Analysis of Trades and Tips for Trading the Japanese Yen

The price test at 143.11 occurred when the MACD indicator was beginning to rise from zero, confirming the correct entry point to buy the dollar. As a result, we reached the target level of 143.80, securing a profit of about 70 points. As I mentioned in the morning forecast, weak statistics from Japan negatively impacted the yen, allowing the pair to decline further during the European session. Now the focus will shift to U.S. wholesale trade inventory data and consumer credit figures. Consumer credit figures are more significant because these numbers can provide insight into banks' expectations regarding future interest rates. The more accessible the rates, the higher the lending volume, which could positively affect the U.S. dollar. As for the intraday strategy, I plan to act based on Scenarios #1 and #2.

Buy Signal

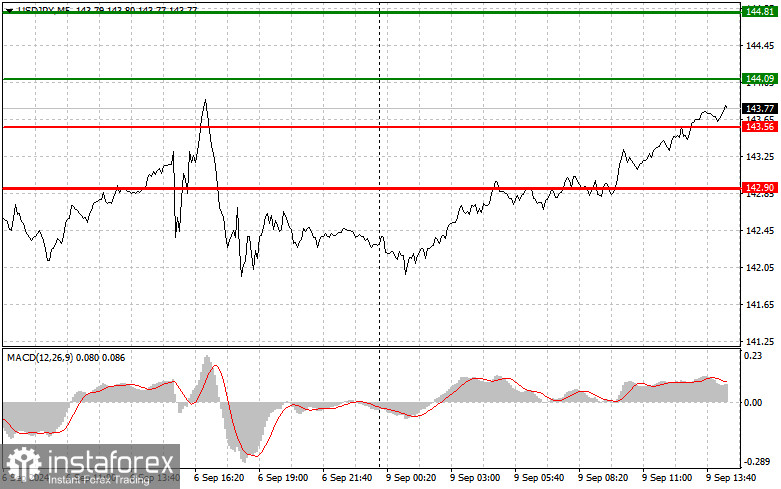

Scenario #1: Today, I plan to buy USD/JPY at the entry point around 144.09 (green line on the chart), targeting a rise to 144.81 (thicker green line on the chart). At 144.81, I will exit the buy position and open sell positions in the opposite direction (aiming for a 30-35 point move in the opposite direction). We can expect a rise today if U.S. data is strong. Important: Before buying, make sure the MACD indicator is above zero and starting to move upward.

Scenario #2: I also plan to buy USD/JPY today if the price tests 143.56 twice while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. We can expect a rise to the levels of 144.09 and 144.81.

Sell Signal

Scenario #1: I plan to sell USD/JPY today if the price breaks below the 143.56 level (red line on the chart), which could lead to a quick decline in the pair. The key target for sellers will be the 142.90 level, where I will exit the sell position and immediately open buy positions in the opposite direction (aiming for a 20-25 pip move in the opposite direction). Selling pressure may return if U.S. statistics are weak. Important: Before selling, make sure the MACD indicator is below zero and starting to move downward.

Scenario #2: I also plan to sell USD/JPY today if the price tests 144.09 twice while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. We can expect a decline to the levels of 143.56 and 142.90.

What's on the Chart:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – target price for taking profits, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – target price for taking profits, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, it's important to use the overbought and oversold zones.

Important: Beginner forex traders should be very cautious when making entry decisions. Before the release of important fundamental reports, it's best to stay out of the market to avoid sharp exchange rate fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you risk quickly losing your entire deposit, especially if you don't manage your money properly and trade with large volumes.

Remember, for successful trading, you need a clear trading plan, like the one provided above. Making spontaneous trading decisions based on the current market situation is a losing strategy for an intraday trader.