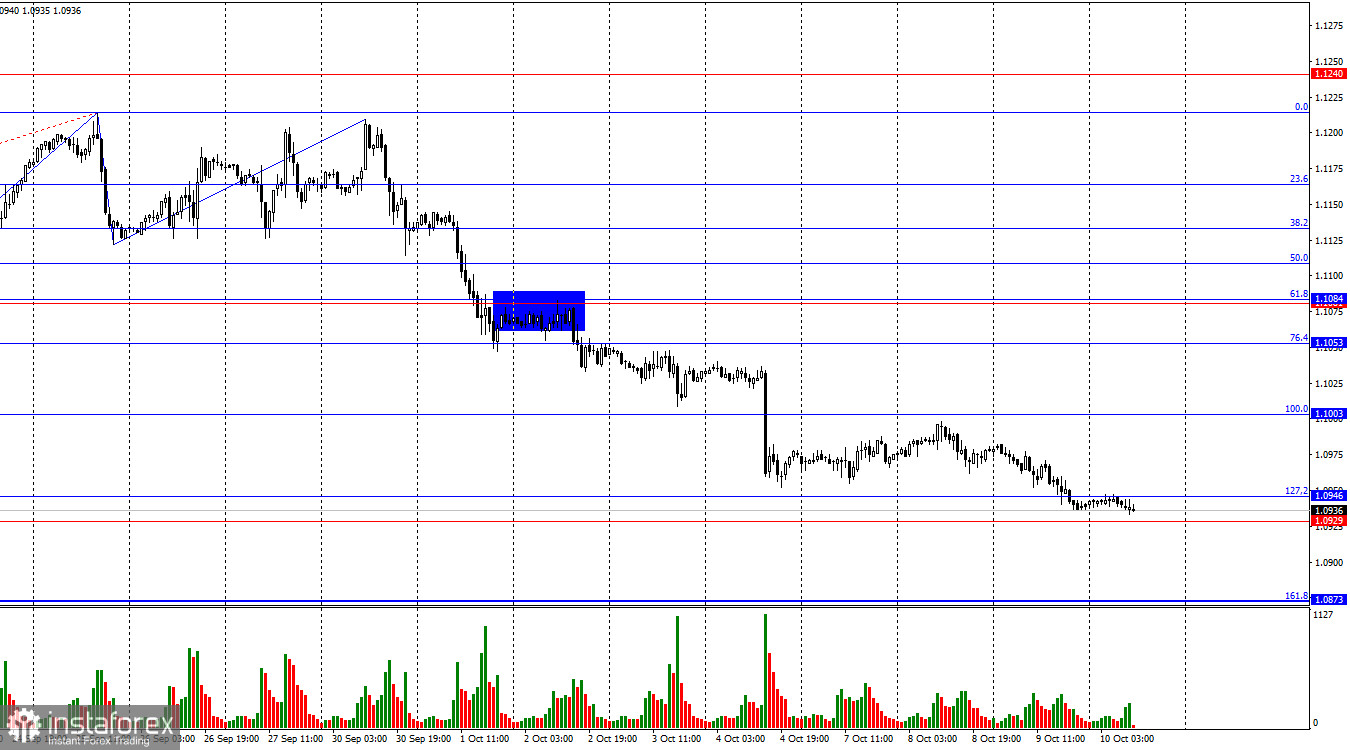

The situation with the waves has become more complex in recent weeks, but it remains generally clear. The last completed upward wave (September 25-30) did not break the peak of the previous wave, while the new downward wave broke the lows of the previous three waves. Thus, the pair has now started forming a new bearish trend. In the near future, we may see a corrective wave, but the bulls have already lost their market initiative.

The information background on Wednesday was very weak. A few weeks ago, the bears needed support to stop the pair's growth. Now, the bulls need some form of support to halt the pair's decline. The situation has completely reversed. Yesterday's FOMC minutes emphasized several key points. First, the decision to cut the rate by 0.50% in September was not unanimous. Second, the minutes showed that a 0.50% cut is not a "normal step" for the Fed. Third, these minutes are of minimal importance as they pertain to events from two weeks ago. Thus, the nature of the minutes was more formal, and traders may have reviewed them due to their formal nature rather than practical impact. The decision regarding a rate change at the next meeting will depend on inflation and labor market data. Today, the inflation report is expected, and early next month, labor market data will be released. The FOMC will make its decision based on these data points.

