The market is starting to prepare for the upcoming Federal Open Market Committee meeting this Wednesday, which is causing the euro to continue strengthening its position. The anticipation centers around the market's expectation of an interest rate cut by the Federal Reserve. There are still strong expectations of a 50-basis-point cut. As a result, it may turn out that after the first rate cut in several years, the dollar could rise if the Fed lowers the key rate by only 25 bps. Until then, the dollar will likely remain under pressure and gradually lose value.

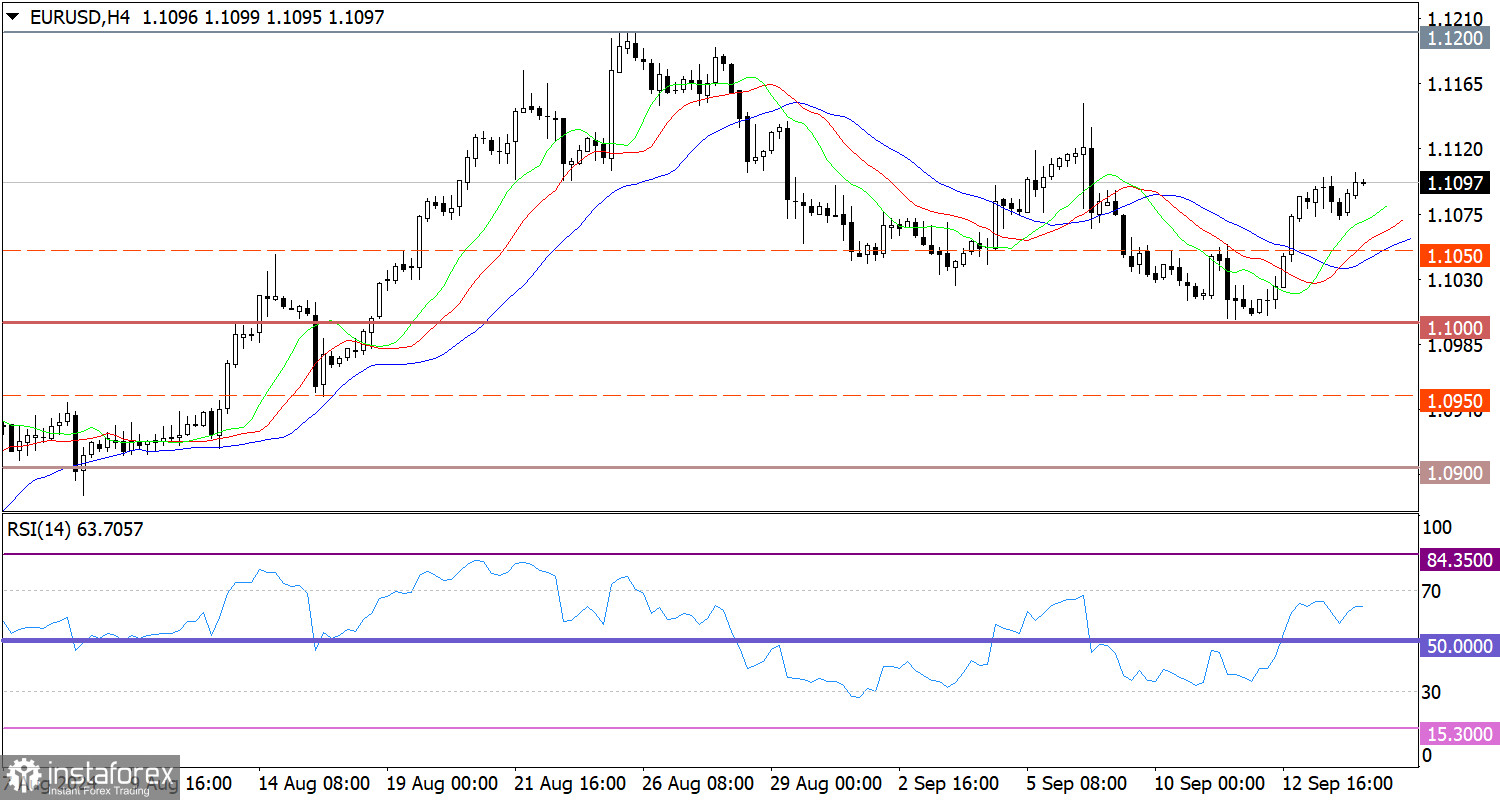

The EUR/USD pair is currently in a recovery phase following a recent corrective move. The psychological level of 1.1000 serves as support.

In the four-hour chart, the RSI technical indicator moves within the buyers' area of 50/70, indicating an upward sentiment among market participants.

Regarding the Alligator indicator in the same time frame, the moving average lines point upward, aligning with the price movement.

Expectations and Prospects

If the next stage of the euro's recovery continues amid the market's dollar sell-off, stabilizing the price above the 1.1100 mark could increase the volume of long positions. Under this scenario, the pair may move at least toward the recent local high of September. As an alternative scenario, there could be a slowdown in the recovery cycle, with the price returning to the upper area of the psychological level.

The complex indicator analysis indicates an ongoing upward cycle in the short-term, intraday, and medium-term periods.