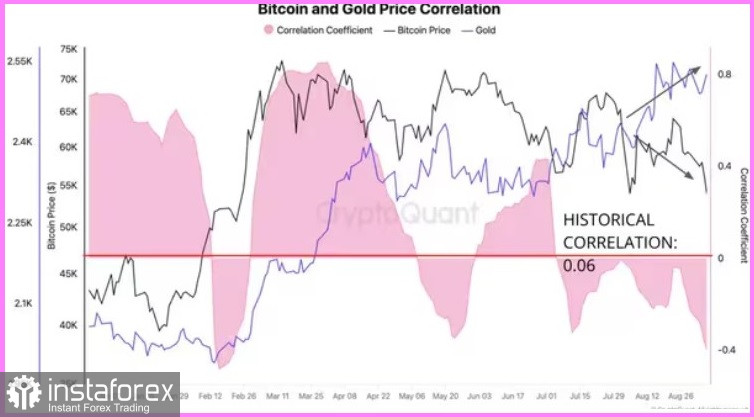

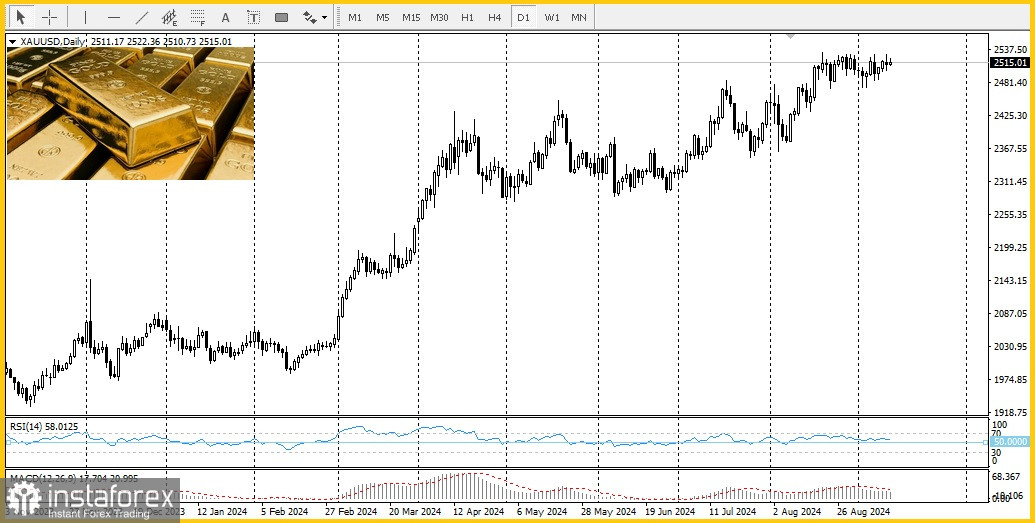

In 2024, both Bitcoin and gold developed a stunning rally, making these two assets the top performers of the year. However, in recent months, gold has outshined Bitcoin, which has lagged behind. This suggests that amid increasing economic turmoil, investors are viewing the yellow metal as the preferred safe-haven asset. According to a report from CryptoQuant, the correlation between Bitcoin and gold has recently turned negative.

