Analysis of Trades and Tips for Trading the Euro

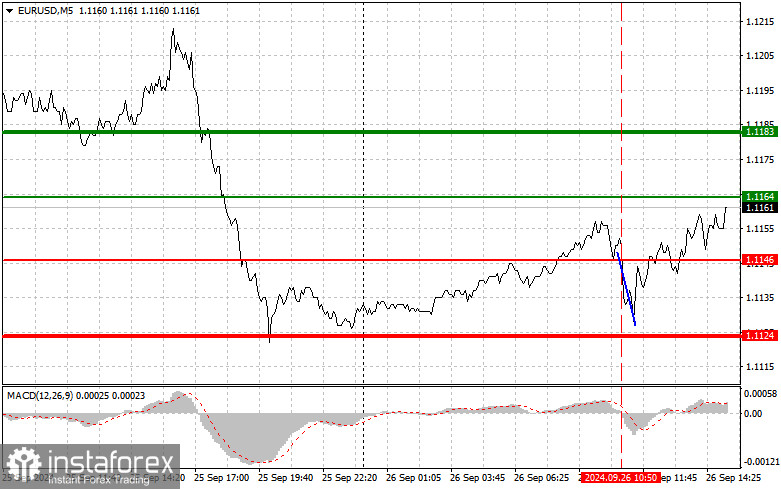

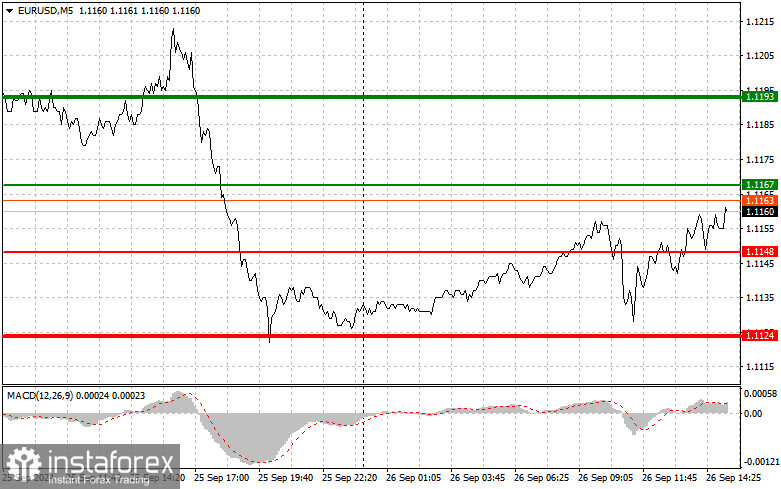

The first test of the 1.1146 level occurred when the MACD indicator was just starting to move downward from the zero mark, confirming the correct entry point into the market. As a result, the pair moved down by nearly 20 points, but it did not reach the target level of 1.1124. It's now crucial to monitor the upcoming U.S. GDP data for the second quarter, along with the weekly initial jobless claims. Additionally, the U.S. report on durable goods orders will be released. Strong statistics indicate a strong dollar, which could only be weakened by dovish rhetoric from Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen, who often express support for the economy. As for the intraday strategy, I plan to act based on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro upon reaching the price around 1.1167 (green line on the chart) with a target of rising to the 1.1193 level. At the 1.1193 mark, I will exit the market and sell the euro in the opposite direction, aiming for a movement of 30-35 points from the entry point. A strong upward movement for the euro today is anticipated only in the event of very weak U.S. statistics. Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting its rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1148 level when the MACD indicator is in the oversold area. This situation will limit the pair's downward potential and lead to a market reversal upward. Growth toward the resistance levels of 1.1167 and 1.1193 can be expected.

Sell Signal

Scenario #1: I will sell the euro after reaching the 1.1148 level (red line on the chart). The target will be the 1.1124 level, where I plan to exit the market and immediately buy the euro in the opposite direction, aiming for a movement of 20-25 points from this level. Pressure on the pair will return if the U.S. statistics are strong. Important: Before selling, ensure that the MACD indicator is below the zero mark and beginning its decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1167 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the levels of 1.1148 and 1.1124 can be expected.

Chart Explanation

- Thin green line – entry price for buying the trading instrument.

- Thick green line – the suggested price where you can set a Take Profit or manually fix profits, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – the suggested price where you can set a Take Profit or manually fix profits, as further declines below this level are unlikely.

- MACD Indicator: When entering the market, it's important to consider overbought and oversold zones.

Important Notes

Beginner forex traders should be cautious when making market entry decisions. It's best to avoid trading before the release of significant fundamental reports to prevent being caught in sudden price fluctuations. If you decide to trade during news releases, always use stop orders to minimize potential losses. Without stop orders, you risk quickly losing your entire deposit, especially if you do not apply money management principles and trade with large volumes.

Remember, successful trading requires a clear trading plan, such as the one outlined above. Spontaneous trading decisions based on the current market situation are fundamentally a losing strategy for intraday traders.