Currently, the EUR/USD pair is drawing in sellers, undoing part of the positive momentum from the previous day. Meanwhile, the U.S. dollar is strengthening ahead of the release of the U.S. Personal Consumption Expenditures (PCE) price index, which is acting as a key factor putting pressure on the currency pair.

However, the U.S. dollar's rally is waning amid expectations of more aggressive monetary easing by the Federal Reserve. This expectation should help limit the decline in the euro. According to CME Group's FedWatch tool, there is now more than a 50% probability that the U.S. Central Bank will cut borrowing costs by another 50 basis points at the November meeting. This likelihood emerged following recent warnings from several Fed officials that rates might not drop as sharply, alongside stronger-than-expected U.S. macroeconomic data. According to the Bureau of Economic Analysis, the third estimate of U.S. GDP showed that annualized growth in the second quarter was 3%.

Additionally, the U.S. Census Bureau reported that new orders for durable goods remained virtually unchanged in August, following a 9.9% surge in the previous month. Excluding transportation, new orders rose by 0.5% in the reporting month. The U.S. Department of Labor also indicated that initial jobless claims fell to 218,000 in the week ending September 21, the lowest level since mid-May, signaling that the labor market remains healthy. However, these figures provided little relief for dollar bulls.

Expectations of lower interest rates boosting economic activity, together with China's stimulus measures, are fueling risk appetite in the markets, thereby capping gains for the safe-haven U.S. dollar.

Conversely, weaker CPI readings in France and Spain confirm the likelihood of a 25 basis point rate cut by the ECB in October, causing the common currency to weaken.

Nonetheless, given the mixed fundamental backdrop, especially ahead of crucial U.S. inflation data, caution is advised before opening aggressive bearish positions in the EUR/USD pair.

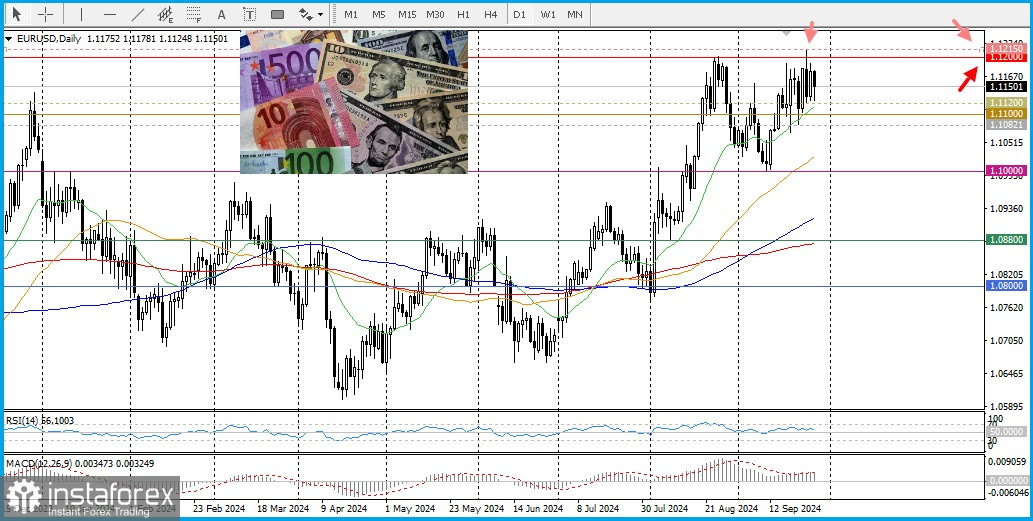

From a technical perspective, recent repeated failures to build momentum and consolidate above the 1.1200 level suggest the formation of a bearish double top. However, positive oscillators on the daily chart indicate that it would be prudent to wait for selling pressure below the 1.1120 support before taking a bearish stance. The EUR/USD pair could then weaken below the 1.1100 psychological level, targeting the weekly low near 1.1080. Subsequently, spot prices could drop toward the 50-day Simple Moving Average (SMA). A decisive breach below the psychological 1.1000 level would then suggest the currency pair is poised for further downward potential.

Conversely, the 1.1200 level acts as a strong resistance ahead of the 1.1215 level or the 14-month high reached on Wednesday.

Additional buying interest could serve as a new trigger for bulls, driving the EUR/USD pair towards the July 2023 swing high near the 1.1275 level. The momentum could extend further to the 1.1300 level and beyond.