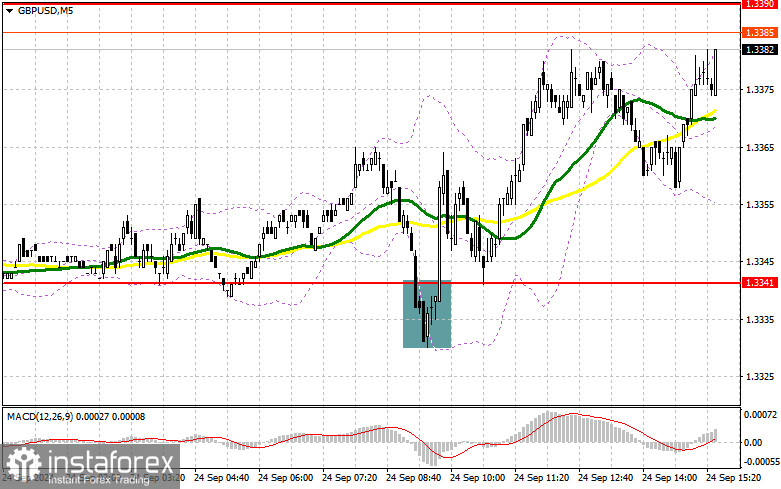

In my morning forecast, I focused on the level of 1.3341 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A drop and the formation of a false breakout at this level provided an excellent entry point for buying the pound, resulting in the pair rising by over 40 points. The technical outlook was not revised for the second half of the day.

For Opening Long Positions on GBP/USD:

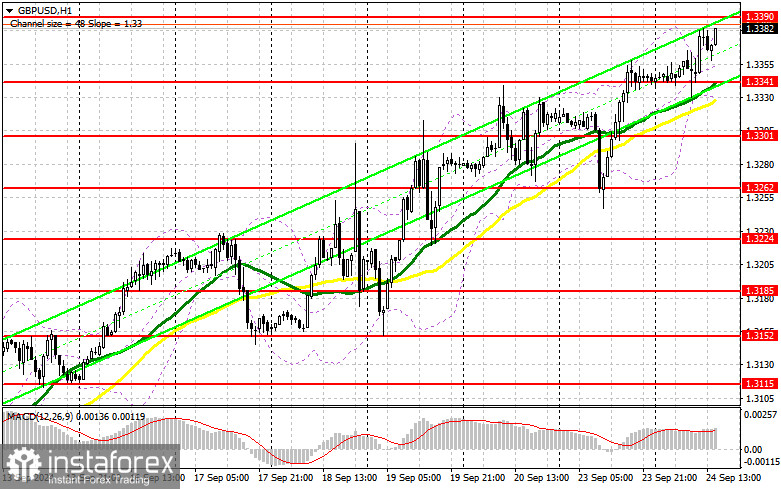

Buyers are controlling the market and aiming to reach a new monthly high around 1.3390. Naturally, a correction of the pound would be desirable, which may only occur if strong US statistics are released. We are expecting data on the Consumer Confidence Index for August, the Housing Price Index in the 20 largest U.S. cities, and the Richmond Fed Manufacturing Index. Strong data could push the pound down to the 1.3341 level, where you already know how to act. A false breakout at this level, as analyzed above, will provide a chance to continue the growth, restoring the pair to the 1.3390 level. A breakout and retest from top to bottom of this range will strengthen the chances of further upward movement, leading to the removal of stop orders from sellers and an excellent entry point for long positions, with the potential to reach the 1.3435 level. The ultimate target will be the 1.3468 level, where I plan to take profit. If GBP/USD declines and the bulls show no activity around 1.3341 in the second half of the day, pressure on the pair will likely return. This could also lead to a drop and renewal of support at 1.3341, where the moving averages are located. Only a false breakout at that level would create a suitable opportunity for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3301 low with a target of a 30-35 point correction during the day.

For Opening Short Positions on GBP/USD:

Sellers made an attempt, and although they initially seemed to succeed, buyers are not ready to lose control of the market. If growth continues amid weak U.S. statistics, I plan to act in the resistance area of 1.3390. A false breakout there will be a good entry point to sell the pound with a correction target to support at 1.3341, which was well-tested earlier in the morning. Therefore, only a breakout and retest from bottom to top of this range will strike at buyers' positions, triggering stop orders and opening the way to 1.3301. The ultimate target will be the 1.3262 level, where I will take profit. If GBP/USD rises and there is no bearish activity at 1.3390 in the second half of the day, which cannot be ruled out in the current bullish trend, buyers will continue to push the pound higher. In such a case, bears will have no choice but to retreat to the 1.3435 resistance area. I will sell there only on a false breakout. If there is no downward movement, I will look for short positions on a rebound from around 1.3468, expecting only a 30-35 point downward correction during the day.

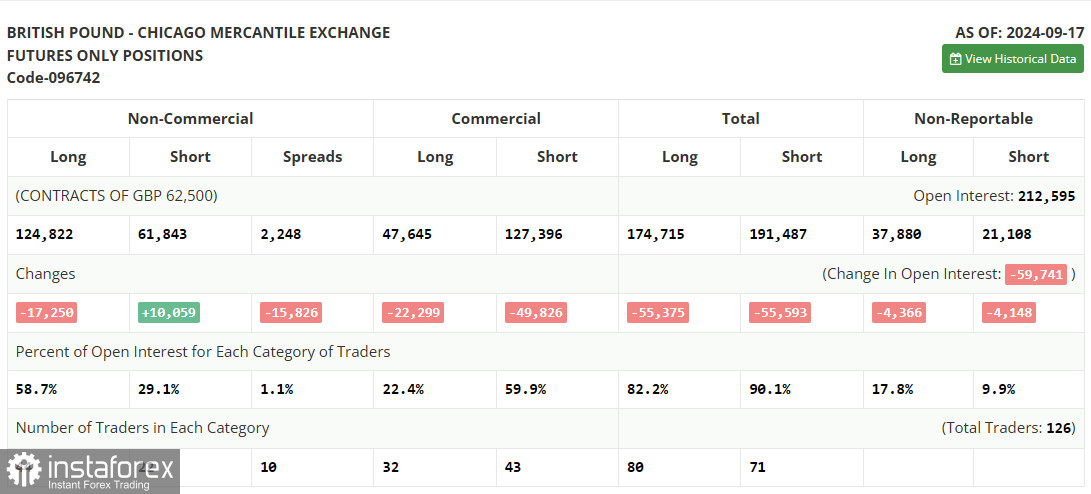

In the COT (Commitment of Traders) report from September 17, there was an increase in short positions and a decrease in long positions. It's clear that after the Bank of England decided to keep its monetary policy unchanged, and the Federal Reserve cut interest rates, the number of pound buyers increased significantly. However, this change is not yet reflected in the current report, so there is no need to pay too much attention to it. To be fair, the recorded increase in short positions hasn't affected the medium-term upward trend. Therefore, the lower the pound goes, the more it will attract new buyers. The latest COT report indicated that long non-commercial positions fell by 17,250 to 124,822, while short non-commercial positions increased by 10,059 to 61,843. As a result, the gap between long and short positions dropped by 342.

Indicator Signals:

Moving Averages:

Trading is occurring above the 30 and 50-day moving averages, suggesting further bullish momentum for the pound.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In the case of a decline, the lower boundary of the indicator around 1.3330 will serve as support.

Description of Indicators:

- Moving average: A tool used to identify the current trend by smoothing out volatility and noise. Period 50 is marked in yellow on the chart.

- Moving average: Another moving average to identify trends, with a period of 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions held by non-commercial traders.