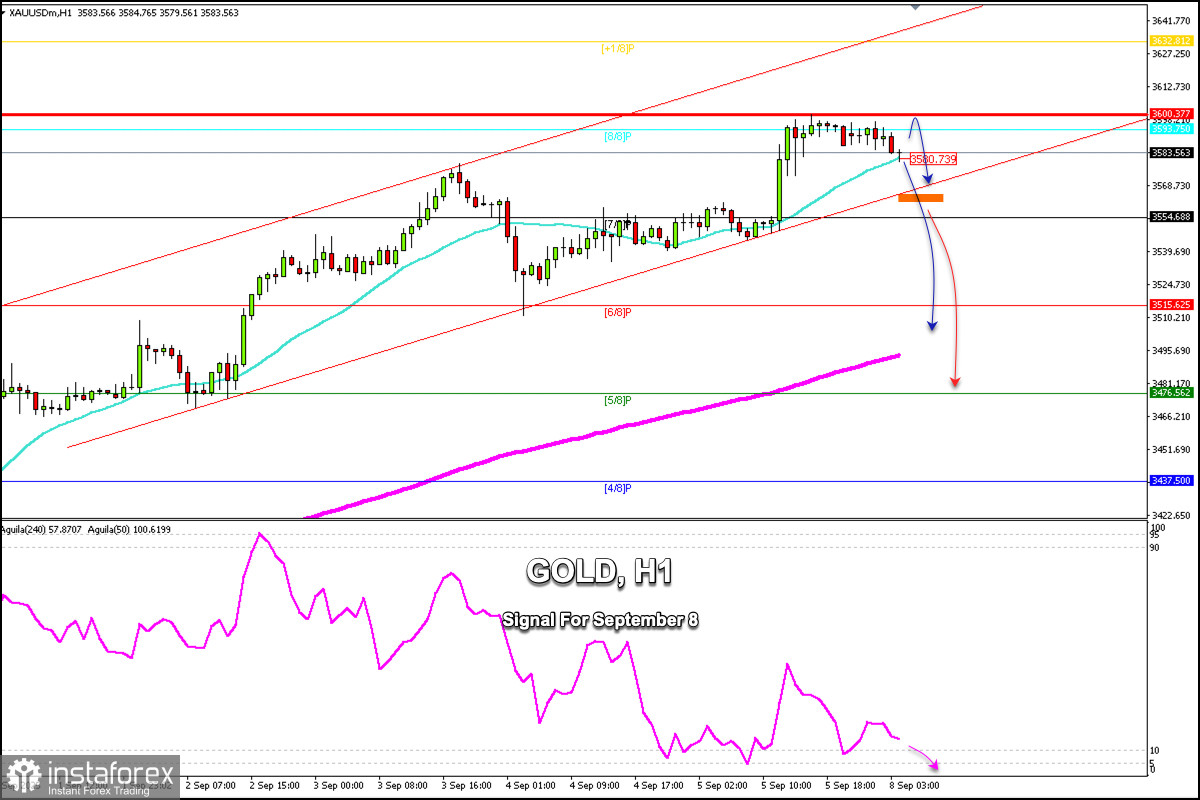

Gold, after reaching its all-time high around $3,600, is now trading below this level and below the 8/8 Murray around $3,583.

Weak US NFP data pushed the gold price up to $3,600, a gain of more than $50 in one day, which favored the bulls. However, a technical correction is likely in the coming days, and gold could reach the key support of the 6/8 Murray around $3,515.

After a week of strong upward movement, gold could enter a corrective phase, as exhaustion levels are observed on the H4 chart. The Eagle indicator is showing negative signals, which supports the likelihood of a technical correction.

A sharp break below 3,570 could be seen as a clear signal to sell, as we could expect a change in gold's trend, which could reach the 200 EMA around 3,480.

Conversely, if gold consolidates above the 8/8 Murray level at 3,593, there is a strong likelihood of a further bullish move, and gold could reach the +1/8 Murray level around 3,632.