The GBP/USD pair sustained its upward movement for most of the day on Tuesday. Yes, it was weak, but the pound sterling steadily appreciated. Only by the end of the day did we see a decline in the British currency, which has no significant impact for now. Today marks the beginning of a news parade for both the dollar and the pound, but it seems like none of the market participants are interested. Usually, news, reports, and important events help traders decide on the trading direction, but currently, the direction seems obvious. The market continues to use any formal excuse to buy pounds and sell dollars.

Today, the inflation report will be released in the UK. Suppose inflation comes in lower than expected, contrary to the Bank of England's concerns. What impact will that have? Based on this report, the BoE is unlikely to lower the key rate on Thursday. The pound sterling is unlikely to drop significantly if it has been rising without any real reasons beforehand. And the market is unlikely to abandon its strategy of "In any uncertain situation, buy the pound" because of one report. Suppose inflation exceeds expectations—what will that change? It would only give the market more reason to believe that the BoE will hold the rate at 5% for an extended period. And it doesn't matter that the BoE has already begun its monetary easing cycle (which means it will continue regardless). It also doesn't matter that for all of 2024, the market has been "pricing in advance" the Federal Reserve's rate cuts. The inflation report will not change anything.

This evening, the results of the Fed meeting will be announced. What impact will they have? If the Fed lowers the rate by 0.25%, it will be another formal excuse to sell the dollar, although this decision has long been priced in. If the Fed cuts the rate by 0.5%, it will provide an even stronger reason to get rid of the U.S. currency. Of course, the dollar could also rise, as no one knows how many stages of easing the market has already priced in. However, in the current circumstances, such an outcome seems naive and unlikely.

On Thursday, the BoE will announce the results of its meeting, and it is already known that the rate will remain unchanged. Therefore, the market might interpret this decision as hawkish—after all, the BoE held the rate steady while the Fed lowered theirs. As we can see, any event can be spun in whichever way the market desires. And now, the market only wants to buy the GBP/USD pair. A miracle is possible, of course, but it seems more likely that the dollar will depreciate again.

