Although not at the same pace as the day before, the dollar strengthened its position, mainly due to another set of labor market data. This time, it was the ADP employment report, which grew by 143,000 jobs. While this figure is relatively weak in the context of the U.S. labor market, it is notably better than the forecast of 90,000. The recent labor market data strongly suggest that the U.S. Department of Labor's report, which will be released this Friday, will likely be much better than expected. As a result, there is little expectation of a further 50 basis point rate cut. In anticipation of such a significant event, it is logical to see some rebound, serving as preparation for the sustained rise of the U.S. dollar.

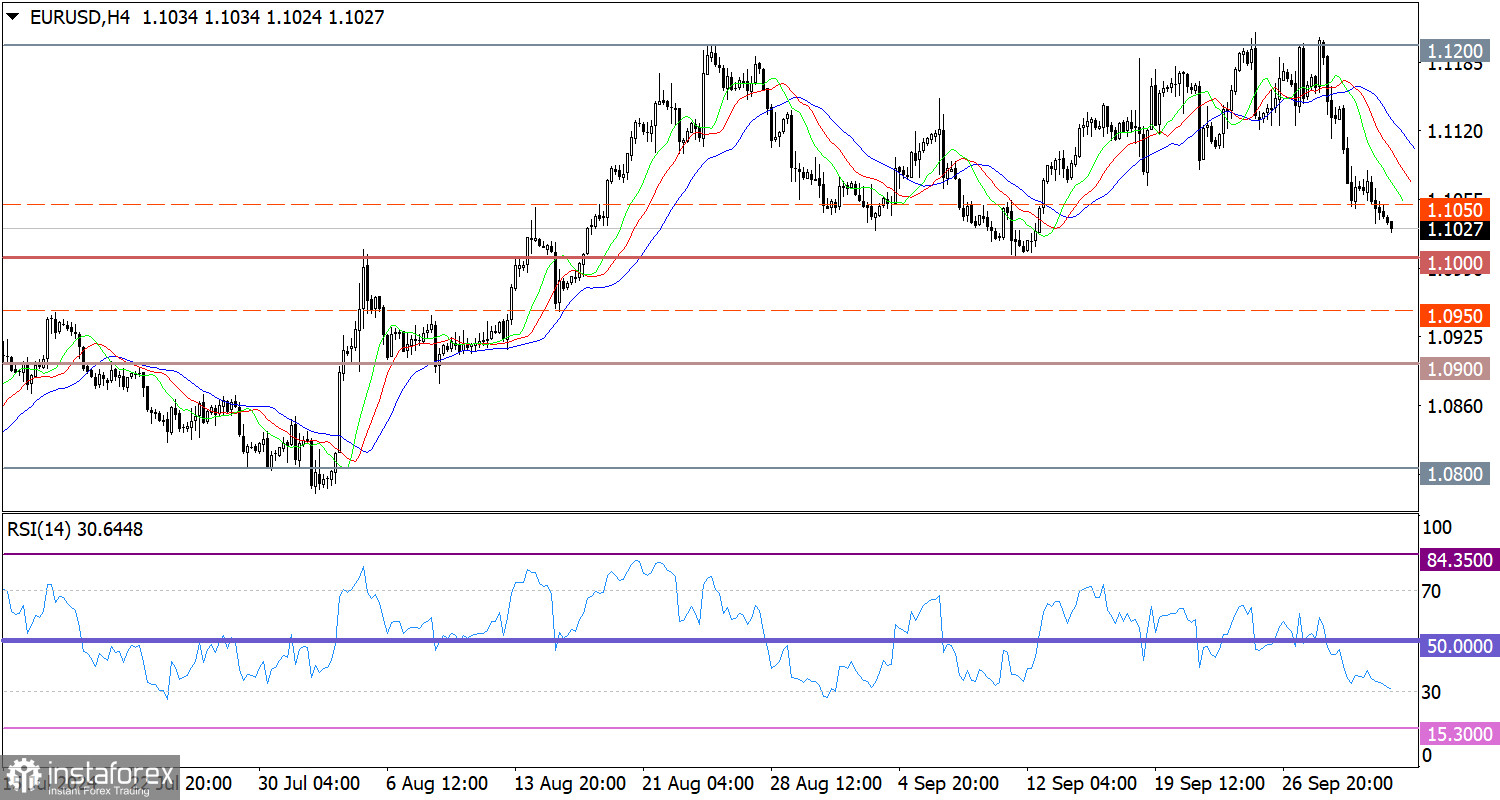

The EUR/USD currency pair is in a corrective phase from the resistance level 1.1200. As a result, the quote has dropped by approximately 1.5%. A possible support level for sellers is around 1.1000, which the price has already approached.

In the four-hour chart, the RSI technical tool is moving in the sellers' zone of 30/50, indicating the appeal of short positions on the euro.

As for the Alligator indicator in the same time frame, the moving average lines (MA) are directed downward, reflecting the current corrective cycle.

Expectations and Prospects

If short positions significantly decrease, the correction may slow down, with an attempt to rebuild long positions on the euro. However, stabilizing the price below the key level will increase the volume of short positions toward the 1.0950 level.

The complex indicator analysis in the short-term and intraday periods points to a correction.