Guess what? The GBP/USD pair continued to move upward on Tuesday. The movement was relatively weak this time, but we also warned about this yesterday. Yes, the market didn't have reasons to sell the dollar and buy the pound this time, but it didn't have them on Monday either. Nevertheless, the British currency also grew on the first trading day of the week.

Let's recall that on Monday, the UK published the Purchasing Managers' Indices (PMI) for the services and manufacturing sectors, which turned out to be weaker than expected. Therefore, the pound had every reason to fall by at least 30-40 pips. And it did fall, but what's the point if it eventually rose by 80 pips without any reason? On Tuesday, there was no news from the UK or the US, yet the British currency continued its sluggish growth.

Thus, we can draw an unambiguous conclusion – time passes, but the situation in the forex market doesn't change. We've been talking about the illogical upward movement since the beginning of the year because even back then, it was evident that the pound was rising much more frequently than there was positive news from the UK or negative news from the US. It's the end of September, and the pound still rises whenever and wherever it wants.

You can endlessly debate that the market is "experiencing a rise in risk sentiment" or that "the market expects a divergence in Federal Reserve and Bank of England rates," but all of this is just an attempt to present wishful thinking as reality. The US dollar has been falling for two consecutive years. If the market is currently pricing in the future divergence between the Fed/BoE rates, why was the pound rising a year ago or even a year and a half ago?

Of course, one could also say that the pound is recovering from the setbacks associated with Brexit, the "coronavirus" pandemic, or the brief period of Liz Truss's rule. However, we always believed that macroeconomic indicators should somehow reflect recovery. The UK economy is growing at low rates; the Labour government began with the statement, "We will raise taxes!" and the BoE has also started easing monetary policy, just like the Fed. But none of this concerns the big players. They have their strategy, which in no way aligns with the current fundamental and macroeconomic backdrop.

