Analysis of Trades and Tips for Trading the Japanese Yen

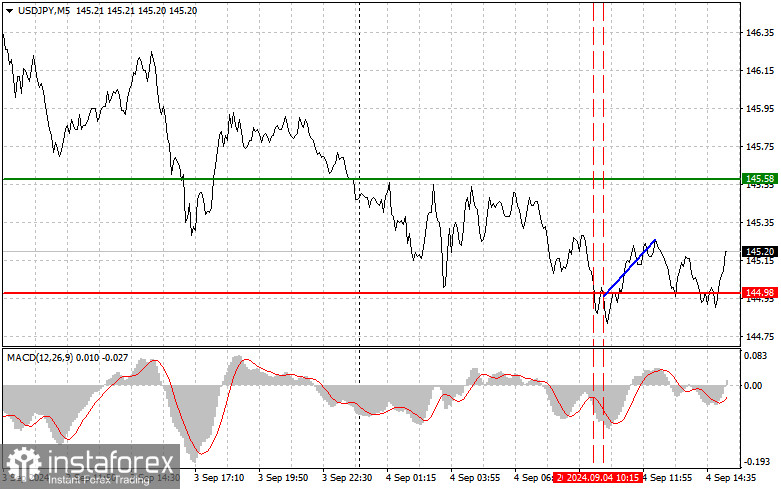

The test of the 144.98 price level occurred when the MACD indicator had moved significantly below the zero line, limiting the pair's further downward potential. For this reason, I chose not to sell the dollar. The second test of this price level, shortly after, coincided with the MACD rebounding from the oversold zone, triggering Scenario #2 for buying and resulting in a rise of nearly 30 points. The U.S. trade balance, job openings and labor turnover data from the Bureau of Labor Statistics, and changes in factory orders are all we can expect in the second half of the day. Weak data will likely be sufficient to continue USD/JPY's downward trend. For the intraday strategy, I plan to act based on the implementation of Scenarios #1 and #2.

Buy Signal

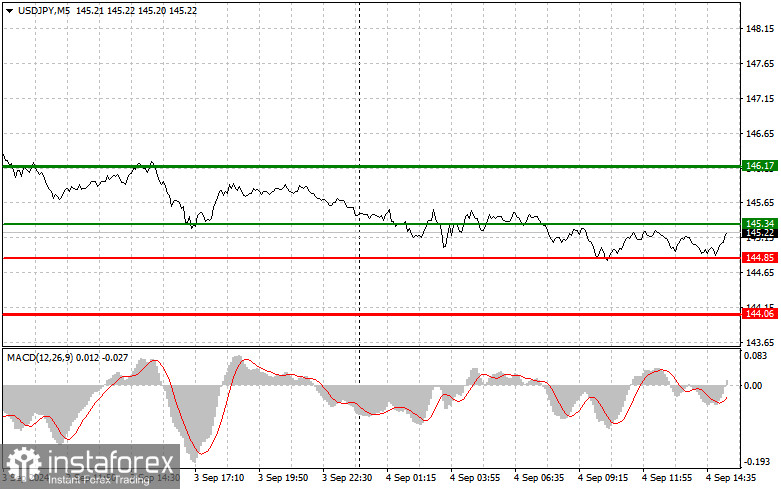

Scenario #1: Today, I plan to buy USD/JPY at the entry point near 145.34 (green line on the chart), targeting a rise to 146.17 (thicker green line on the chart). Around the 146.17 level, I will close buy positions and open sell positions, expecting a 30-35 point movement in the opposite direction. A rise in the pair is likely today if U.S. data turns out strong. Important! Before buying, ensure the MACD indicator is above the zero mark and is just beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if the 144.85 level is tested twice consecutively, with the MACD indicator in the oversold zone. This will limit the pair's downward potential and trigger an upward reversal. A rise toward the 145.44 and 146.17 levels is expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY after a break below the 145.85 level (red line on the chart), which will lead to a quick drop in the pair. The key target for sellers will be the 144.06 level, where I will exit sell positions and immediately open buy positions, expecting a 20-25 point rebound from this level. Pressure on the pair will increase if U.S. statistics are weak. Important! Before selling, ensure the MACD indicator is below the zero mark and is just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if the 145.34 level is tested twice consecutively, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A drop toward the 144.85 and 144.06 levels is expected.

Chart Details:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: Projected price where you can set take-profit orders or manually secure profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: Projected price where you can set take-profit orders or manually secure profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it's important to monitor overbought and oversold zones.

Important:

Beginner traders in the forex market must be very cautious when making entry decisions. Before major fundamental reports are released, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-loss orders, you could quickly lose your entire deposit, especially if you don't use proper money management and trade large volumes.

And remember, for successful trading, you need to have a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.