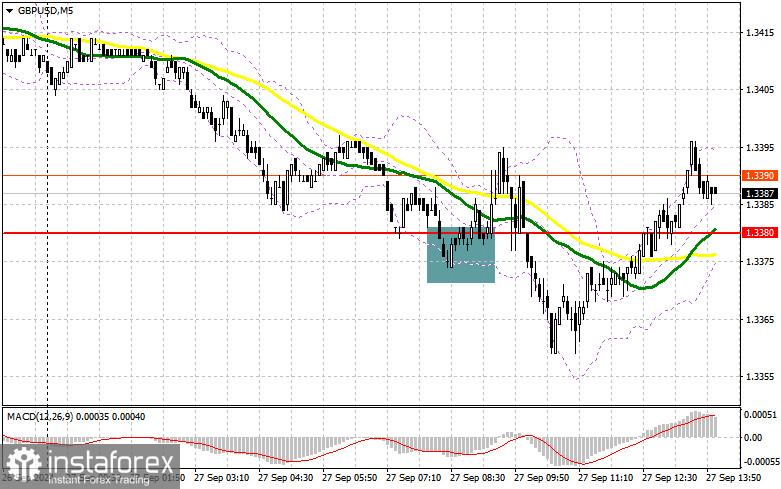

In my morning forecast, I focused on the level of 1.3380 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. The decline and the formation of a false breakout around 1.3380 provided an excellent entry point for buying the pound, but it didn't lead to a significant rise, and trading continued around 1.3380. The technical outlook was revised for the second half of the day.

Requirements for Opening Long Positions on GBP/USD:

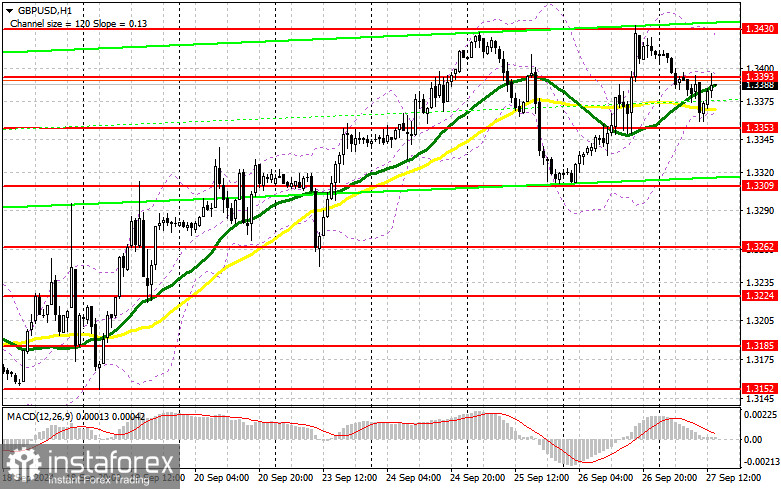

Given the upcoming release of important U.S. statistics, which could either extend the bullish trend for the pound or put significant pressure on it, it is essential to act cautiously at current highs. An increase in the core Personal Consumption Expenditures (PCE) index will strengthen the dollar, presenting an opportunity to enter the market. In this case, I will consider long positions after an update to the support level at 1.3353, which was established from yesterday's results. A false breakout at this level will provide a chance for the pair to rise toward the 1.3393 intermediate resistance. A breakout and retest from top to bottom of this range will strengthen the chances of developing an uptrend, leading to the triggering of sellers' stop orders and providing an entry point for long positions, potentially reaching the 1.3430 weekly high. The ultimate target will be the 1.3468 level, where I plan to take profit. If GBP/USD declines and there is no bullish activity around 1.3353 in the second half of the day, pressure on the pair will intensify, potentially leading to a drop to the 1.3309 support. Only a false breakout there will be a suitable condition for opening long positions. I plan to buy GBP/USD directly on a rebound from the 1.3262 low with an upward correction target of 30-35 points intraday.

Requirements for Opening Short Positions on GBP/USD:

Sellers are attempting to take action, but their efforts have been limited, as seen on the chart. The main task now is to defend the 1.3393 resistance, which will likely be tested if news shows a decline in the PCE index and a drop in American spending and income levels. Only a false breakout there will provide a suitable entry point for selling the pound, aiming for a correction toward the 1.3353 support. A breakout and subsequent retest from below will hit buyers' positions, triggering stop orders and opening the way toward 1.3309. The ultimate target will be the 1.3262 level, where I plan to take profit. If GBP/USD rises and there is no bearish activity at 1.3393 in the second half of the day—which can't be ruled out in the current bullish trend—buyers will continue to push the pound higher. Bears will have no choice but to retreat to the 1.3430 resistance area. I will sell there only after a false breakout. If there is no downward movement, I'll look for short positions on a rebound from 1.3468, aiming for a downward correction of 30-35 points.

Indicator Signals:

Moving Averages:

The pair is trading around the 30- and 50-day moving averages, suggesting market uncertainty.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3360 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 50, marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

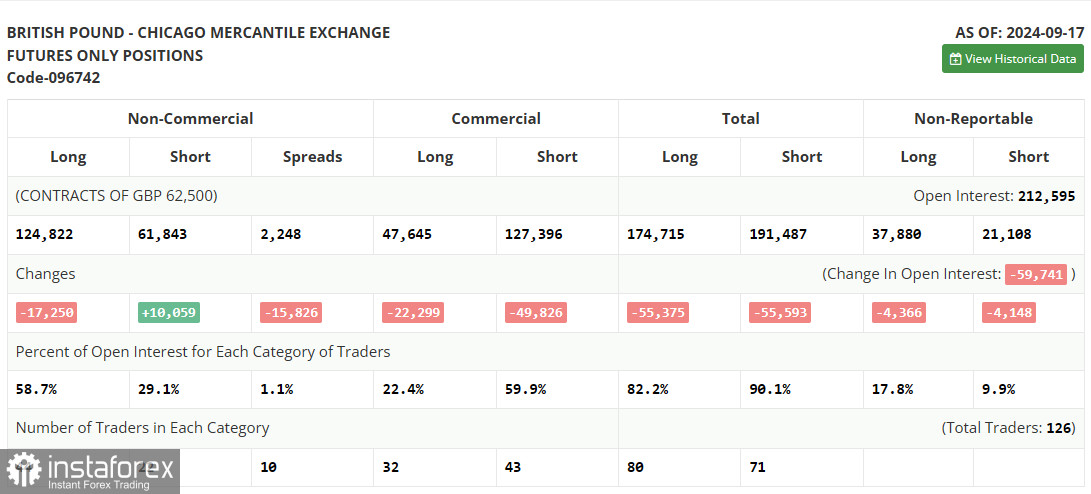

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- The total non-commercial net position: The difference between short and long positions of non-commercial traders.