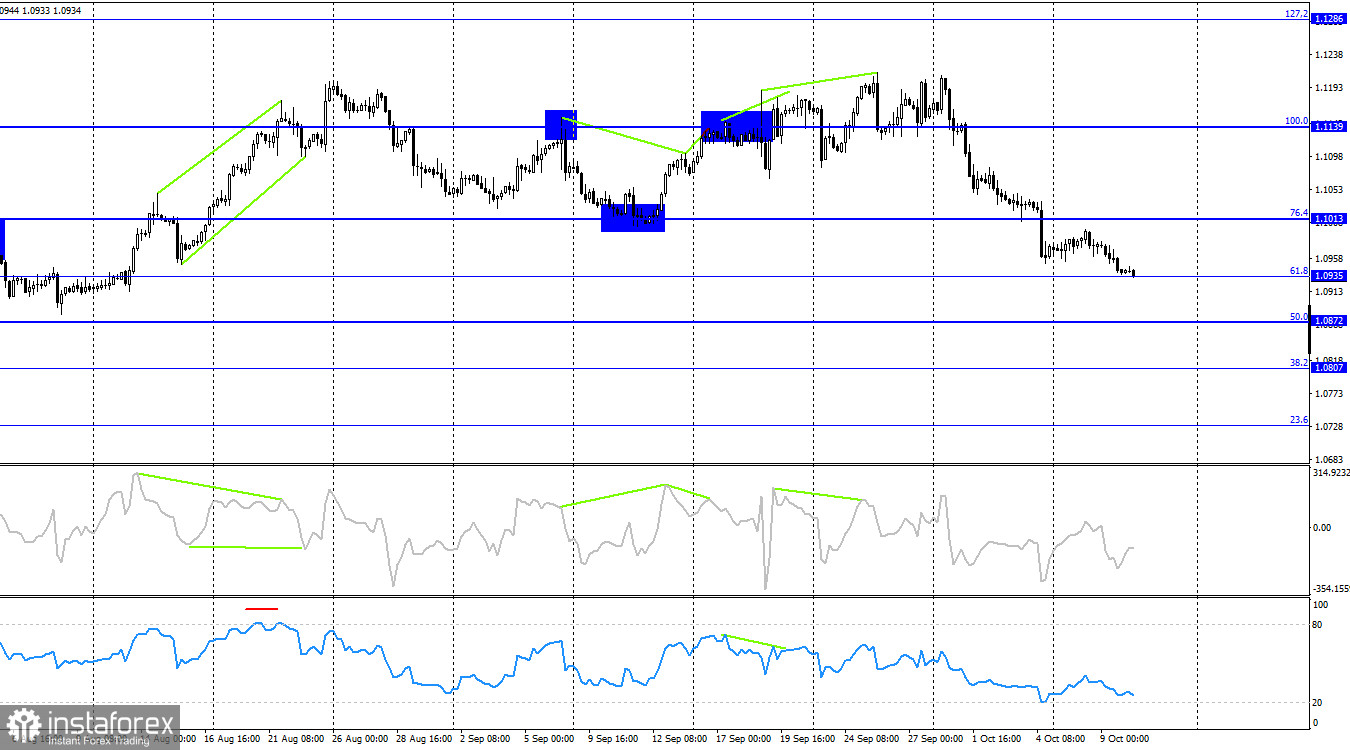

On the 4-hour chart, the pair turned in favor of the U.S. dollar after forming a series of bearish divergences on the RSI and CCI indicators. The RSI had also entered the overbought territory several weeks ago. The pair has recently declined to the 61.8% corrective level at 1.0935. Consolidation below this level could lead traders to expect further decline towards the next Fibonacci level of 50.0% at 1.0872. Both indicators currently suggest that bullish divergences are emerging.