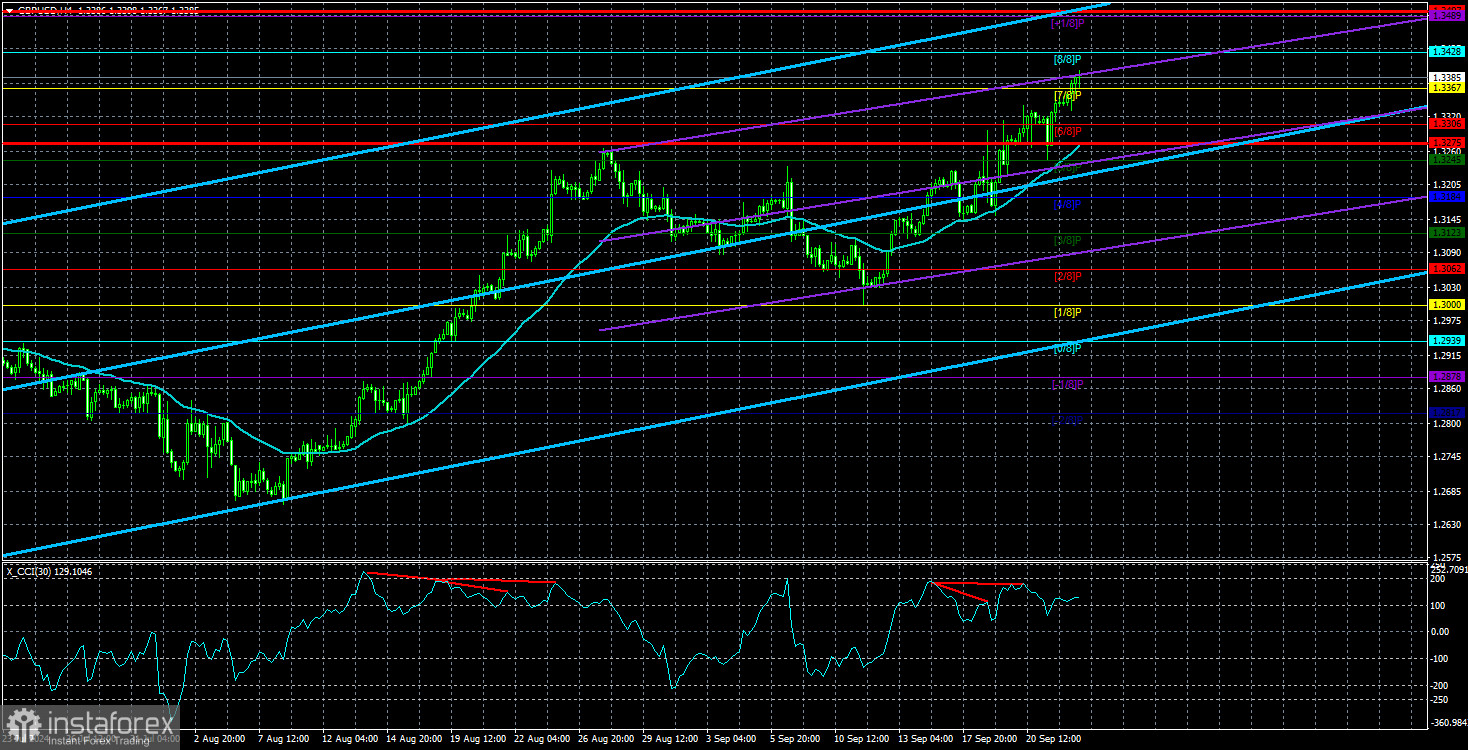

Therefore, traders who pay at least some attention to macroeconomics and fundamentals are left with just one option: to wait. Wait for the right moment, wait for signs that this illogical journey to the north is ending, wait for the pound bulls to reach saturation, and so on. Of course, we're not prohibiting anyone from buying the pound sterling, especially since it's rising daily. If you're trading purely based on technicals, then buying now is the only option, as there hasn't been a single sign of the pair falling for a while. That is if we disregard the countless bearish divergences on the CCI indicator and its constant hovering around the overbought area.

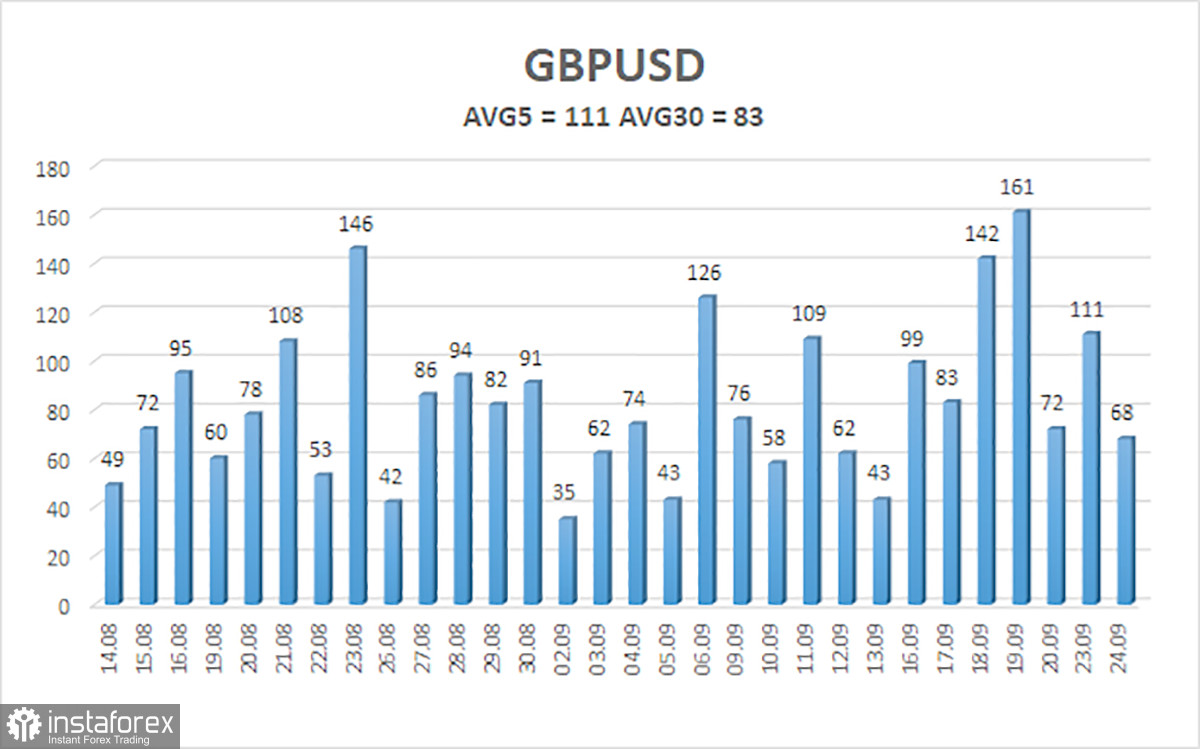

The average volatility of the GBP/USD pair over the last five trading days is 111 pips. For the pound/dollar pair, this value is considered "medium-high." Therefore, on Wednesday, September 25, we expect movement within the range defined by the levels of 1.3275 and 1.3497. The upper linear regression channel is directed upwards, signaling the continuation of the uptrend. The CCI indicator has formed four bearish divergences, and now there's even a fifth, which suggests a significant decline that we still do not see.

Nearest support levels:

S1 – 1.3368

S2 – 1.3306

S3 – 1.3245

Nearest resistance levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair continues its upward movement easily and steadily. We are not considering long positions now, as we believe that all factors supporting the British currency's growth have already been priced in by the market several times. However, it is hard to deny that the pound may continue to rise due to momentum. Therefore, if you are trading based on "pure technicals," long positions are possible with targets at 1.3428 and 1.3489 as long as the price remains above the moving average. Short positions can be considered with targets at 1.3062 and 1.3000 if the price consolidates below the moving average line.

Explanations for Illustrations:

Linear Regression Channels: These help determine the current trend. If both point in the same direction, the trend is currently strong.

Moving Average Line (settings 20,0, smoothed): It defines the short-term trend and the direction in which trading should currently be conducted.

Murray Levels: Target levels for movements and corrections.

Volatility Levels (red lines): The likely price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.