Analysis of Macroeconomic Reports:

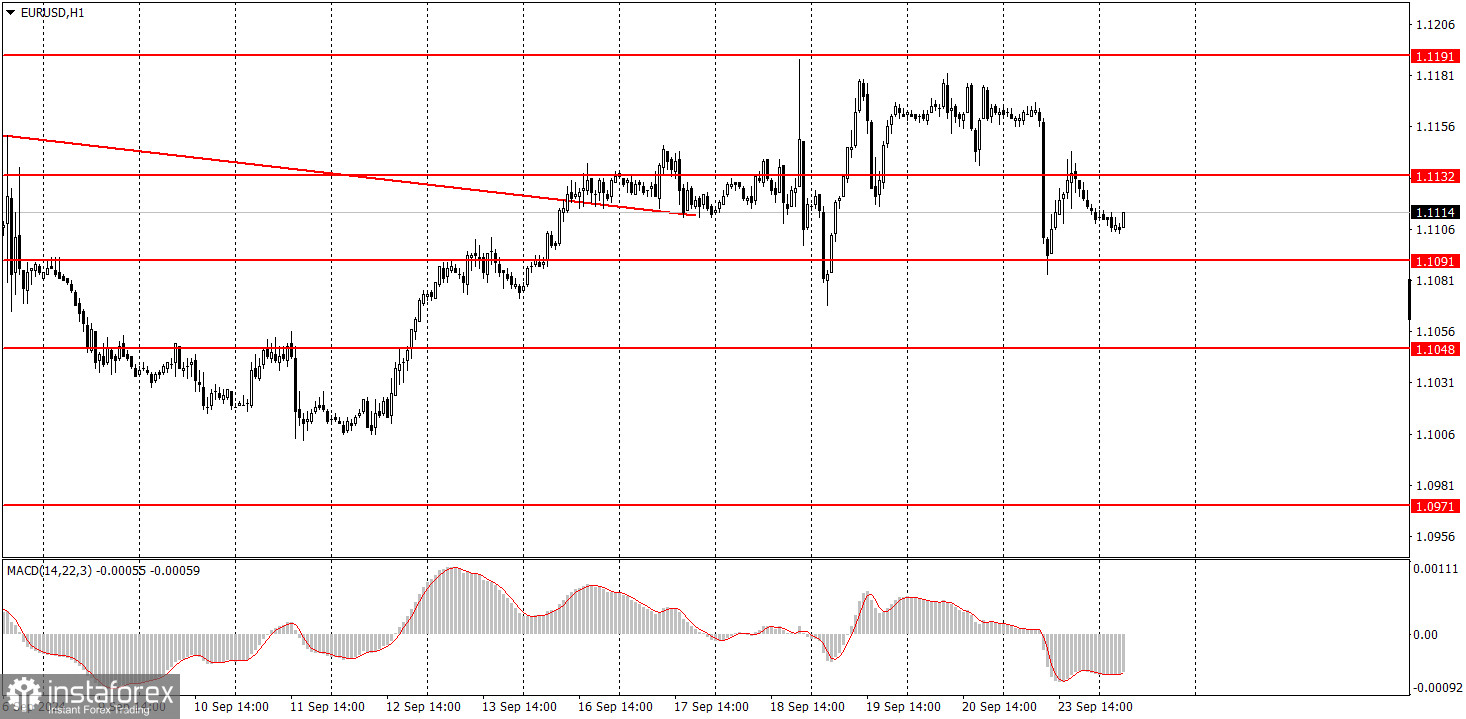

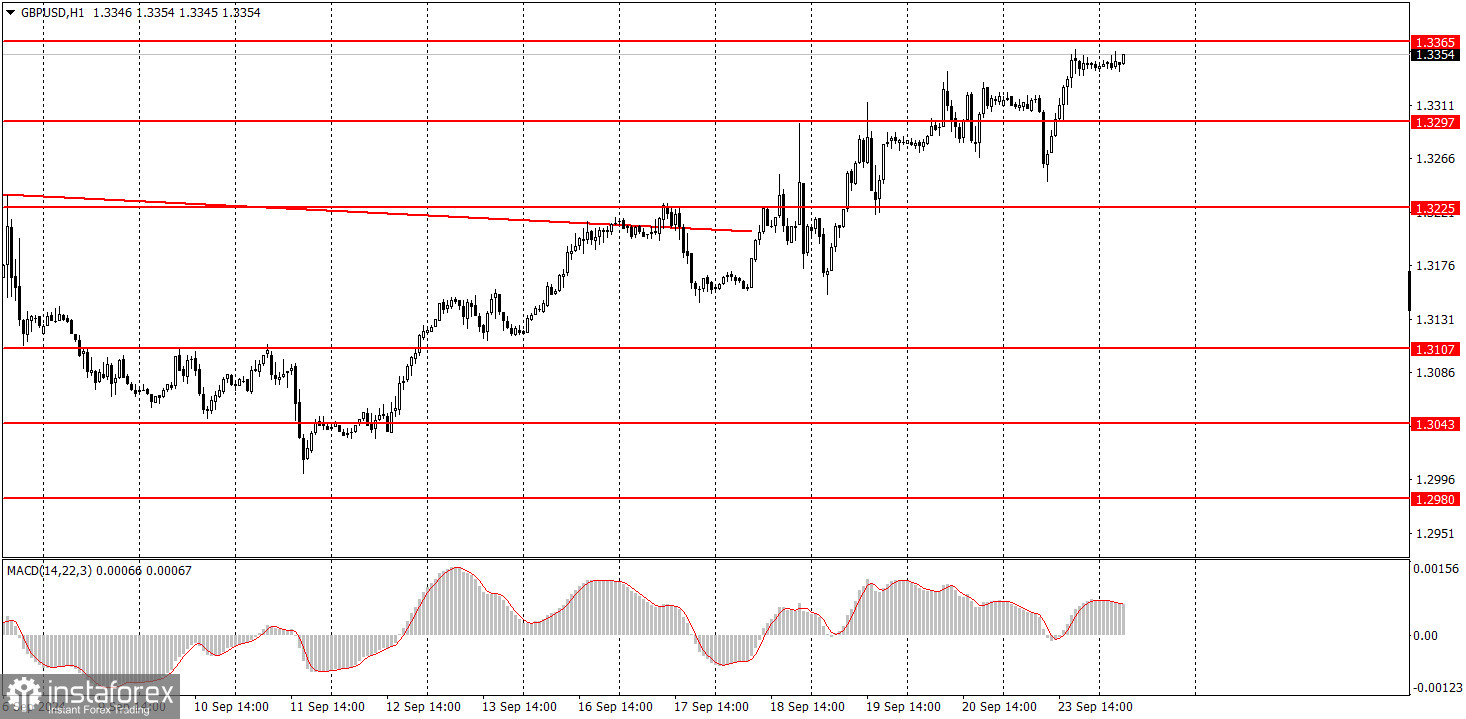

No significant macroeconomic events regarding significant reports are scheduled for Tuesday. The only somewhat noteworthy report of the day is the Business Climate Index in Germany from the IFO Institute. In our opinion, expecting any reaction to this report makes little sense – if there is any reaction, it will likely be minimal. Thus, today, the market will have little to respond to. The euro will likely remain within the horizontal channel of 1.1091-1.1191, while the pound may either continue its upward movement or pause around the 1.3365 level.

Analysis of Fundamental Events:

There is absolutely nothing noteworthy from Tuesday's fundamental events, either. In the Eurozone, European Central Bank Monetary Committee representative McCaul will give a speech, but over the last week and a half, we have likely heard the views on monetary policy from almost all committee members. Therefore, it is unlikely that McCaul will provide any new information today.

General Conclusions:

On Tuesday, the euro might remain within the horizontal channel, while the pound could continue its upward movement. Even though the euro occasionally takes breaks, the pound doesn't seem capable of doing so. However, even when positioned at local highs, the euro cannot undergo a proper correction. Thus, there is currently very little logic in the movements of both currency pairs.

Basic Rules of the Trading System:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades were opened around any level due to false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst good volatility and a trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered a support or resistance area.

7) After moving 15-20 pips in the intended direction, the Stop Loss should be set to break even.

What's on the Charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels around them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD indicator (14,22,3): encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to avoid sharp price reversals against the prevailing movement.

For beginners, it's important to remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over the long term.