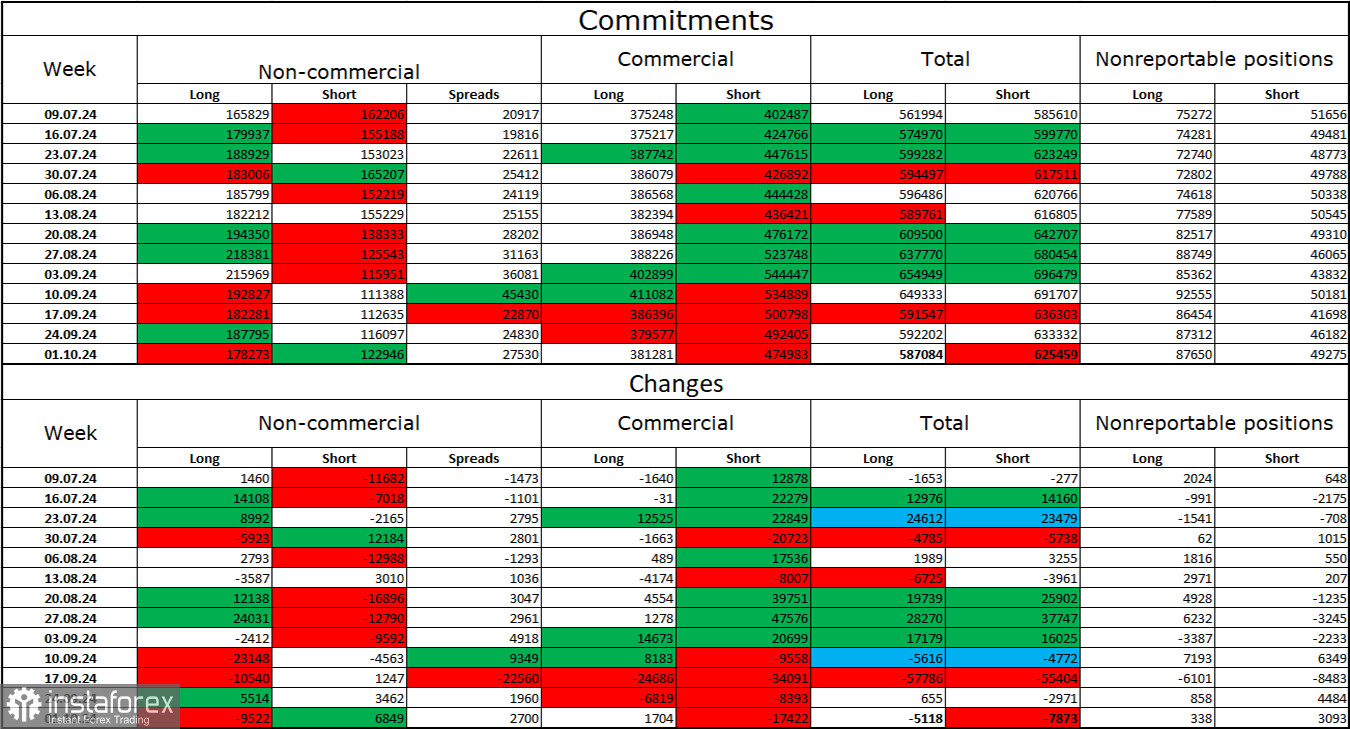

Commitments of Traders (COT) Report:

During the latest reporting week, speculators closed 9,522 long positions and opened 6,849 short positions. The sentiment of the "Non-commercial" group turned bearish several months ago, but currently, the bulls are once again in control. The total number of long positions held by speculators is now 178,000, while short positions amount to just 123,000.

However, for the fourth consecutive week, large players have been offloading the European currency. In my view, this could be a precursor to a new bearish trend or at least a correction. The key factor for the dollar's previous decline—expectations of Fed policy easing—has played out, and there are no more reasons for the dollar to fall. While new factors could emerge over time, for now, the growth of the U.S. dollar seems more likely. Chart analysis also indicates the start of a bearish trend. Thus, I anticipate a prolonged decline in the EUR/USD pair.

Economic Calendar for the US and Eurozone:

- US – Consumer Price Index (12:30 UTC)

- US – Change in Initial Jobless Claims (12:30 UTC)

On October 10, the economic calendar includes two entries; the U.S. inflation report is particularly significant. This is a very important report, and the market's reaction could be substantial. Therefore, I expect increased trader activity tomorrow.

Forecast for EUR/USD and Trading Advice:

Selling the pair was possible upon closing below the 1.1139 level on the 4-hour chart with targets at 1.1081, 1.1070, 1.1013, and 1.0984. All targets were reached. A consolidation below the 1.0929 level allows for new sales with a target of 1.0873. I would consider buying the pair on a rebound from the 1.0873 level.

Fibonacci levels are drawn from 1.1003–1.1214 on the hourly chart and from 1.1139–1.0603 on the 4-hour chart.