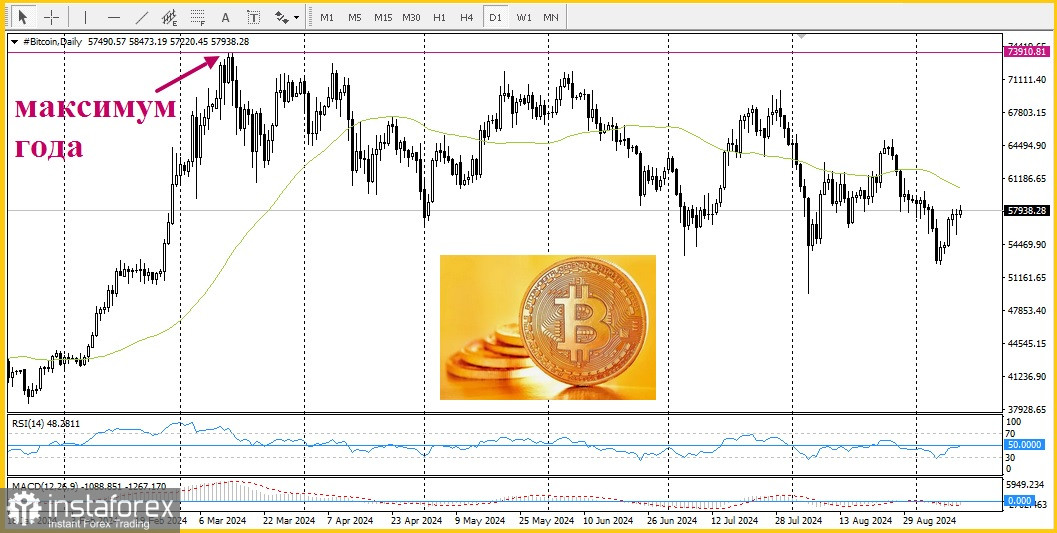

Gold has reached a new all-time high above $2,500 per troy ounce, while Bitcoin has tumbled by more than 22% from its peak of over $73,000 set in March.

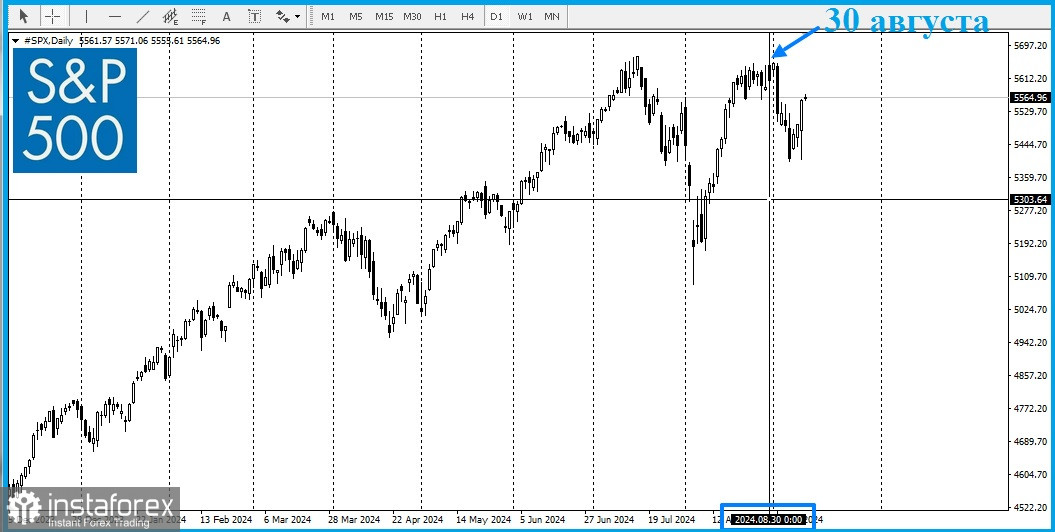

At the same time, as gold gained favor with investors, US stocks faced difficulties, with the S&P 500 index falling by 3.6% since August 30.

