Analysis of Trades and Tips for Trading the British Pound

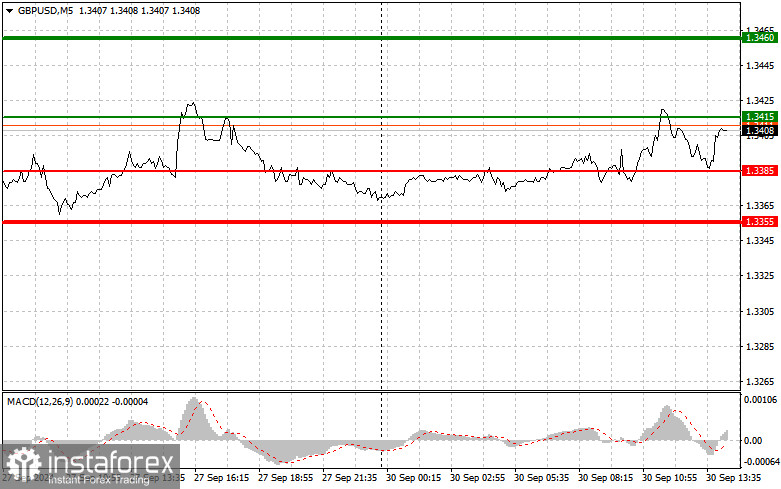

The test of the 1.3380 price level occurred when the MACD indicator was just beginning its downward movement from the zero line, confirming a suitable entry point for selling the pound. However, as seen on the chart, even with the weak GDP data from the UK, which was revised downward, a significant sell-off of the pound did not materialize. Consequently, this trade resulted in a loss. It's crucial to focus on Federal Reserve Chairman Jerome Powell's speech today, as he may shed light on the Federal Reserve's future monetary policy and the pace of interest rate cuts expected in November. Alternatively, he might refrain from preparing the market for future changes, which could strengthen the U.S. dollar. Therefore, exercise caution when buying the pound near today's monthly high. Regarding my intraday strategy, I plan to proceed based on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: I plan to buy the pound today when the entry point reaches around 1.3415 (green line on the chart), aiming for a rise to the 1.3460 level (thicker green line on the chart). At around 1.3460, I will exit my buys and initiate sales in the opposite direction (targeting a movement of 30-35 points in the opposite direction from this level). The pound is expected to rise today, especially following weak U.S. statistics. Important! Before buying, ensure that the MACD indicator is above the zero line and has just started moving upward.

Scenario #2: I also plan to buy the pound today if the price tests 1.3385 twice in succession while the MACD indicator is in the oversold area. This will limit the pair's downward potential and likely cause a market reversal upward. Growth to the opposite levels of 1.3415 and 1.3460 can be anticipated.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.3385 level is breached (red line on the chart), leading to a quick decline in the pair. The primary target for sellers will be the 1.3355 level, where I will exit my sell positions and open purchases in the opposite direction (targeting a movement of 20-25 points in the opposite direction from this level). Sellers are expected to strengthen in case of robust US statistics. Important! Before selling, ensure that the MACD indicator is below the zero line and has just begun its downward movement.

Scenario #2: I will also consider selling the pound today if the price tests 1.3415 twice in succession while the MACD indicator is in the overbought area. This will restrict the pair's upward potential and prompt a market reversal downward. A decline to the opposite levels of 1.3385 and 1.3355 is expected.

Chart Key:

- Thin Green Line – Entry price for buying the trading instrument.

- Thick Green Line – Estimated price for setting Take Profit or closing profits manually, as further growth above this level is unlikely.

- Thin Red Line – Entry price for selling the trading instrument.

- Thick Red Line – Estimated price for setting Take Profit or closing profits manually, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, pay attention to overbought and oversold zones.

Important Advice:

Beginner forex traders should exercise extreme caution when making entry decisions. It's best to stay out of the market before the release of significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize potential losses. Without stop-losses, you could quickly deplete your entire deposit, especially if you neglect money management and trade large volumes.

Remember, successful trading requires a clear trading plan, such as the one outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.