During yesterday's trading session, the British pound gained 34 pips, buoyed by the ADP's data on new private sector jobs for August, which showed 99,000 new jobs versus the expected 144,000 and a downward revision of July's figure by 11,000. However, more crucial data on new non-farm sector jobs and the unemployment rate will be brought in today. Nonfarm payrolls are expected at 139,000 compared to July's 97,000, and the unemployment rate may decrease from 4.3% to 4.2%.

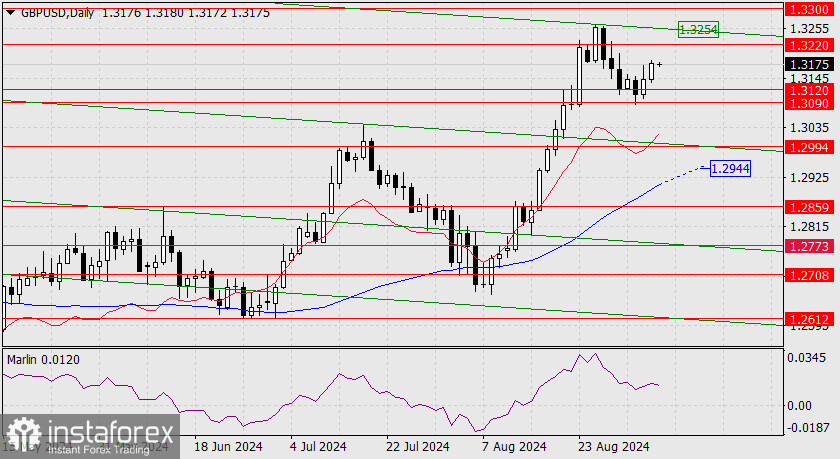

If the data is as good as expected, investors will sharply reduce the likelihood of a double rate cut by the Federal Reserve, and the pound may break the support range of 1.3090-1.3120 and head towards 1.2994. This is our main scenario. The Marlin oscillator, which is turning downward, leans towards this scenario. The alternative involves an attempt to overcome the upper boundary of the price channel at 1.3254 and further growth to 1.3300.

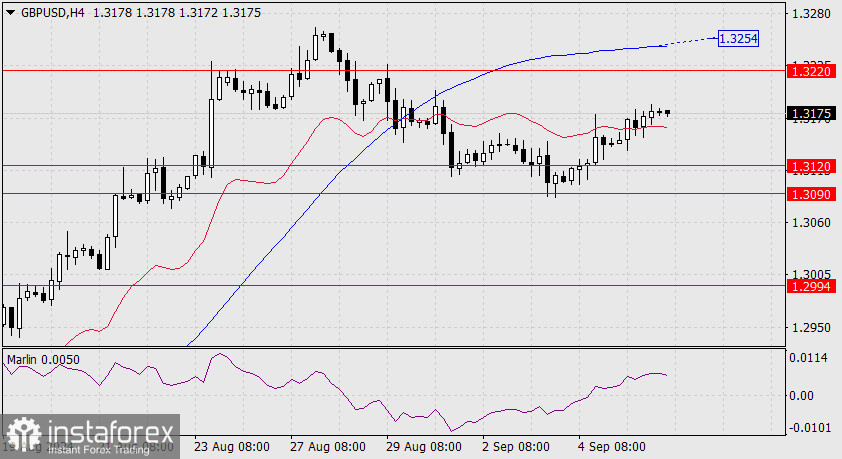

In the 4-hour chart, the price consolidated above the balance indicator line. However, Marlin appears weak, and the MACD line is high, coinciding with the price channel's boundary at 1.3254. The price will be able to overcome such strong resistance with weak US employment data.