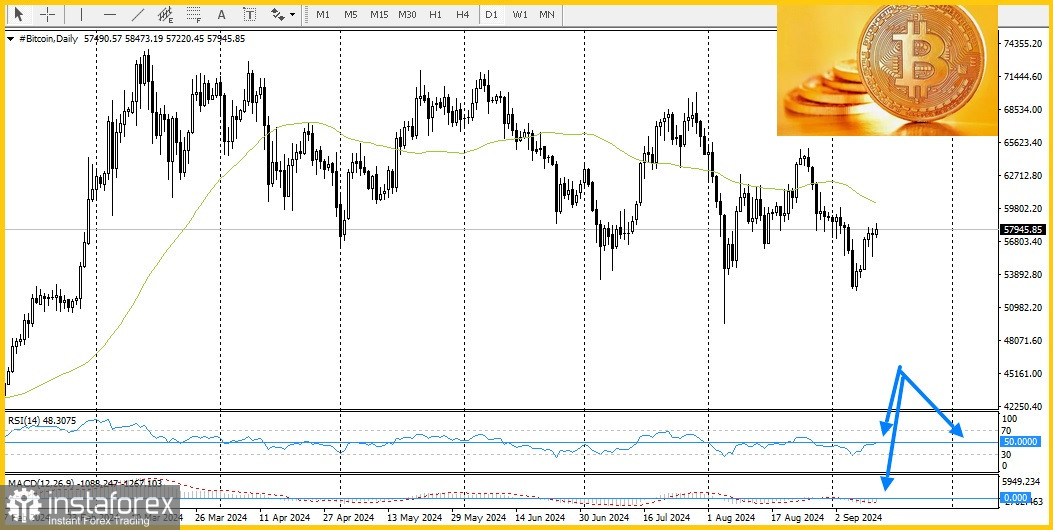

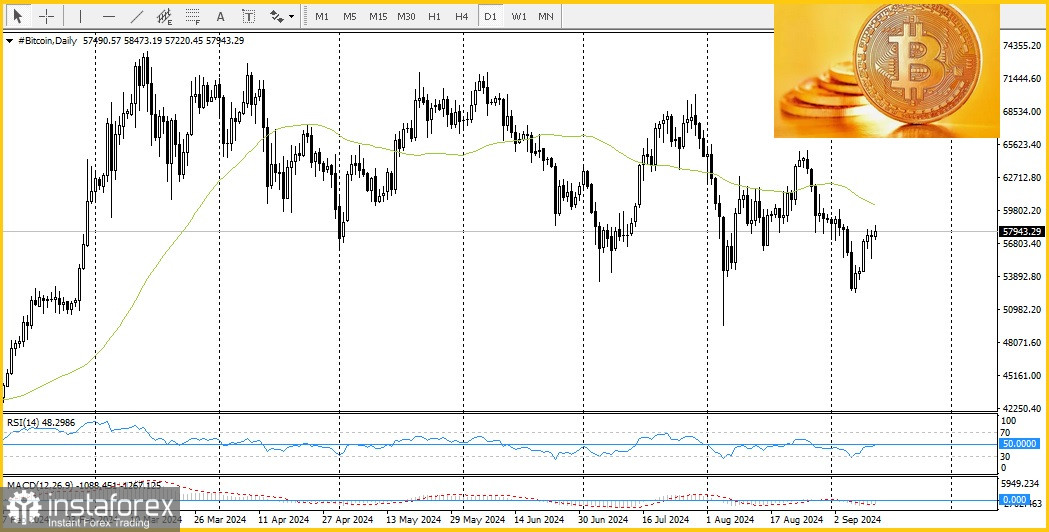

In terms of valuation metrics, Bitcoin remains in a bearish trend. According to CryptoQuant analysts, the CryptoQuant Bull-Bear Market Cycle Indicator has been in the bearish phase since August 27, when Bitcoin was trading at $62,000. As long as the indicator remains in the bearish phase, significant price growth is hardly possible.

Due to weakening demand, Bitcoin has decoupled from gold. While Bitcoin has declined, gold has hit a new all-time high, resulting in a negative correlation between the two assets.

Periods of negative correlation between Bitcoin and gold—when gold rises and Bitcoin falls—typically indicate a risk-averse environment where investors prefer traditional safe-haven assets like gold. Meanwhile, Bitcoin has followed the stock market in its downward trajectory.

However, from a technical viewpoint, oscillators on Bitcoin's daily chart are attempting to move into positive territory. Therefore, it is quite possible that Bitcoin will gradually begin to recover.