Leading media outlets are increasingly promoting the idea of a 50-basis point cut in the U.S. rate, contributing to further weakening of the U.S. dollar. Considering that the Federal Open Market Committee meeting is tomorrow, this trend is likely to persist until the close of today's trading. However, the scale of the dollar's weakening is expected to be somewhat more modest than yesterday. The dollar will find some support from macroeconomic data. Despite the possible slowdown in retail sales growth, from 2.7% to 2.2%, the decline in industrial production of -0.3% is likely to turn into growth of 0.2%. So, two key sectors of the economy might show growth, which should provide at least some support for the dollar.

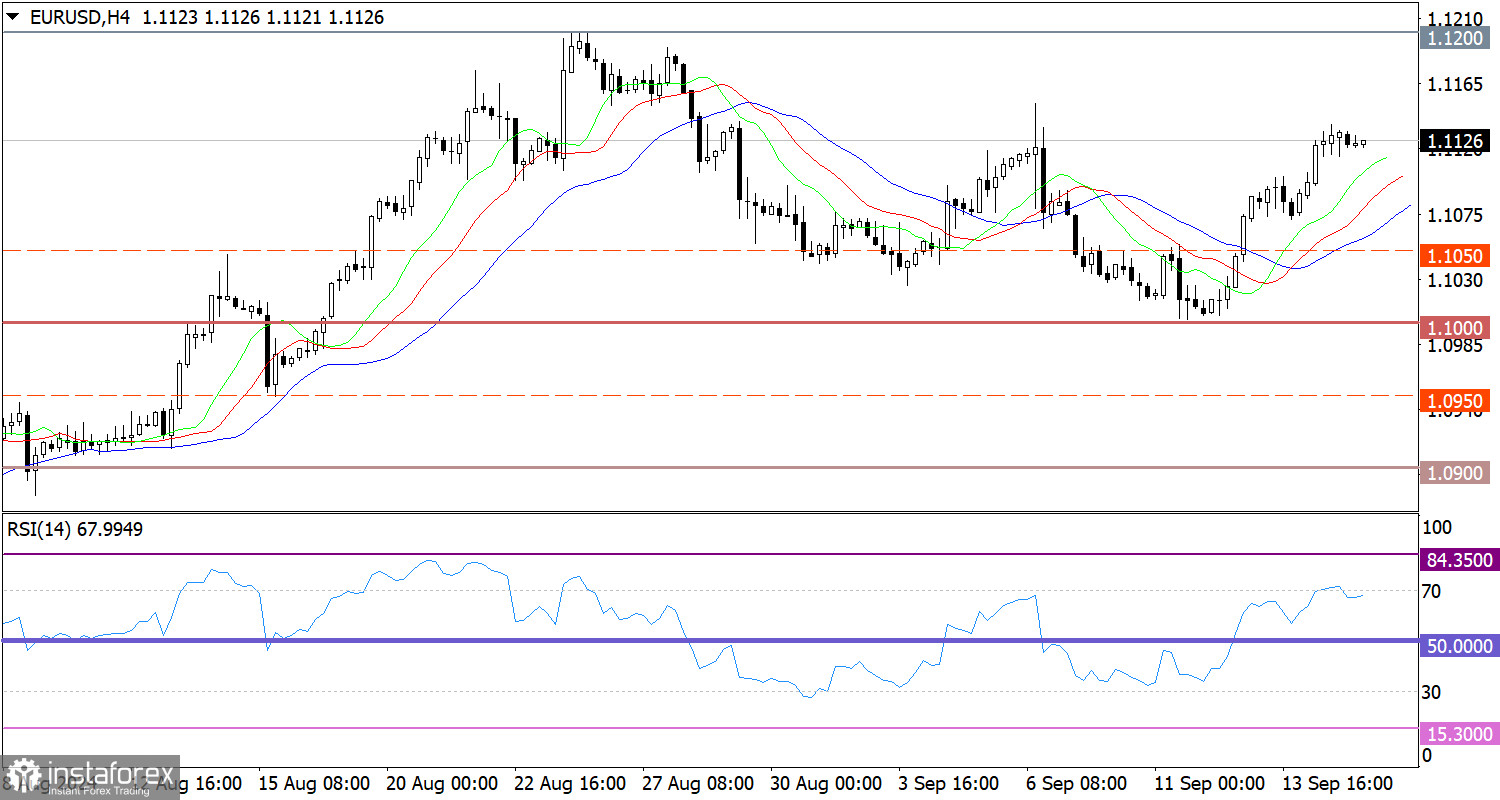

Since the start of the new trading week, the euro's recovery has accelerated, allowing it to surpass the 1.1100 level. This price movement indicates more than a 60% recovery relative to the recent corrective cycle.

In the four-hour chart, the RSI technical indicator is moving in the buyers' area of 50/70, indicating a bullish market sentiment. It is worth noting that the overbought zone has already been reached.

Regarding the Alligator indicator in the same time frame, the moving average lines point upward, aligning with the price movement.

Expectations and Prospects

The price's stabilization above 1.1100 may indicate further growth in the volume of long positions in the euro, which, from a technical analysis perspective, suggests the possibility of the price rising toward the resistance level of 1.1200. The alternative scenario considers a slowdown in the upward cycle in the form of a pullback due to the euro's local overbought condition in the short term.

The complex indicator analysis indicates a sustained upward cycle in the short-term, intraday, and medium-term periods.