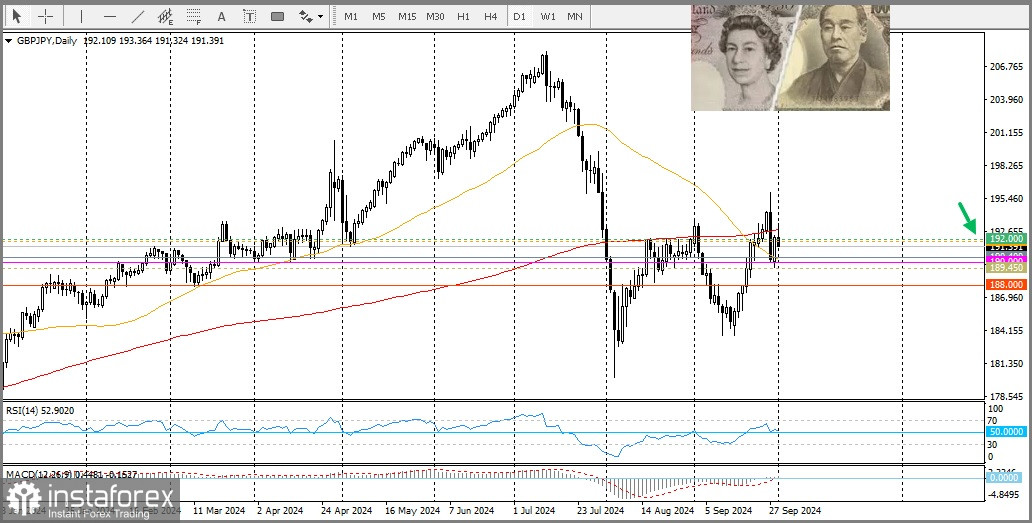

Today, the GBP/JPY pair is attracting some intraday sellers amid increasing selling pressure on the British pound against the U.S. dollar.

Currently, spot prices are trading slightly below the 192.00 level, having dropped by nearly 0.20% for the day.

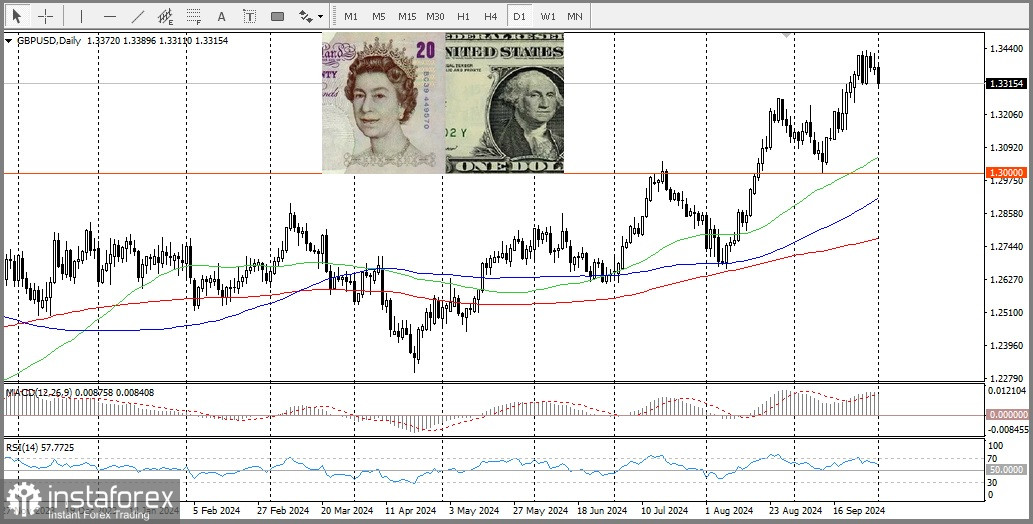

The U.S. dollar, which gained momentum following Federal Reserve Chair Jerome Powell's hawkish stance, is exerting downward pressure on the British pound.

Additionally, the intraday decline of the pound lacks a clear fundamental catalyst, meaning it is likely to remain limited. This is especially true given expectations of a slower rate-cut cycle by the Bank of England compared to the ECB and the Federal Reserve. Combined with the cautious outlook toward the Japanese yen, this should help limit the decline of the GBP/JPY pair.

Japan's new Prime Minister, Shigeru Ishiba, expressed caution regarding potential interest rate hikes by the Bank of Japan on Monday and mentioned his intention to call for general elections on October 27. These statements, combined with recent economic stimulus in China, are weakening the safe-haven yen.

Meanwhile, after the release of the final UK Manufacturing PMI, which was revised up to 45.0 in September from 44.8 in the previous month, spot prices showed little reaction.

Nonetheless, the aforementioned fundamental backdrop suggests that it would be wise to wait for sustained selling pressure before confirming a significant decline in the GBP/JPY pair.

From a technical standpoint, the recent failures to break through the crucial 200-day simple moving average (SMA), along with its crossover with the 50-day SMA, suggest caution for aggressive bulls.