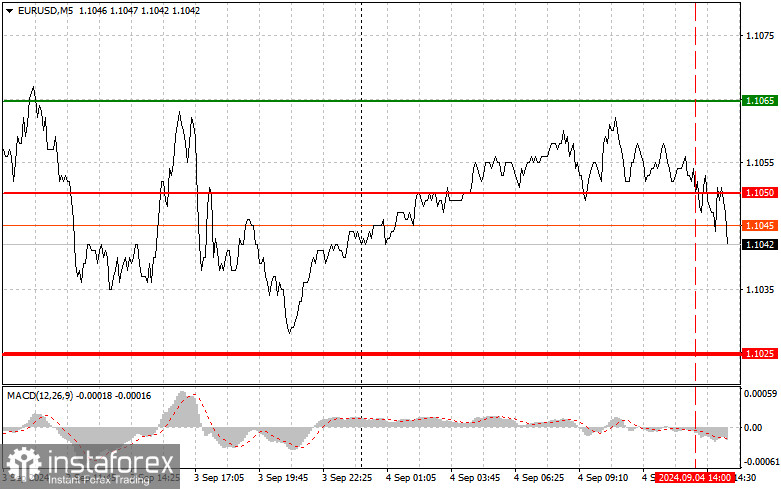

The test of the 1.1050 price level occurred when the MACD indicator had already moved well below the zero mark, which, in my opinion, limited the pair's downward potential. Even though the eurozone's PMI data came out weak, the euro didn't react significantly. This didn't lead to a sell-off but kept the pair stuck in a sideways channel. U.S. statistics are unlikely to cause major market movements, so I wouldn't be surprised if we continue trading within a narrow range today. U.S. trade balance data and changes in factory orders will attract traders' attention, and only particularly poor figures could lead to a slight rise in the euro following the downward correction seen earlier this week. For the intraday strategy, I plan to trade according to either Scenario #1 or Scenario #2.

Buy Signal

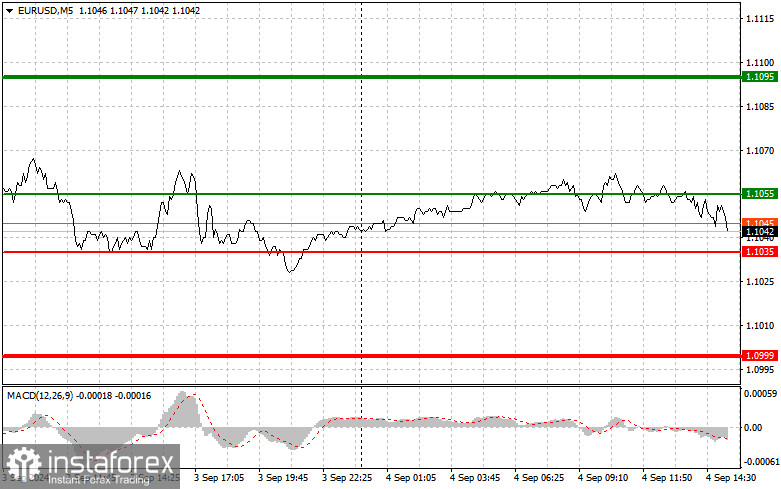

Scenario #1: I plan to buy the euro when the price reaches around 1.1055 (the green line on the chart), with a target of rising to 1.1095. At the 1.1095 level, I will exit the market and sell the euro afterward, targeting a 30-35 point move from the entry point. A strong upward movement in the euro today can be expected after weak U.S. statistics. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the euro today after two consecutive tests of the 1.1035 price level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger an upward reversal. A rise toward the 1.1055 and 1.1095 levels is expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1042 level (red line on the chart). The target will be 1.1000, where I plan to exit the market and immediately buy the euro afterward, targeting a 20-25 point recovery from that level. Pressure on the pair will return if there are no buyers near the daily high and if U.S. statistics come out strong. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today after two consecutive tests of the 1.1055 price level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A decline toward the 1.1035 and 1.1000 levels is expected.

Chart Details:

- Thin green line – price entry point for buying the instrument.

- Thick green line – projected price level where take-profit orders can be set, or profits can be manually fixed, as further growth beyond this level is unlikely.

- Thin red line – price entry point for selling the instrument.

- Thick red line – projected price level where take-profit orders can be set, or profits can be manually fixed, as further decline beyond this level is unlikely.

- MACD Indicator – when entering the market, it's crucial to monitor overbought and oversold zones.

Important Note:

Beginner traders in the forex market should exercise caution when making entry decisions. It's best to avoid trading before the release of key fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-loss orders, you could quickly lose your entire deposit, especially if you trade large volumes without proper money management.

And remember, successful trading requires a well-structured trading plan, like the one outlined above. Spontaneous trading decisions based on current market conditions are a losing strategy for intraday traders.