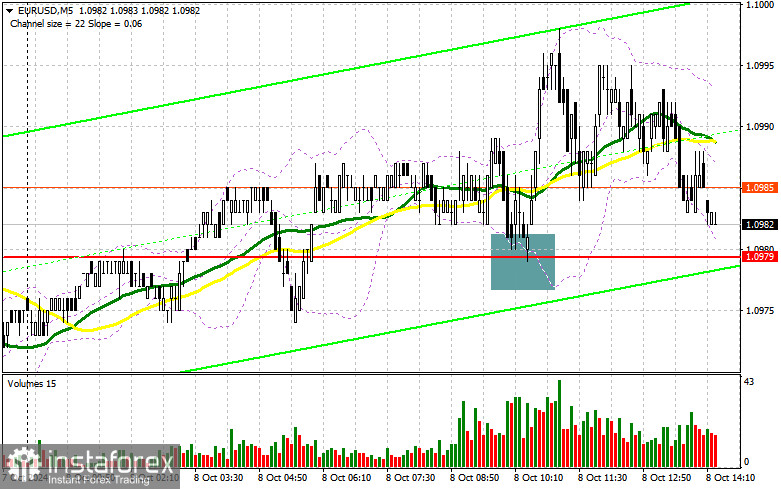

In my morning forecast, I highlighted the level of 1.0979 and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The decline and formation of a false breakout around 1.0979 led to a good entry point for buying the euro, which resulted in a rise of nearly 20 points at that moment. The technical picture has not been revised for the second half of the day.

To open long positions on EUR/USD, the following conditions must be met:

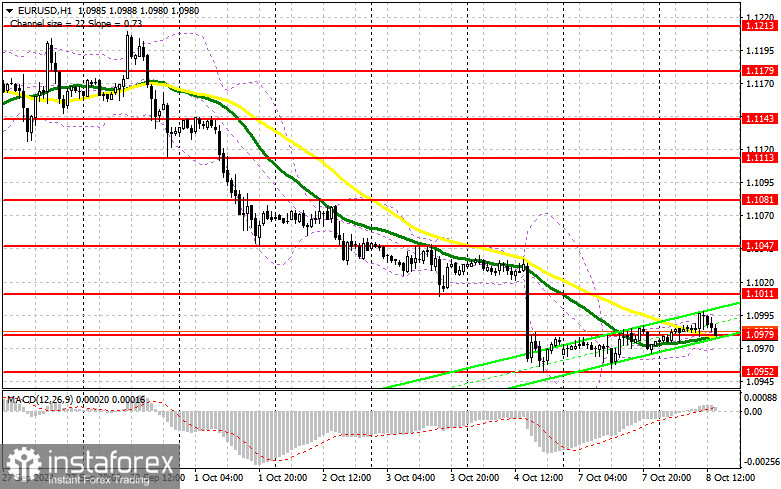

The absence of important data and a lack of volatility are quite understandable. Most likely, the second half of the day will proceed in a similar manner. The trade balance and the RCM/TIPP Economic Optimism Index for the U.S. are not indicators that could lead to significant market changes, so all attention is on the speeches of FOMC members, Raphael Bostic and Susan M. Collins. A cautious tone may help the dollar regain Friday's bullish momentum, so I will be extremely careful with purchases. I intend to act according to the morning scenario. The formation of a false breakout around 1.0979, similar to what I discussed above, will be a suitable condition for increasing long positions, opening the way to the level of 1.1011. A breakout and a retest of this range will confirm the correct entry point for buying, with the target of updating to 1.1047, allowing buyers to recover somewhat after Friday's drop. The farthest target will be the high of 1.1081, where I intend to take profits. In the event of further declines in EUR/USD and a lack of activity around 1.0979 in the second half of the day, which is more likely to occur, pressure on the euro will remain. In this case, I will only enter after a false breakout forms near the next support at 1.0952. I plan to open long positions immediately on a rebound from 1.0916, aiming for an upward correction of 30-35 points intraday.

