Analysis of Trades and Trading Tips for the British Pound

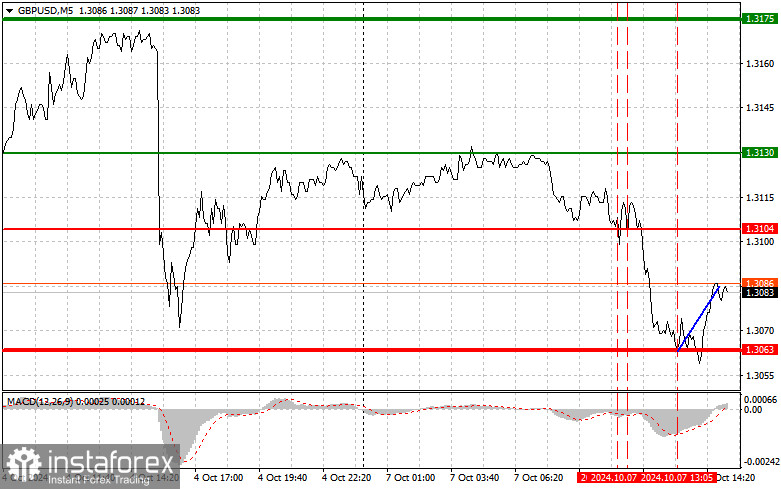

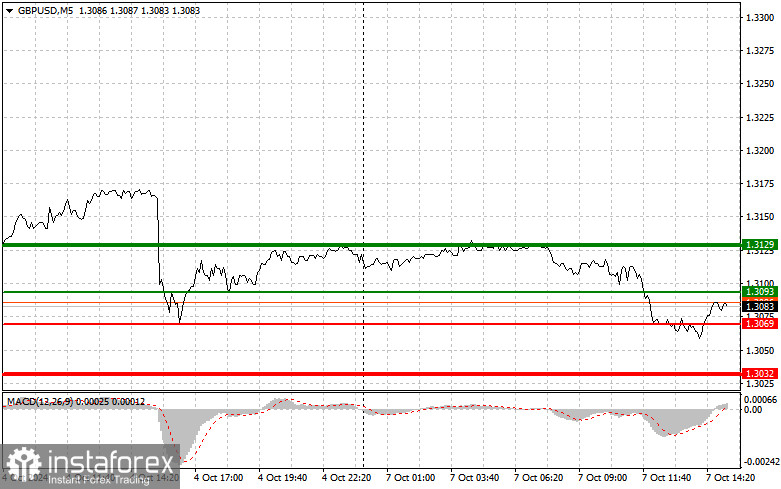

The price level at 1.3104 coincided with the moment when the MACD indicator had moved significantly downward from the zero mark, which limited the pound's downward potential. For this reason, I did not sell. Shortly after, another test of 1.3104 occurred when the MACD was in the oversold area, allowing for the implementation of Scenario #2 for buying. However, as you can see on the chart, the pair did not rise, resulting in a loss for the position. The losses were mitigated only by buying on the rebound at the price of 1.3083, as I had warned in the morning forecast. The data from the UK did not help the pound, and the situation may only worsen in the second half of the day. A cautious tone from policymakers following recent U.S. labor market data will likely lead to a new sell-off of the pound and a strengthening of the U.S. dollar. Therefore, I do not expect strong growth of the pair during the U.S. session. As for the intraday strategy, I plan to act based on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy pounds today when the price reaches around 1.3093 (the green line on the chart), aiming for growth to the level of 1.3129 (the thicker green line on the chart). Around 1.3129, I will exit my positions and open short positions in the opposite direction, expecting a movement of 30-35 points. An upward movement of the pound today can be anticipated after a soft tone from policymakers. It is important to ensure that the MACD indicator is above the zero mark and is just starting its upward movement from it before buying.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of the price at 1.3069 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. We can expect growth to the levels of 1.3093 and 1.3129.

Sell Signal

Scenario #1: I plan to sell pounds today after updating the level of 1.3069 (the red line on the chart), which will lead to a rapid decline of the pair. The key target for sellers will be the level of 1.3032, where I will exit my sales and also open immediate buys in the opposite direction, expecting a movement of 20-25 points. Sellers will show themselves in the case of a cautious position from the Fed. It is important to ensure that the MACD indicator is below the zero mark and is just starting its downward movement from it before selling.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of the price at 1.3093 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. We can expect a decline to the levels of 1.3069 and 1.3032.

What's on the Chart:

- Thin green line – entry price at which traders may consider buying the trading instrument.

- Thick green line – estimated price where traders can set Take Profit or secure profits themselves, as further growth above this level is not anticipated.

- Thin red line – entry price at which traders may consider selling the trading instrument.

- Thick red line – estimated price where traders can set Take Profit or secure profits themselves, as further decline below this level is not anticipated.

- MACD Indicator – When entering the market, it is important to be guided by overbought and oversold zones.

It is important for beginner traders in the forex market to make entry decisions very cautiously. Before the release of significant fundamental reports, it is best to stay out of the market to avoid sharp fluctuations in the exchange rate. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, similar to the one I presented above. Making spontaneous trading decisions based on the current market situation is fundamentally a losing strategy for intraday traders.