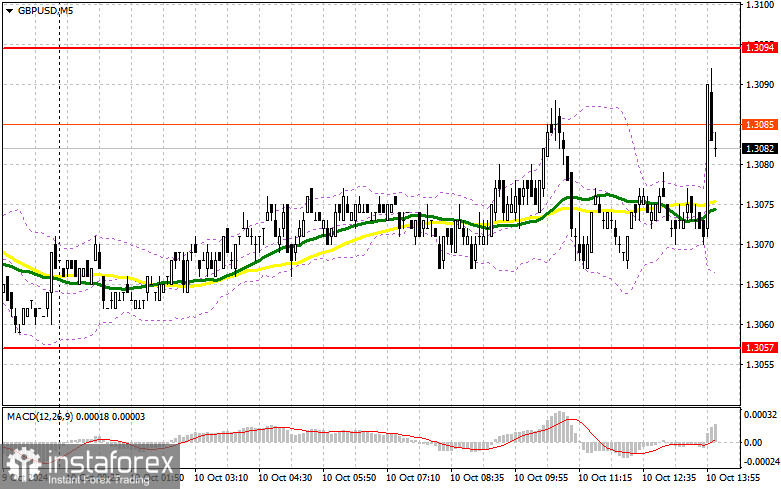

In my morning analysis, I concentrated on the 1.3057 level and planned to make decisions based on it. We will review the 5-minute chart to analyze what occurred. A decline took place, but due to low volatility, the test of 1.3057 did not materialize, leaving me without suitable entry points. The technical outlook for the second half of the day has not changed.

To Open Long Positions on GBP/USD:

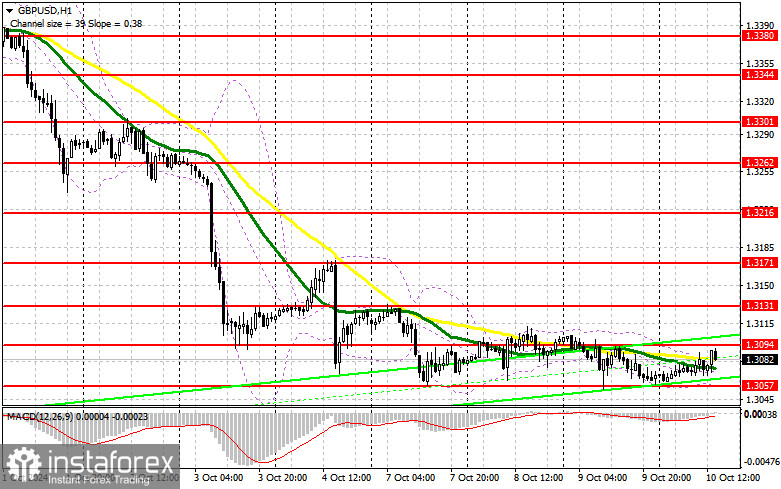

The Consumer Price Index (CPI), especially the core prices, is the key focus in the second half of the day. News of higher-than-expected U.S. inflation could trigger new dollar buying and push GBP/USD below its weekly low. Data on initial jobless claims in the U.S. and comments from Fed officials will play a secondary role. If the pound declines, only a false breakout around 1.3057 would create an opportunity for the pair to recover toward the resistance at 1.3094, where the moving averages favor the sellers. A breakout and subsequent retest of this range from above would strengthen the prospects of a bullish trend, leading to a short squeeze and a suitable entry point for long positions, with a potential target of 1.3131. The final target would be the 1.3171 level, where I plan to take profit. If GBP/USD declines and shows no bullish activity around 1.3057 in the second half of the day, the bearish market will likely return. This would also lead to a decline and a retest of support at 1.3016. Only a false breakout would be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2974 low, targeting a 30-35 point upward correction during the day.

To Open Short Positions on GBP/USD:

Sellers are in no rush to act as news of a deceleration in inflation in the U.S. in September could hurt the bearish market further. Therefore, if the pair rises, it is crucial for the bears to defend the resistance at 1.3094. A false breakout at this level would provide a suitable scenario for opening short positions with a target of a decline toward the 1.3057 support—the weekly and monthly low. A breakout and retest of this range from below would pressure buyers, triggering stop-loss orders and opening the path to 1.3016. The final target would be the 1.2974 level, where I plan to take profit. Testing this level would reinforce the bearish market. If GBP/USD rises and sellers remain inactive at 1.3094 in the second half of the day, buyers may attempt to regain control. In such a case, the bears would need to adjust their positions around the resistance area at 1.3131, which could act as the upper boundary of a sideways channel. I will only sell there after a failed consolidation. If there is no downward movement at that level, I will look for short positions on a rebound around 1.3171, aiming for a 30-35 point downward correction during the day.

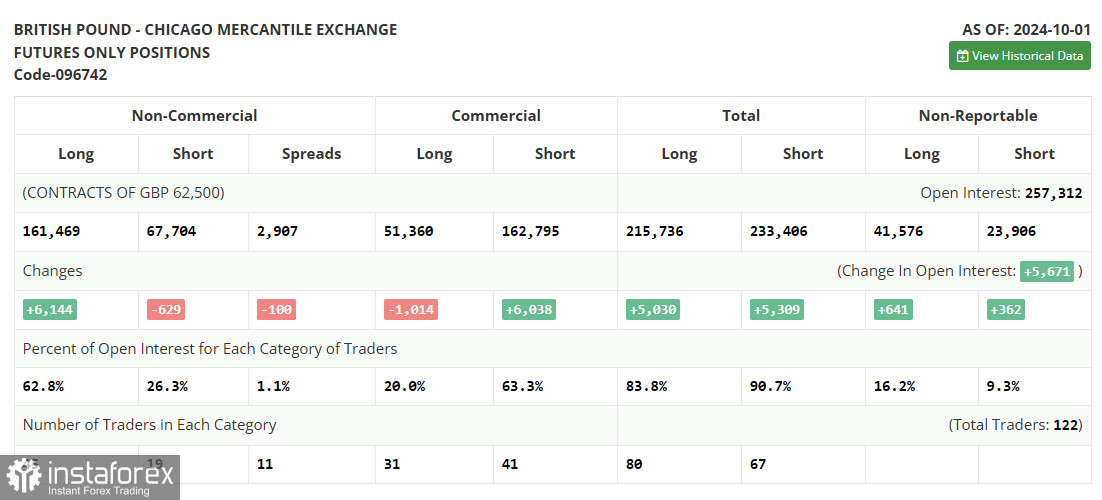

The Commitment of Traders (COT) report for October 1 showed an increase in long positions and a slight decrease in short positions. It is clear that the latest UK data has created additional challenges for further upward pressure on the pound, but there isn't much interest in selling either, given the current market conditions. However, it is important to note that this report does not account for recent changes in the market following the release of strong labor market data late last week. Therefore, paying close attention to this report might not be particularly meaningful. The latest COT report indicated that long non-commercial positions increased by 6,144, reaching 161,469, while short non-commercial positions decreased by 629, to 67,704. As a result, the gap between long and short positions widened by 100.

Indicator Signals:

Moving Averages:

Trading takes place around the 30 and 50-day moving averages, indicating a sideways market trend.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the standard definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator around 1.3057 will serve as support.

Indicator Descriptions:

- Moving average (determines the current trend by smoothing volatility and noise). Period – 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders – speculators like individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total open long positions held by non-commercial traders.

- Short non-commercial positions represent the total open short positions held by non-commercial traders.

- Net non-commercial position is the difference between the short and long positions of non-commercial traders.