To open short positions on EUR/USD, the following conditions must be met:

It is evident that sellers do not intend to lose control over the market, but their inactivity also raises many questions. In the case of further smooth growth of the euro, only the formation of a false breakout around 1.1011, which may occur after the speeches of Fed representatives, will provide a good entry point for opening new short positions with the prospect of a decline to the intermediate support at 1.0979. A breakout and consolidation below this range, along with a retest from below, will become another suitable option for selling, with a move toward 1.0952 and 1.0916, further strengthening the bearish market. I only expect to see a more active manifestation of bulls there. The farthest target will be the area of 1.0884, where I will take profits. If the EUR/USD moves upward in the second half of the day and there are no bears at 1.1011, buyers will have a chance for a significant strengthening of the pair. In this case, I will postpone selling until the next resistance at 1.1047 is tested. I will only sell there after a failed consolidation. I plan to open short positions immediately on a rebound from 1.1081, aiming for a downward correction of 30-35 points.

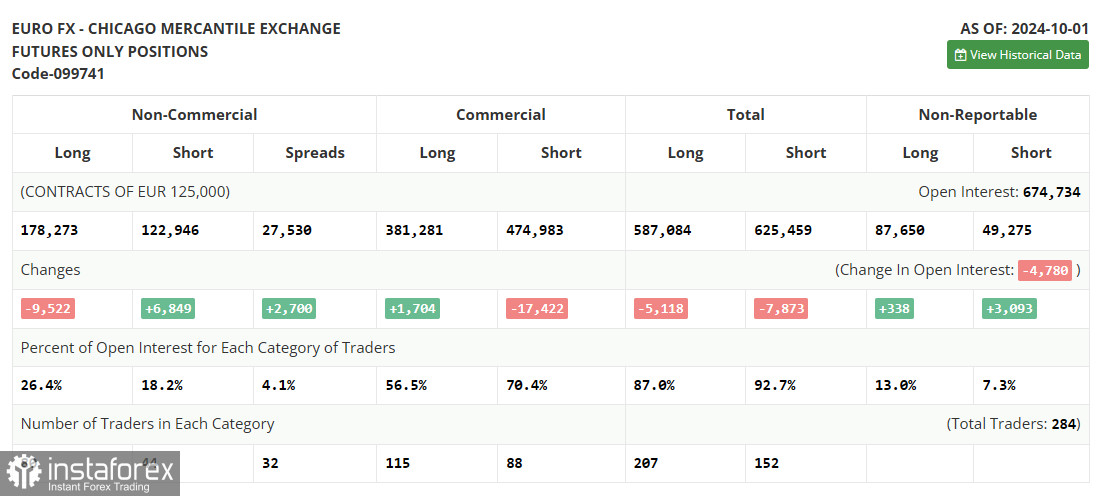

In the COT report (Commitment of Traders) for October 1, there was a slight increase in short positions and a sharp reduction in long positions, leading to some changes in the market balance toward sellers. It is clear that recent data on the U.S. labor market, which turned out better than economists' forecasts, is now key for the future decisions of the Federal Reserve, which will no longer be as sharp and unexpected. Most likely, the central bank will take a more cautious position on rate cuts in the future, which will positively reflect on the U.S. dollar and its strength. However, this does not cancel the medium-term upward trend for the pair, and the lower the pair goes, the more attractive it becomes for purchases. The COT report indicates that non-commercial long positions decreased by 9,522 to 178,273, while non-commercial short positions increased by 6,849 to 122,946. As a result, the gap between long and short positions grew by 2,700.

Indicator Signals:

Moving Averages:

Trading is occurring around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of moving averages are considered by the author on the hourly chart (H1) and differ from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator around 1.0965 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator: Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long Non-Commercial Positions: Represents the total long open position of non-commercial traders.

- Short Non-Commercial Positions: Represents the total short open position of non-commercial traders.

- Total Non-Commercial Net Position: The difference between the short and long positions of non-commercial traders.