USD/JPY is consolidating its recent losses near a more than one-year low, reached on Monday.

This was the lowest level since July 2023. It is likely that traders preferred to wait for the results of central bank events, which will be released this week, before positioning themselves for the next stage of directional movement. The U.S. Federal Reserve will announce its decision at the end of a two-day meeting on Wednesday, followed by an update on monetary policy from the Bank of Japan on Friday.

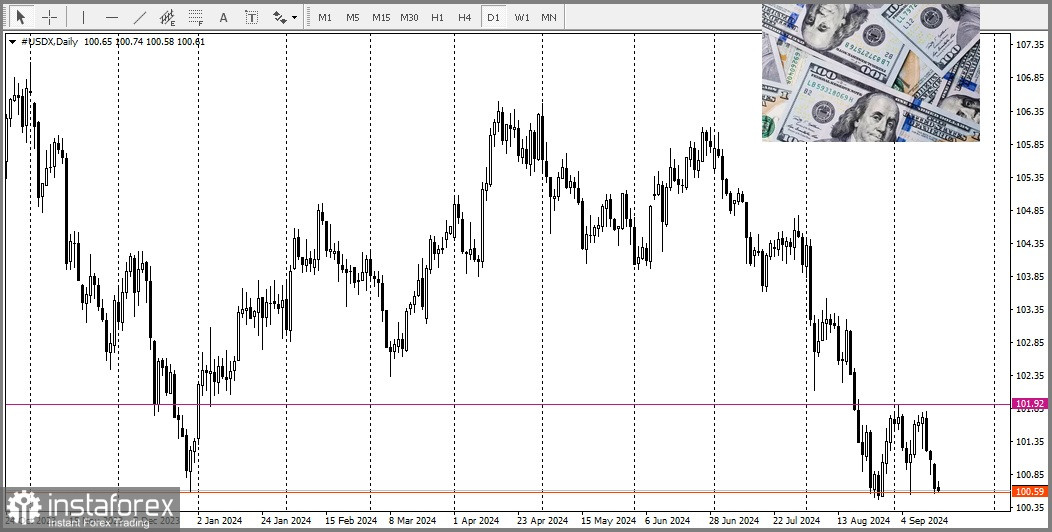

At the same time, some reorientation of trading is allowing the U.S. dollar to recover from the 2024 low. This is supporting the USD/JPY pair. However, any significant recovery seems unlikely due to diverging policy expectations between the two banks: the Fed and the Bank of Japan. Amid signs of easing inflationary pressure in the U.S., markets are pricing in the possibility of more aggressive easing from the Fed. This has lowered yields on rate-sensitive 2-year U.S. Treasury bonds to their lowest level since September 2022, while the yield on 10-year U.S. Treasuries has dropped to its lowest since June 2023.

Regarding the Japanese yen, recent hawkish signals from Bank of Japan officials suggest that the Japanese central bank may raise interest rates again by the end of the year. Additionally, new concerns about slowing economic growth in China, triggered by a series of negative data released over the weekend, alongside ongoing geopolitical risks, may strengthen the safe-haven Japanese yen. These events will further constrain the USD/JPY pair in the near term, necessitating caution before confirming that spot prices have reached a bottom and are ready to rise.

Regarding economic data, the Empire State Manufacturing Index for September was reported at 11.5, indicating the first growth in business activity in nearly a year. The figure exceeded expectations of -3.9 and the previous reading of -4.7, but it did not impress dollar bulls significantly.

For short-term momentum, attention should now turn to the release of U.S. retail sales data later in the North American session. However, the primary focus should remain on the important monetary policy meetings of the Fed and the Bank of Japan, which suggests that the immediate market reaction is likely to be brief.

From a technical perspective, the lack of buying interest indicates that the path of least resistance for the USD/JPY pair remains downward. That said, spot prices have managed to protect the support indicated by the lower boundary of the short-term downward trend channel. Moreover, the RSI (Relative Strength Index) on the daily chart has just shown slightly oversold conditions. This, in turn, makes it prudent to wait for a short-term consolidation or modest rebound before opening directional positions.

The overnight high around 141.25 serves as an immediate obstacle, above which the USD/JPY pair may manage to return to the 142.00 mark. Subsequent buying could lift spot prices even higher, but any further upward movement is likely to be capped by the round level of 143.00.

On the other hand, the psychological level of 140.00 now protects against immediate declines before the annual low of 139.55, reached on Monday. A failure to defend these support levels will confirm a breakout of the descending channel and make the USD/JPY pair even more vulnerable. The pair could then drop below the round level of 139.00, heading toward the July 2023 swing low, with intermediate support around 138.65–138.60, near the round figure of 138.00.