Trade Analysis and Tips for Trading the Japanese Yen

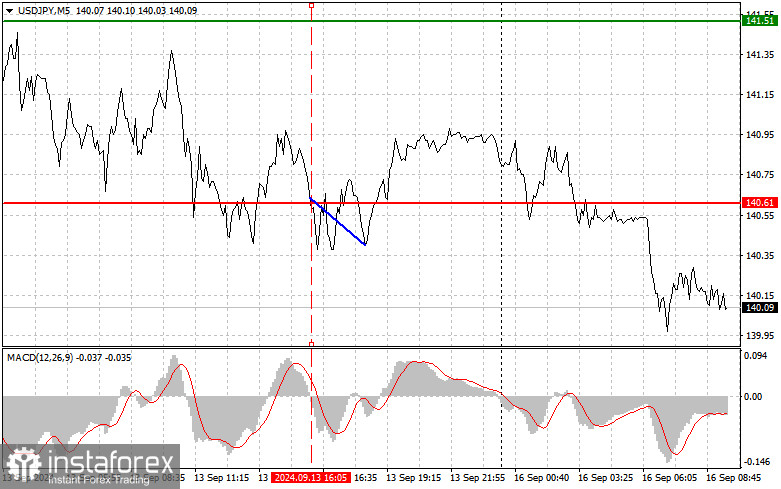

The price test at 140.61 occurred just as the MACD indicator began moving down from the zero mark, confirming a valid entry point to sell the dollar in line with the ongoing bearish trend. As a result, the pair dropped by only 25 pips, but we did not reach the target level of 139.80. Even though the bearish market for the dollar persists, caution should be exercised when selling at current lows. The pair will face selling pressure ahead of the Federal Reserve's decision — particularly during upward corrections, which we will see and plan to take advantage of. It's better to wait for a minor correction and open new short positions to further the downward trend rather than selling at the lows with a large stop-loss and falling into a bull trap. As for the intraday strategy, I will rely more on the realization of scenarios No. 1 and 2.

Buy Signal

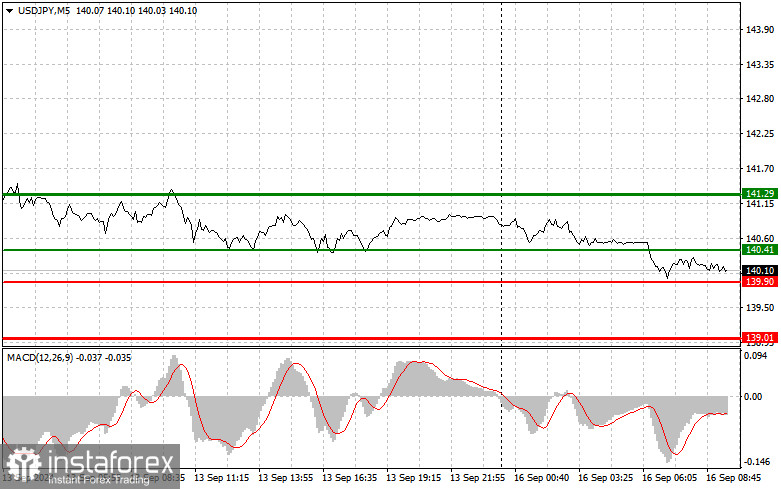

Scenario No. 1: I plan to buy USD/JPY today when the entry point at around 140.41 (green line on the chart) is reached, with a target of rising to the 141.29 level (thicker green line on the chart). Around 141.29, I plan to exit long positions and open shorts in the opposite direction (expecting a 30-35 pip move from the entry point). Today, the pair's growth is expected only as part of a correction. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning its upward movement.

Scenario No. 2: I also plan to buy USD/JPY today if there are two consecutive tests of the 139.90 level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 140.41 and 141.29 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today only after testing the level of 139.90 (red line on the chart), leading to a rapid decline in the pair. The key target for sellers will be the 139.01 level, where I plan to exit short positions and immediately open longs in the opposite direction (expecting a 20-25 pip move in the opposite direction from the level). Pressure on the pair may return since the bearish market for the dollar persists. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning its downward movement.

Scenario No. 2: I also plan to sell USD/JPY today if there are two consecutive tests of the 140.41 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 139.90 and 139.01 can be expected.

What's on the Chart:

Thin green line: the entry price at which you can buy the trading instrument.

Thick green line: the estimated price at which you can set Take Profit or manually close positions, as further growth above this level is unlikely.

Thin red line: the entry price at which you can sell the trading instrument.

Thick red line: an estimated price at which you can place Take Profit or manually close positions, as further decline below this level is unlikely.

MACD indicator: when entering the market, it is essential to be guided by overbought and oversold zones.

Important: Novice traders in the forex market need to be very careful when making decisions about entering the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You must set stop orders to avoid losing your entire deposit, especially if you don't use money management and trade in large volumes.

Remember, a clear trading plan, like the one I've outlined, is essential for successful trading. Making impulsive decisions based on the current market situation is a losing strategy for novice intraday traders.