Analysis of Trades and Tips for Trading the Japanese Yen

The test of the 144.16 price level occurred as the MACD indicator began moving downward from the zero mark, confirming that it was an appropriate entry point for a sell trade. As a result, the pair dropped about 40 points but didn't reach the target level of 143.46, where I had planned to initiate a bounce sell. Evidently, dollar sellers against the yen remain active, and the bearish trend for the pair continues. However, the U.S. ISM Manufacturing Index and the Job Openings and Labor Turnover data from the U.S. Bureau of Labor Statistics for September could change the situation in the second half of the day. Strong figures could trigger a new wave of growth for the pair, as could statements with a moderate tone from FOMC members Raphael Bostic and Lisa D. Cook. Regarding the intraday strategy, I plan to act based on the implementation of Scenarios #1 and #2.

Buy Signal

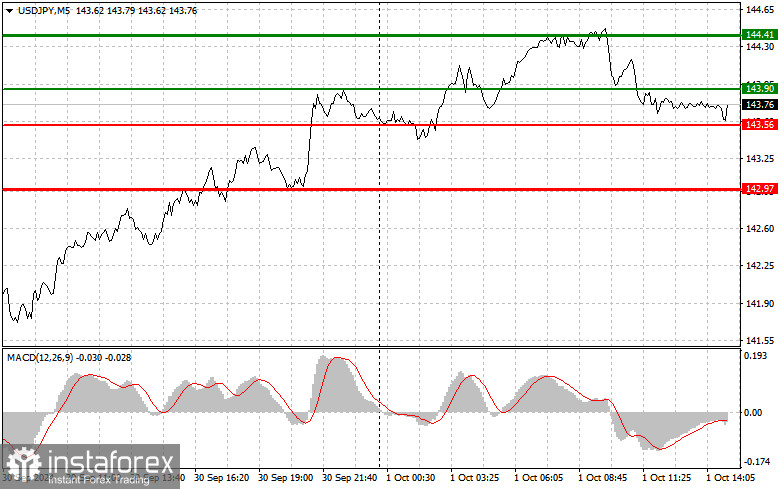

Scenario #1: Today, I plan to buy USD/JPY when it reaches the entry point around 143.90 (green line on the chart) with a target of rising to the 144.41 level (thicker green line on the chart). At 144.41, I will exit the buy trades and open sell positions in the opposite direction (aiming for a 30-35 point movement in the opposite direction from the level). You can only expect a rise in the pair today if US data is strong. Important! Before buying, make sure the MACD indicator is above the zero mark and just start its rise from there.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 143.56 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and cause a reversal in the pair's direction toward an upward trend. You can expect a rise to the opposite levels of 143.90 and 144.41.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after the price breaks the 143.56 level (red line on the chart), leading to a quick decline in the pair. The key target for sellers will be 142.97, where I will exit the sell trades and immediately open buy positions in the opposite direction (aiming for a 20-25 point movement in the opposite direction from the level). The pressure on the pair will return if U.S. statistics are weak. Important! Before selling, make sure the MACD indicator is below the zero mark and just start its decline from there.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 143.90 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. Expect a decline to the opposite levels of 143.56 and 142.97.

What's on the Chart:

- Thin green line – the entry price at which you can buy the trading instrument.

- Thick green line – the estimated price where you can set Take Profit or lock in profits yourself, as further growth above this level is unlikely.

- Thin red line – the entry price at which you can sell the trading instrument.

- Thick red line – the estimated price where you can set Take Profit or lock in profits yourself, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it's important to consider overbought and oversold zones.

Important:

Beginner forex traders should exercise extreme caution when making market entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to limit potential losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, for successful trading, it's essential to have a clear trading plan, such as the example I've provided above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.