Divergent expectations between the Federal Reserve and the Bank of Japan have recently led to a narrowing of the interest rate differential between the U.S. and Japan.

In fact, after the release of a softer-than-expected U.S. Producer Price Index (PPI), which pointed to declining inflation, markets began pricing in the possibility of a larger interest rate cut by the U.S. central bank. Meanwhile, increasingly dovish expectations for the Fed are pushing the yield on 10-year U.S. Treasury bonds to their lowest level since May 2023.

Similarly, the yield on 10-year Japanese government bonds fell to a four-week low, although hawkish signals from Bank of Japan policymakers were expected to limit this decline. According to Bank of Japan board member Junko Nakagawa, the central bank will raise interest rates further if the country's economy and inflation align with its forecasts.

Additionally, according to BOJ board member Naoki Tamura, to reach the 2% inflation target by fiscal year 2026, the central bank needs to raise interest rates to at least 1%. These statements suggest that the Bank of Japan will announce another interest rate hike by the end of this year, which will continue to drive flows toward the Japanese yen, supporting the outlook for further declines in the USD/JPY pair.

However, risk-on sentiment may limit the yen's further rise. Traders are waiting for major central bank events next week before opening new directional positions. On Wednesday, the Federal Reserve is set to announce its decision on interest rates at the conclusion of its two-day monetary policy meeting.

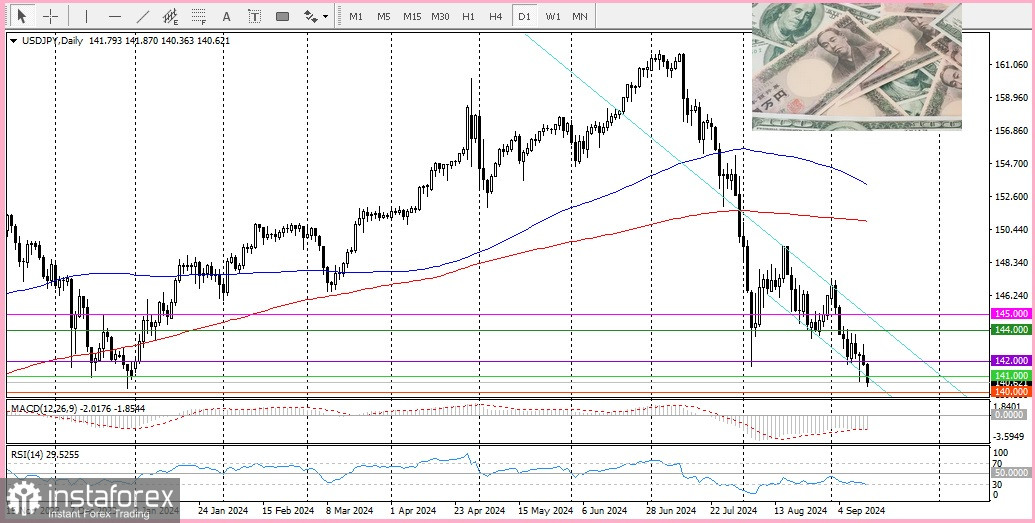

This will be followed by the Bank of Japan's monetary policy update on Friday, which is expected to significantly influence the USD/JPY pair's outlook in the near term. Nevertheless, for the second consecutive week, spot prices remain on track to register losses.