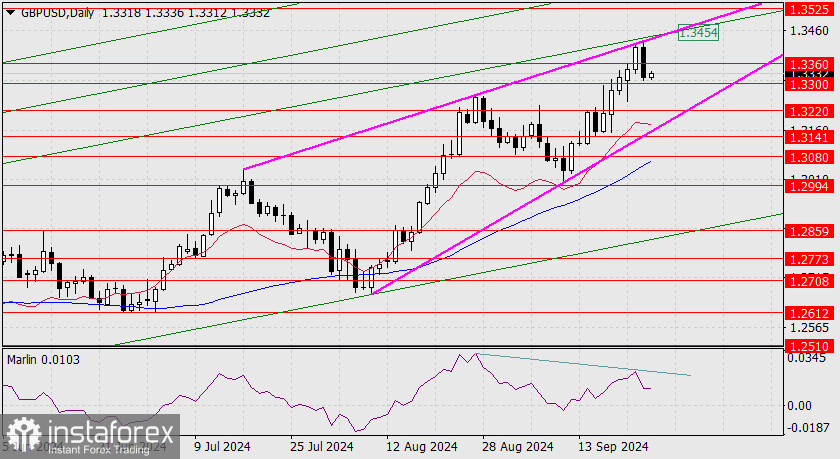

The British pound fell by 89 pips yesterday, finally forming a stable divergence with the Marlin oscillator. However, none of the target levels were reached – neither the price channel line nor the 1.3300 support level. Instead, an ascending wedge was formed, which now provides a new target at the intersection point of the wedge and the price channel – 1.3454. The divergence may reform.

After reaching this target, a correction to the lower boundary of the channel (1.3300) might occur, followed by the final leg of growth up to the target level of 1.3525. Afterward, a reversal to a long-term decline could follow along with the rest of the market.

The four-hour chart shows that the price is turning upward as it approaches the 1.3300 support level. The Marlin oscillator dropped sharply, but this could indicate a significant release of tension before a potential rise, possibly even into the overbought zone, which it couldn't reach during the formation of the Triple Top. The MACD line has now risen above the 1.3300 level to protect it.