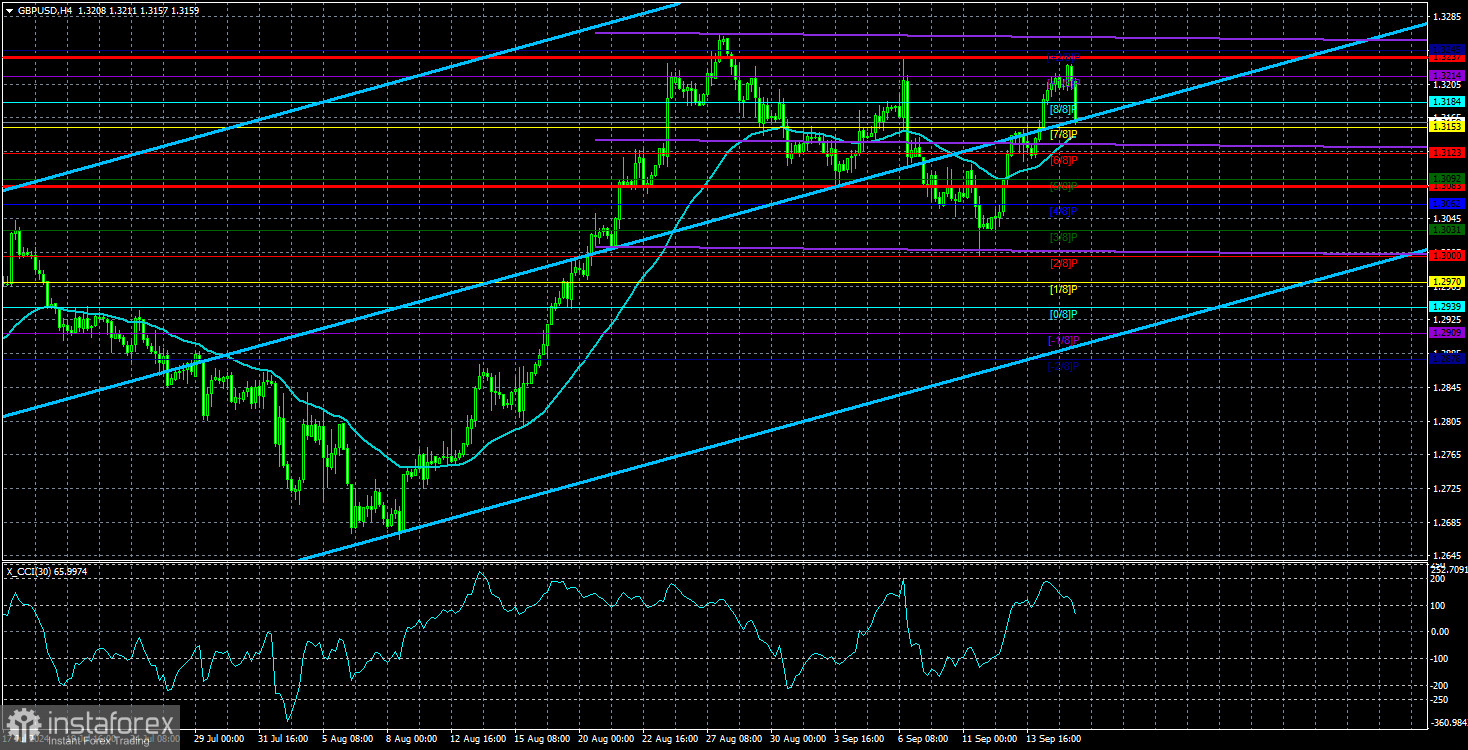

Moreover, the price is above the moving average on the 4-hour chart, and on the 24-hour chart, it quickly returned to its last local high. Neither overbought indicators nor the overvalued British pound concern anyone, nor do the series of bearish divergences. Since August 10, the CCI indicator has spent most of its time in overbought territory, and the pair has not even managed a proper downward correction. The situation remains highly ambiguous, as no one knows when this illogical growth will end.

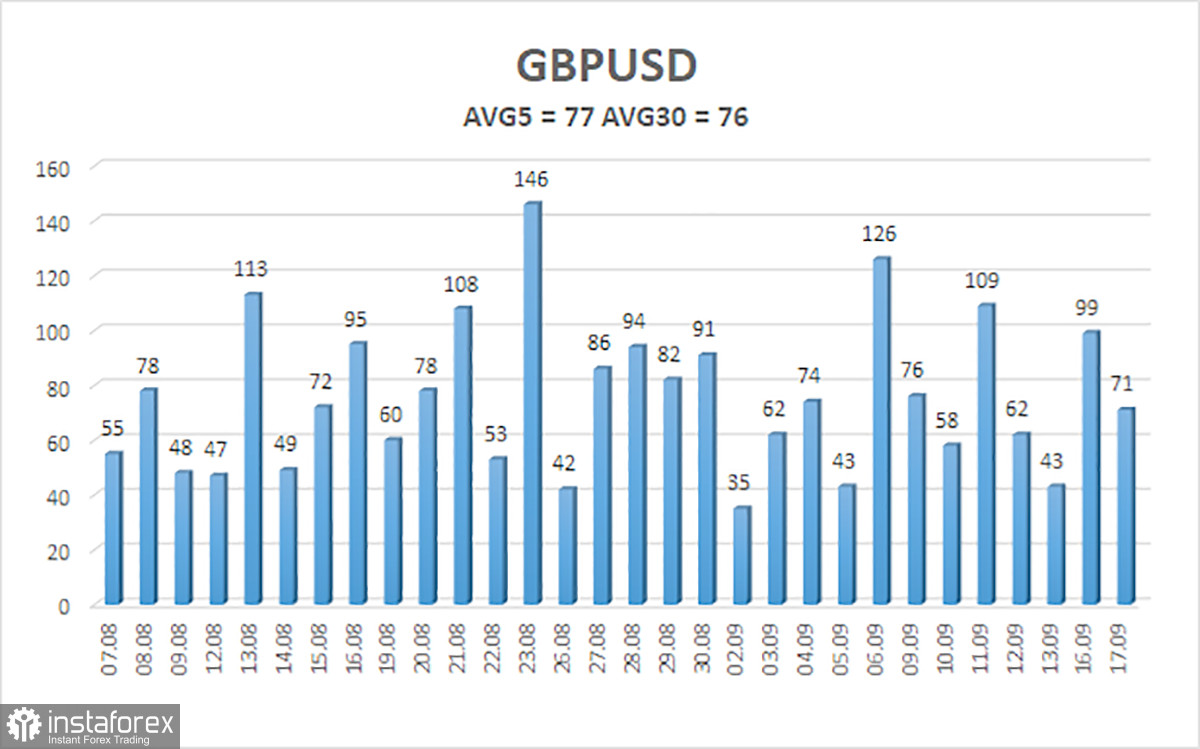

The average volatility of the GBP/USD pair over the past five trading days is 74 pips, which is considered average for this pair. Therefore, on Wednesday, September 18, we expect the pair to move within a range between 1.3083 and 1.3237. The upper linear regression channel is directed upwards, indicating that the upward trend remains intact. The CCI indicator has formed four bearish divergences, which suggest a potential substantial decline, which we have yet to see.

Nearest Support Levels:

- S1 – 1.3153

- S2 – 1.3123

- S3 – 1.3092

Nearest Resistance Levels:

- R1 – 1.3184

- R2 – 1.3214

- R3 – 1.3245

Trading Recommendations:

The GBP/USD pair has taken the first step towards a downtrend, and we hope this won't be the only one. We are not considering long positions now, as we believe that the market has repeatedly factored in all the bullish factors for the British currency (which are not much). However, it is hard to deny that the pound could continue to rise. Therefore, if you're trading purely on technicals, long positions are possible with targets at 1.3245 and 1.3275 as long as the price remains above the moving average. Short positions can be considered with targets at 1.2939 and 1.2878 if the price consolidates below the moving average. However, the market could still resume pricing in the future easing of the Fed's monetary policy. Caution is advised.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are pointed in the same direction, this indicates a strong trend.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entry into the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction is approaching.