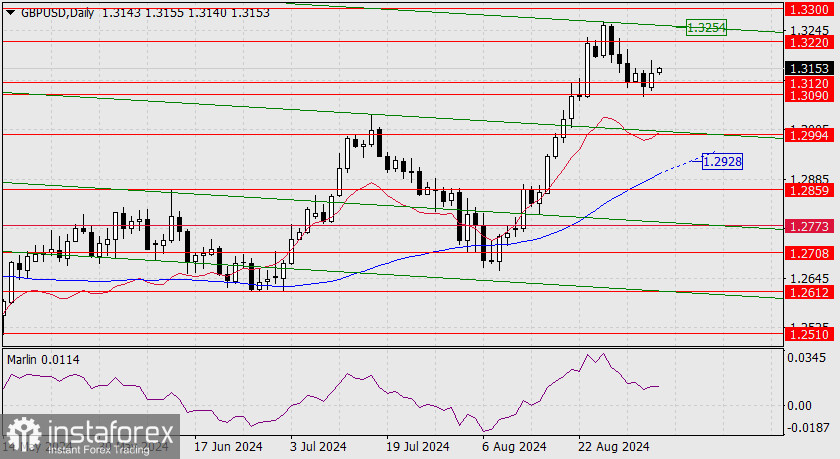

The pound sterling decided not to linger in the narrow range of 1.3090-1.3120 but instead went up from it. The growth potential is small, as the Marlin oscillator does not react to this rise and moves sideways.

On the other hand, a reliable sign of a trend break could only be a price move above the upper line of the price channel at the 1.3254 level. The mark is high, and this circumstance does not allow sellers of the pound to maintain optimism.

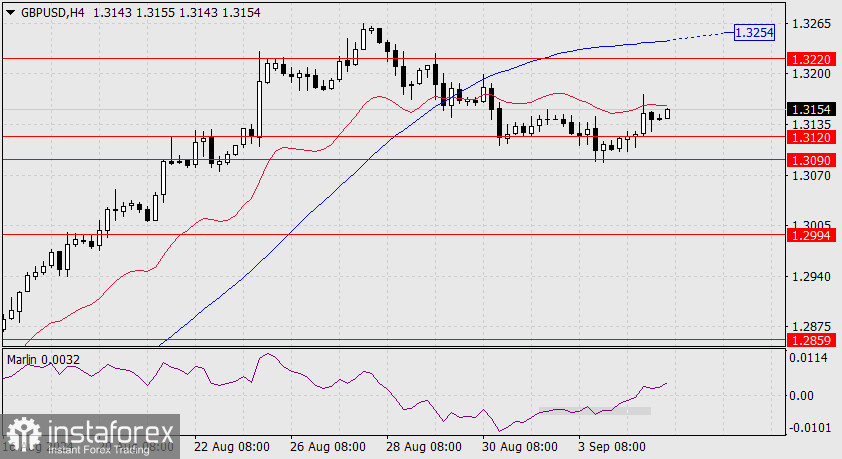

To confirm the downward trend, the price must drop below the lower boundary of the range – 1.3090. In the 4-hour chart, the Marlin oscillator has left the range and moved upwards, and the oscillator is already in the positive area.

However, the price is still below the balance line (red moving average) and moderately restraining the pound's corrective growth. In the H4 chart, we also see that if the price grows, the MACD line will coincide with the upper boundary of the daily price channel (1.3254), confirming the importance of this level. At the moment, the primary scenario remains bearish.