Bitcoin and Ethereum recovered quite well but failed to consolidate at the achieved highs. During today's Asian session, the key cryptocurrencies sharply declined, which shifted the upward correction into a horizontal channel. This is quite unfavorable for Bitcoin and Ethereum buyers.

In my forecast yesterday, I noted that the recent decline in Bitcoin's price was accompanied by a significant outflow of funds from 12 American exchange-traded funds (ETFs). While this may seem alarming at first glance, several experts call it a sign of a healthy market. Nothing can move in a straight upward line, just like the influx of new investors interested in the cryptocurrency market.

According to Farside Investors, the funds lost about $1.2 billion between August 27 and September 6, with a net outflow of funds observed for eight consecutive days. However, $1.2 billion represents only around 3% of the total assets in the funds, which, according to Bianco Research, amounted to $46 billion after outflows. Therefore, there isn't much cause for concern at this point. When ETFs lose between 15% to 20%, it would be time to "start worrying."

Considering that Bitcoin and Ethereum buyers made a solid effort to recover after the market dip, partially saving the situation, there is a chance for the upward intraday correction in the cryptocurrency market to resume.

As for the intraday strategy in the cryptocurrency market, I will continue to rely on significant dips in Bitcoin and Ethereum, anticipating the continuation of the medium-term bullish market, which hasn't disappeared.

The strategy and conditions for short-term trading are described below.

Bitcoin

Buy Scenario

I will buy Bitcoin today upon reaching the entry point around 56657, aiming for a rise to the level of 57900. Around 57900, I will exit the long positions and sell immediately on a rebound. Before buying on the breakout, it's best to ensure that the Stochastic indicator is near the lower boundary, around the 20 level.

Sell Scenario

I will sell Bitcoin today upon reaching the entry point around 56049, aiming for a drop to the level of 54945. Around 54945, I will exit the short positions and buy immediately on a rebound. Before selling on the breakout, ensure the Stochastic indicator is near the upper boundary, around the 80 level.

Ethereum

Buy Scenario

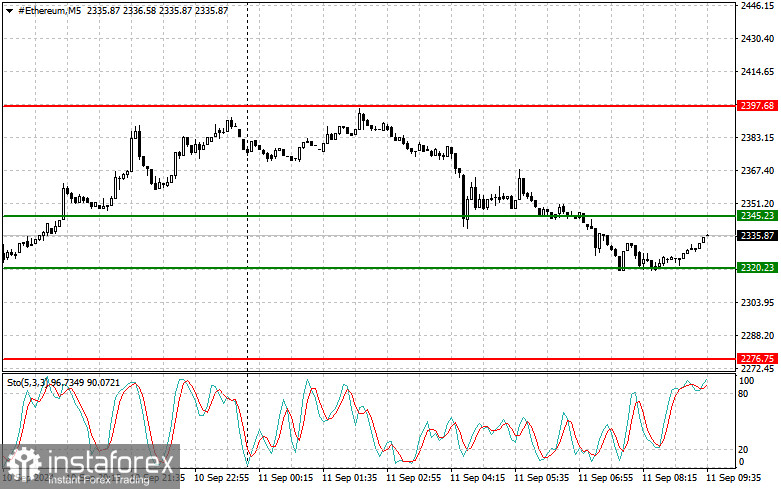

I will buy Ethereum today upon reaching the entry point around 2345, aiming for a rise to the level of 2397. Around 2397, I will exit the long positions and sell immediately on a rebound. Before buying on the breakout, ensure that the Stochastic indicator is near the lower boundary, around the 20 level.

Sell Scenario

I will sell Ethereum today upon reaching the entry point around 2320, aiming for a drop to the level of 2276. Around 2276, I will exit the short positions and buy immediately on a rebound. Before selling on the breakout, ensure that the Stochastic indicator is near the upper boundary, around the 80 level.